Israel Attacks Iran: Gold Soars

by Evie SoemardiIn a dramatic escalation, Israel has launched strikes against Iran, reportedly targeting nuclear facilities. Iran has confirmed multiple casualties—including leaders and children—intensifying fears of a broader regional conflict. This is precisely what every gold investor dreads but also prepares for.

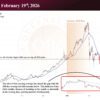

Since trading opened this morning, gold has surged by as much as AU$126. With spot prices currently sitting at AU$5,299 for gold, AU$56.22 for silver, and AU$1,972 for platinum, it appears that precious metals are poised for further upside. However, it is critical to examine the underlying drivers of this rally to determine the likelihood and sustainability of another bull run.

Geopolitical tensions and safe haven demand

Safe haven demand has spiked dramatically as tensions between Israel, the United States, and Iran intensify. Earlier this week, Washington advised restraint from Israel amid ceasefire negotiations with Hamas relating to Gaza and ongoing nuclear diplomacy with Tehran. However, by midweek, President Donald Trump had ordered the withdrawal of all non-essential State Department personnel from Iran, Iraq, and neighbouring nations, citing a credible threat of imminent attack. While Trump later softened his stance—from declaring war “imminent” to it “could very well happen”—the damage to market confidence was done. With hostilities now underway, the veneer of diplomacy has all but vanished.

Compounding the volatility, three European nations announced intentions to trigger snapback sanctions in response to Iran’s alleged violations of nuclear non-proliferation agreements.

Iran’s response

Regarding the European sanctions, Iran has denounced them as politically motivated rather than grounded in IAEA findings. Russia, meanwhile, has issued a stark warning that pursuing such sanctions would be “playing with fire.” Despite the inflamed rhetoric, Iranian military movements have thus far remained non-provocative. According to The Jerusalem Post, “none of the moves appear military in nature.” That, however, may not last long with Iran vowing a strong retaliatory response to the current strikes.

Gold in Iran: a surge beyond the global norm

The impact on gold within Iran has been even more dramatic than elsewhere. Amid rampant inflation, crippling sanctions, currency devaluation and mounting geopolitical uncertainty, Iranian citizens have increasingly turned to gold as a financial refuge.

While Australian gold investors have seen price growth exceeding 50% over the past twelve months, Iran has experienced an even steeper climb. Gold prices denominated in Iranian rials have skyrocketed more than 80%, with the value of a single gold coin soaring from IRR 401 million to IRR 735 million. This represents an outperformance of approximately 45% over global gold price growth.

What’s fuelling the rally in Iran?

Several structural and macroeconomic forces are contributing to Iran’s extraordinary gold rally:

- Runaway Inflation: As of May, inflation in Iran approached 30%, making gold a practical hedge for everyday savers.

- Currency Collapse: A steadily weakening rial has accelerated demand for hard assets.

- Sanctions and Isolation: Gold remains one of the few liquid stores of value not subject to direct international controls.

- Central Bank Strategy: The Central Bank of Iran, among the few that remains relatively independent, is aggressively stockpiling gold to insulate its reserves against financial sanctions.

In some instances, bullion imports have even been exempted from tariffs—facilitating discreet international trade in defiance of formal sanctions. Gold in this context serves not only as a store of value but as an economic weapon.

What this means for investors

Regardless of your geographic location—be it Iran or the West—uncertainty, inflation, and conflict continue to elevate gold’s appeal. While silver remains a valuable component in a diversified portfolio and often outperforms in bull markets, it is more sensitive to broader economic slowdowns.

Gold, on the other hand, is largely decoupled from industrial cycles during times of geopolitical upheaval. In such moments, it is not merely an investment; it is an imperative.