Gold: Short-Term Pullback vs Long-Term Gains

by Evie SoemardiGold has endured a turbulent stretch since President Trump’s recent “Liberation Day” announcement, where tariffs firmly took centre stage. Market reactions have been sharp, with policy decisions driving short-term volatility. In Australia, gold touched a low of AUD $4,865 before rebounding overnight, and is currently trading at AUD $5,010 (USD $3,340). Silver is sitting at AUD $50.66 (USD $33.75), and platinum at AUD $1,542 (USD $1,028). The rally appears largely driven by the strengthening Australian dollar against the U.S. dollar, reinforcing the critical role currency plays in local bullion pricing.

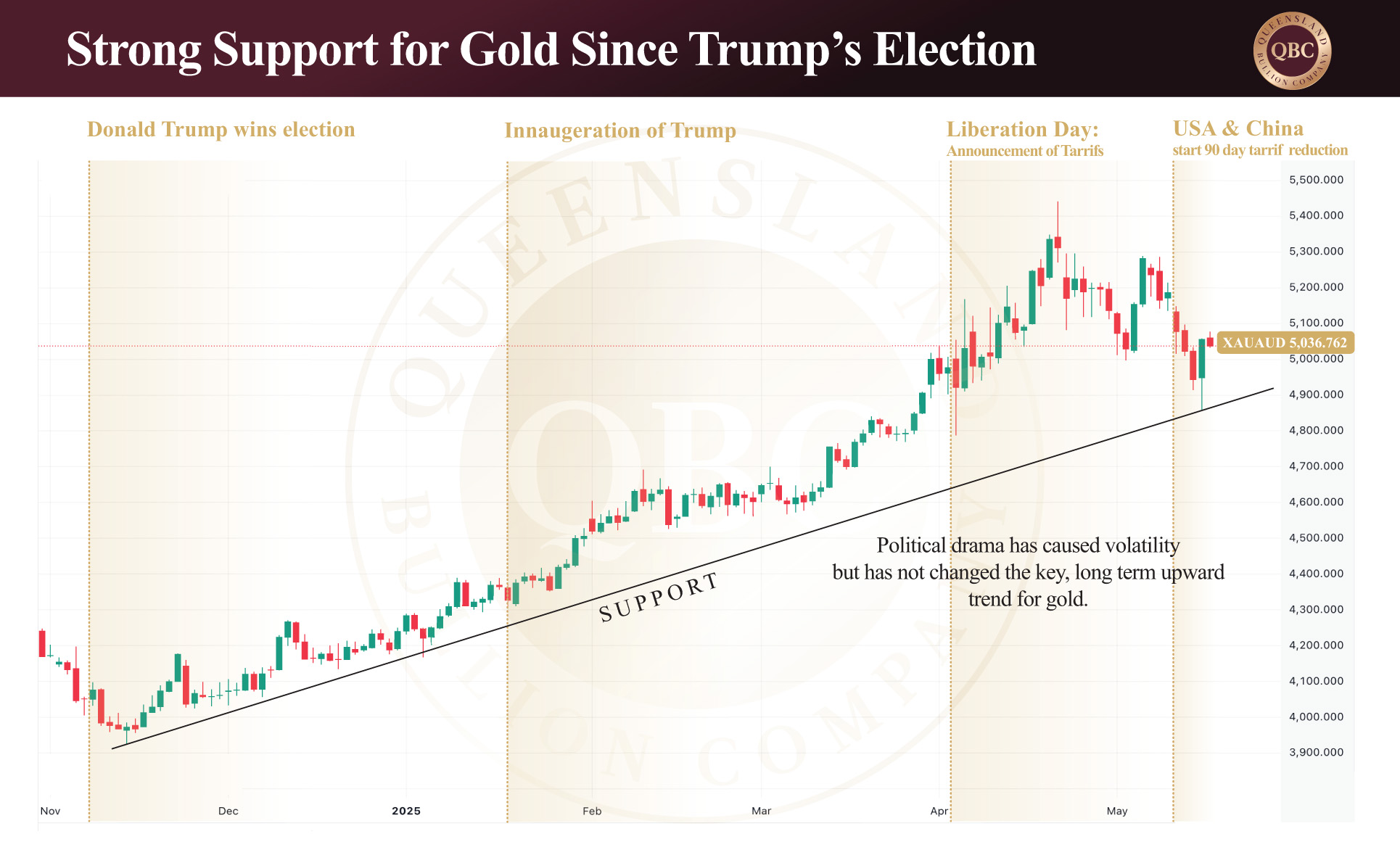

From one angle, it seems as though President Trump can shift markets with a single press conference—sending both institutional and retail investors into rapid response mode; however, when viewed from a broader perspective, this behaviour has not fundamentally changed the gold price. In fact, today’s price levels are consistent with those seen in early April. What is the net result? Heightened volatility, but little change in overall valuation.

Much of the financial media continues to focus on the threat of a trade war, but the underlying question is whether this truly impacts gold’s trajectory—or simply fuels the broader financial noise. Technically, the recent drop in price tested long-term support and bounced back convincingly. As the accompanying chart shows, the overall trend remains upward. If support holds, there’s little technical justification for a sustained reversal to the downside at this stage.

Beyond short-term price moves, several longer-term fundamentals continue to support gold’s positive outlook. Firstly, there is growing pressure from the U.S. administration on the Federal Reserve to cut interest rates—raising concerns over the Fed’s independence. A key indicator of confidence in the Fed is the yield on treasury bonds, which currently stands at 4.42%. Comparatively, this is an expensive rate. Rising yields typically reflect declining trust in the Fed’s repayment capacity. If confidence collapses, the risk of a deeper systemic issue in the U.S. financial system increases—something with global implications.

Secondly, inflation has not been resolved. Although it cooled slightly in April, with U.S. Consumer Price Index (CPI) now running at 3.2% year-on-year, it remains well above healthy levels. If a significant correction occurs, authorities will face two choices: stimulate with more quantitative easing—pushing inflation (and gold) higher—or accept the pain of a hard landing. Given political reluctance for short-term hardship, the former remains the likelier path.

It is also important to occasionally decouple gold’s performance from U.S. dollar bias. As shown in the above chart (based on AUD pricing), gold remains in a firm uptrend. This holds true across other major metrics too, including the Euro and the World Currency Unit (WCU), a GDP-weighted composite of the world’s top twenty economies. In all cases, support levels remain intact, which underscores the metal’s strength on a global scale.