The Twin Presidencies of Trump and Biden and How it Affected Gold

by Melanie YoungIt feels like the recent retraction in precious metals has been significant but the truth is, it is still within the historical norm when the current aftermath of Trump’s second victory is compared to that of his first. With gold currently trading at $3,970.78, silver at $47.52, and platinum at $1,477.84, it is worth stepping back and considering some of the trends established during Trumps first term to assess what this tells us about the current market, and what we can expect in the future.

On November 8, 2016, Trump stepped onto the world stage with a decisive win for the Republican Party in America. The world gasped and metals went down. Within a week the value of gold was down 3.4% and silver followed with a decline of 9% on the Australian market. Similarly, nine days ago Trump returned, again riding the red wave and heralding yet another contraction for precious metals in the same week after the election, this time 3.5% for gold, and silver losing only 2.9%. This illustrates that what feels like a somewhat violent contraction in the price of precious metals is really “situation normal,” suggesting that further consolidation (especially in silver) is hardly out of the question, even likely. Indeed some analysts believe that based on Trump’s first term gold may dip as low as $3,870 if it kept pace with American markets; however, the likelihood is unknown. To read more about the reasons for the current pullback read last week’s article.

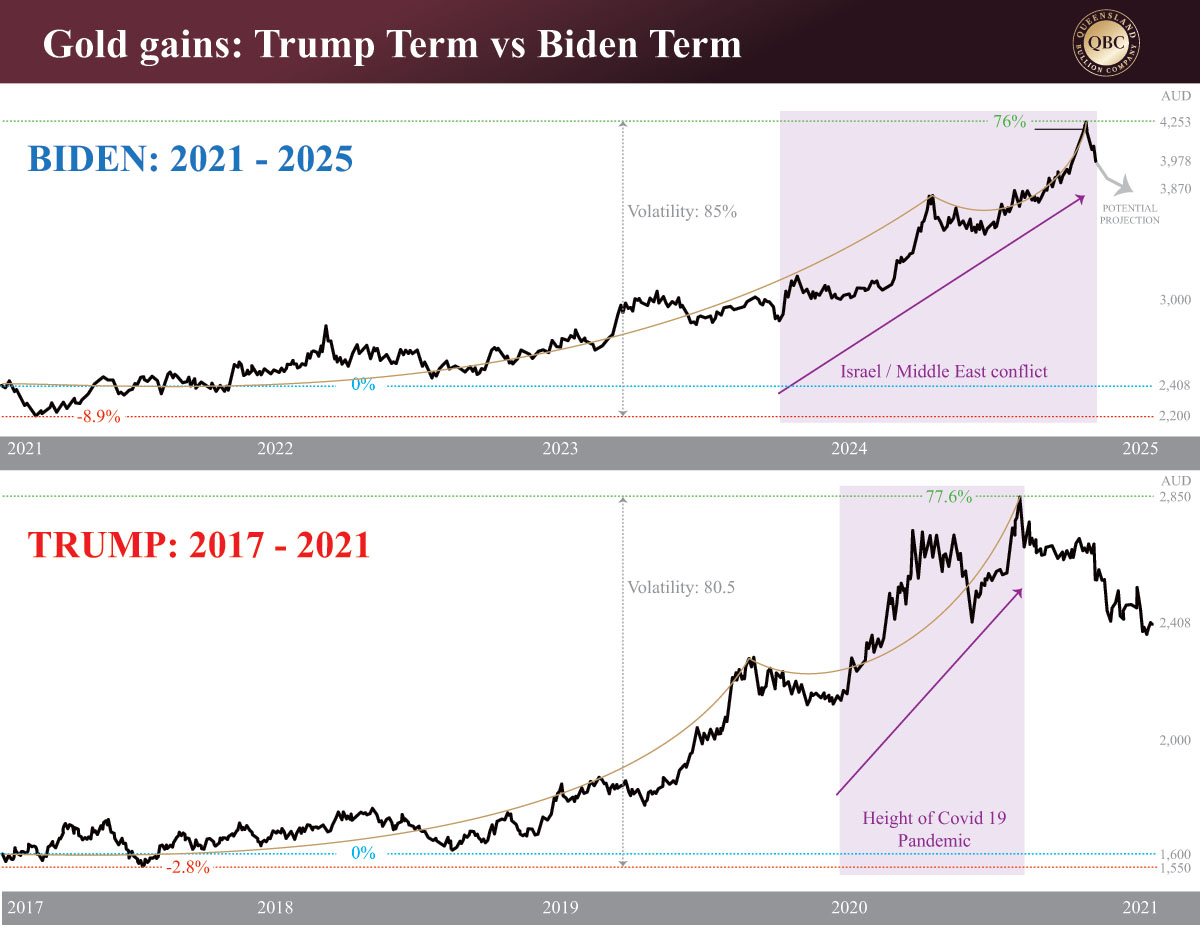

There are further extrapolations of interest when comparing gold’s performance during Trump’s first presidency versus Biden’s. When Trump took office in January of 2017 gold was at $1660 and at the end of his term it was $2408, an increase of 50.5%. From $2408, with governance under Biden gold is currently at $3978, an increase of 65%. From this perspective one could argue that gold fares better under Democratic leadership; however, Biden still has two months of his term left when volatility is at its highest- at this point, nothing is sacred.

Volatility, on the other hand, deserves a mention. Based on the price of gold at the start of Trump’s term in 2017 it did not drop more than 2.8% during his term. At its highest, it reached 77.6% above the starting price. This leaves a spread between the low and the high of 80.5%. Applying the same formula to gold during Biden’s presidency produces a very similar result thus far at 85%.

Another interesting coincidence is that, based on the price of gold at the beginning of their terms, the increase in the gold price varied only 1.6% between the two presidents, with Trump achieving an increase of 77.6% and Biden 76%.

So far regarding gold both presidencies seem eerily similar. So was there anything different? Apart from domestic politics, global events that affected gold prices has been the main difference. The graphs below show very similar behaviour in the yellow metal but the underlying causes differ greatly. The cause behind the main upward trend in gold under Trump was the Covid 19 Pandemic, while the breakout of conflict between Israel and Palestine et. al. has been the source of the upward pressure on gold under Biden. Arguing whether either president was provocative or reactive to their relative emergencies is irrelevant. The main take away is that, regardless of who is in power and what domestic challenge unfolds, global events are the dominating factor that affects precious metals, of which geopolitics plays a significant role.

So moving forward, what comes next? Will Trump end the war in Ukraine as he pledged? Signs are promising. But what about Israel? History paints this tiny country as a wildcard that the USA does not necessarily influence all that well. Some would argue it’s the opposite. Whether peace is possible in the Middle East is unknown. At the time of writing resolution does not look possible. “Complicated” might be a positive spin. So more importantly, if conflict breaks out in a larger way what does this mean for gold? All gold bugs know the answer to this. Anyone looking to add to their position might consider now as the perfect time to buy the dip.