Trump Tariffs: Gold Currently the Only Winner

by Evie SoemardiLiberation Day has been declared by President Trump in America and the global fallout has been swift and significant.China has met America and imposed their own 34% retaliatory tariff on all US imports, a move that some analyst fear could lead to a fully-fledged international trade war.With gold trading at $4,957, silver at $50.00, and platinum at $1,519, it is clear what asset class has benefited the most from the confusion and turmoil.

Stock market fallout: statistics to date

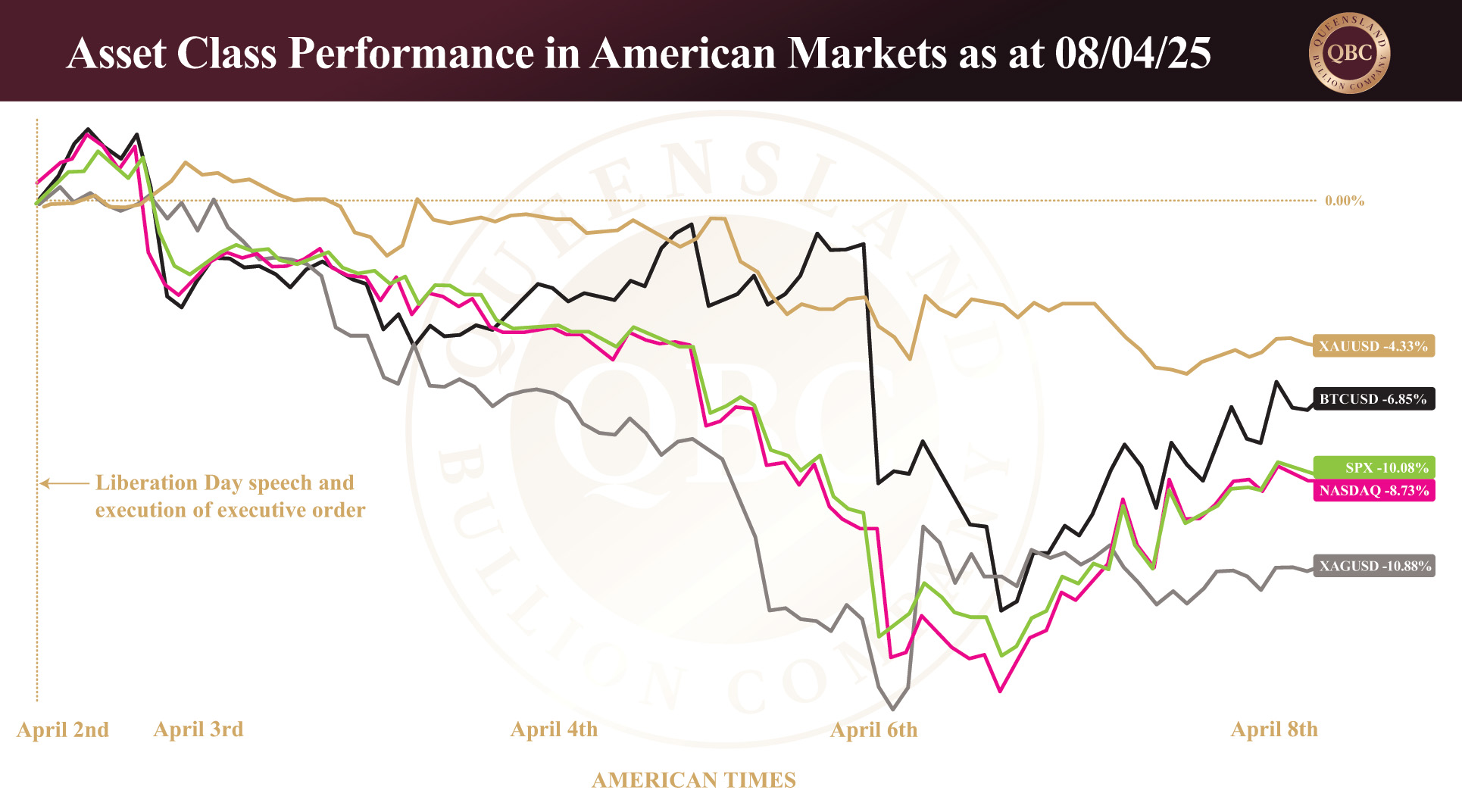

Since the Liberation Day executive order was announced, American markets experienced a downward trajectory, however this morning has seen the first signs of recovery across various sectors. This afternoon the S&P 500 (the broadest benchmark of largest-capitalised companies) experienced an 10% decrease. Bitcoin is down 6.8%, the NASDAQ (tech stocks) has slumped 8.7%, and silver has been hit the hardest sliding backward by 10.8%. Gold held its value the best dropping only 4.3%, hence providing the best purchasing power of all asset classes affected by the harsher-than-anticipated tariffs.

Precious metals fared much better in Australian markets due to the USD to AUD exchange rate with the Australian dollar losing value during this time. Silver dropped 7.1% and gold is down only 0.1%. Again, those holding precious metals locally will have maintained better purchasing power than their American counterparts.

Below is a graph illustrating how each asset has performed since the Liberation Day speech.

Historical precedent: 1987

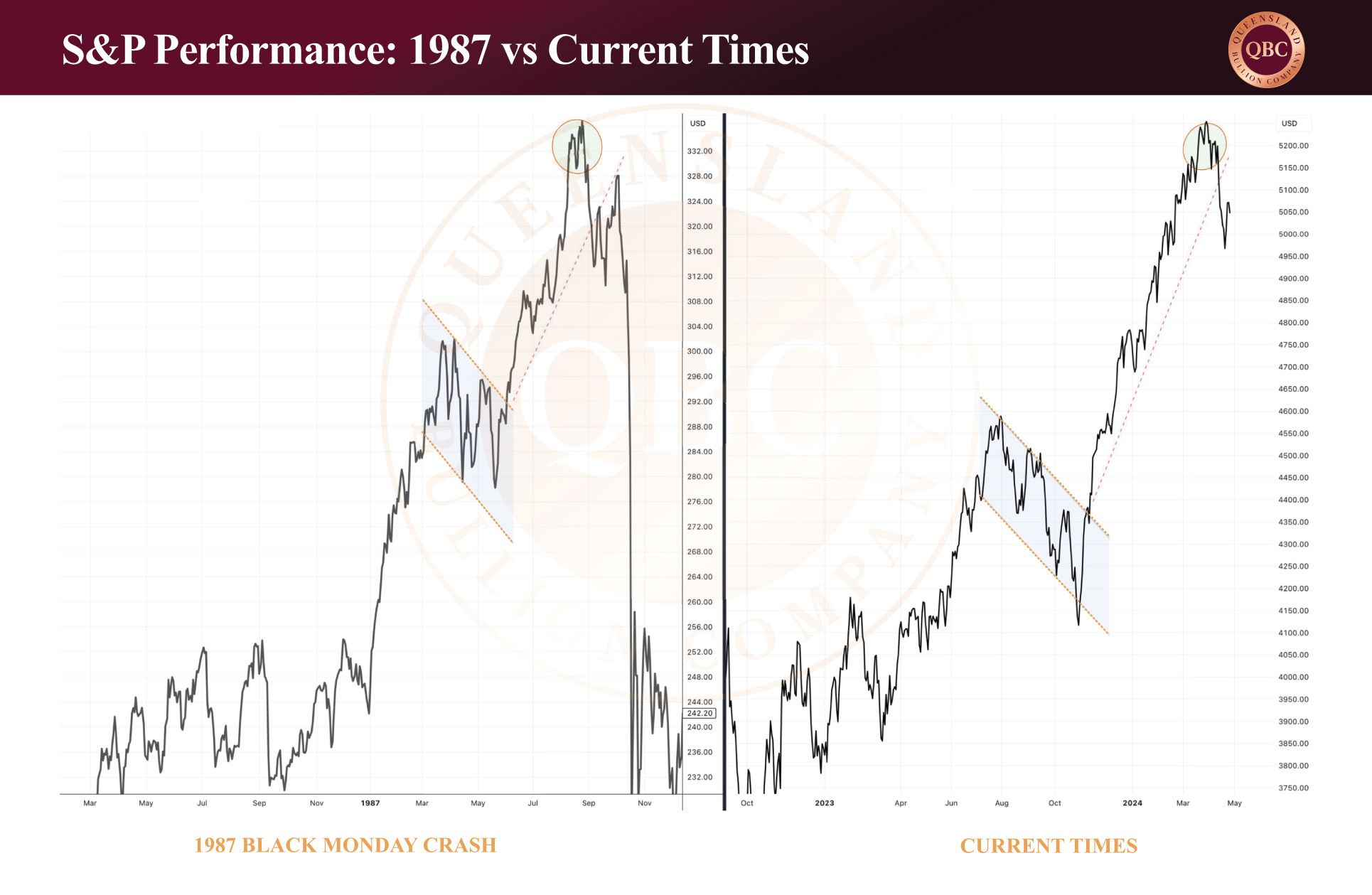

Many analysts are comparing current events to the crash in late 1987. This is because graphs from the 1987 Black Monday event are eerily similar to now. Black Monday is an important historical marker because it highlighted how globalisation, a new concept at the time, impacted the international markets and illustrated how interconnected financial sectors had become. The events preceding the Black Monday crash included a massively over-valued stock market, persistent US trade and budget deficits, and rising interest rates. Today America matches the same description except the Federal Reserve interest rate is only 4.33%, whereas it was 6.5% in 1987. While it appears that the interest rate is lower today, keep in mind that it exists in the context of quantitative easing where the share market is hooked on easy money- hence, 4.33% could be seen as larger burden to bear for the current institutional investors than 6.5% back in the 1980s. Below is a graph of the S&P 500 at the time of the Black Monday event versus today.

What is important to note about the 1987 Black Monday crash is that the aftermath did not include a recession. The stock market continued its strong upward trend until the dot-com crash in 2000. Alternatively, the Great Depression of 1930 saw a severe global economic downturn with a stock market crash that continued through the 1930s that was marked by high unemployment, poverty and business failures at large. So what is the likelihood of recession in 2025? Goldman Sachs has raised the odds to 45%. Polymarket, an American betting platform for investors, has the odds at 62%. If the Federal Reserve does enter a rate cutting cycle as is now anticipated, the probability could grow. They will not, however, have an early decision with inflation remaining first priority for the Fed.

What is important to note about the 1987 Black Monday crash is that the aftermath did not include a recession. The stock market continued its strong upward trend until the dot-com crash in 2000. Alternatively, the Great Depression of 1930 saw a severe global economic downturn with a stock market crash that continued through the 1930s that was marked by high unemployment, poverty and business failures at large. So what is the likelihood of recession in 2025? Goldman Sachs has raised the odds to 45%. Polymarket, an American betting platform for investors, has the odds at 62%. If the Federal Reserve does enter a rate cutting cycle as is now anticipated, the probability could grow. They will not, however, have an early decision with inflation remaining first priority for the Fed.

How does gold and silver behave in a crash?

Gold and silver are subject to macro-economic influences and competes for capital against other asset classes in volatile trading periods as well as in times of economic growth. The current decline in value is to be expected in all markets, including the precious metals. This is due to the extreme uncertainty in how things can unfold in relation to trade, investor debt obligations and their ability to close short positions in a falling market, political implications, and on it goes. Like other assets, precious metals historically decline in value at the beginning of a crash; however, as investors look for safety gold (followed by silver) will decouple and start a new upward trajectory as capital flows into safe-haven assets. Seasoned investors will see this decline as an opportunity to dollar cost average prior to the value moving back up.