Bank Warns Client Base of Potential Stock Market Crash

by Evie SoemardiBoth gold and silver have reached new all-time highs with gold trading above US $3000 and silver above $53 for much of the week. With gold currently trading in local markets at $4,823, silver at $53.28, and platinum at $1,572, precious metal bulls have plenty to celebrate.

Individual analysts have projected the value of gold to be as high as US $4,000 by the end of the year (or AU $6,310 with an exchange rate at 0.6338). And while we cannot be sure what the figure will be, we are very bullish at Queensland Bullion Company. Below are new outlooks for gold among some of the major banks:

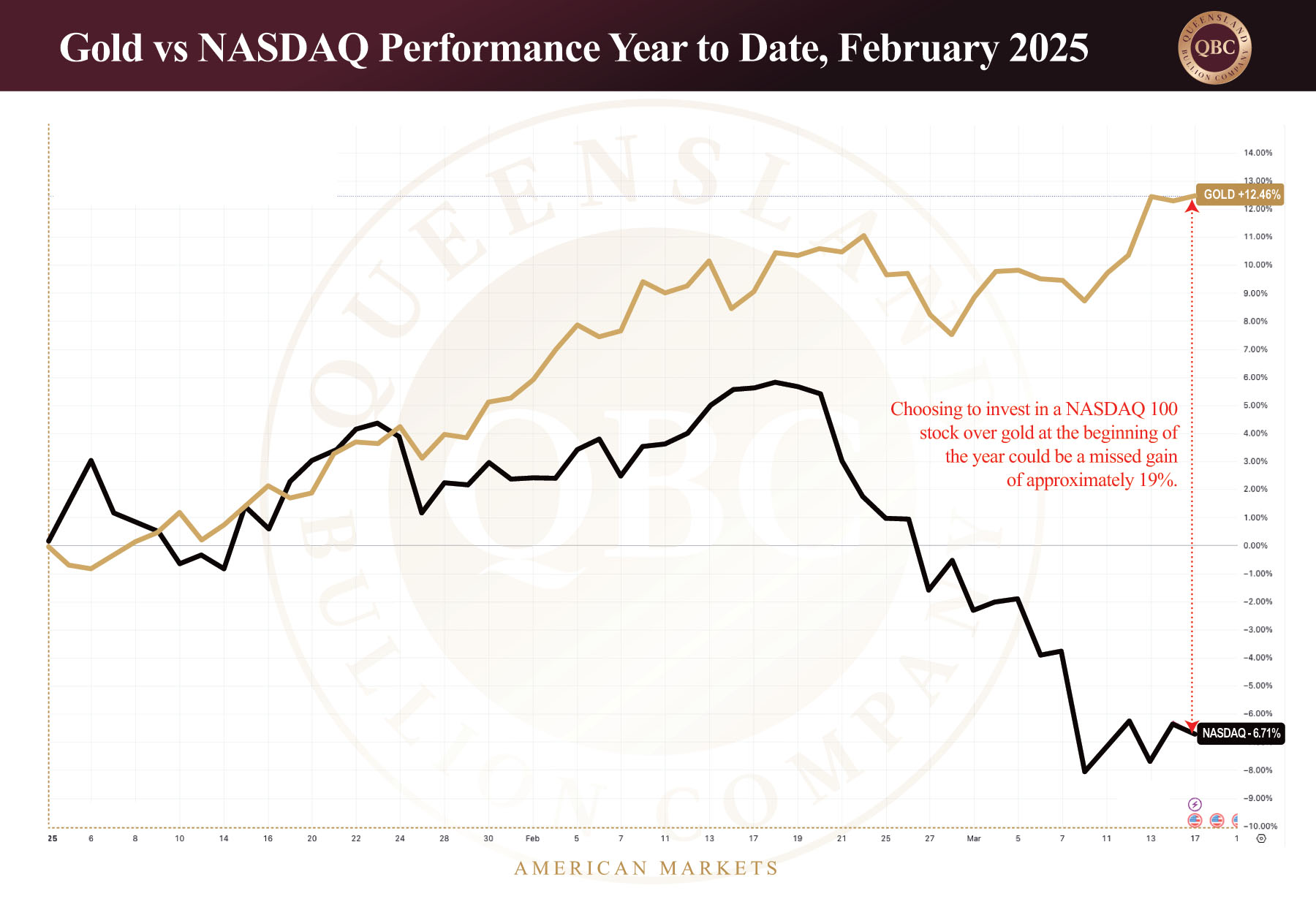

Yet as is usually the case when precious metals perform well, the economic undercurrents make for dangerous waters. In a private communication Macquarie Bank recently warned its client base of a potential stock market crash in American markets. They have based this on its analysis of US President Trump’s economic policies. Further, US Secretary of the Treasury, Scott Bessent (who’s largest position is gold), is on record saying that the Trump Administration is not concerned with market volatility but, like the Federal Reserve, it is focussed on the real economy (not the stock market). This is despite the fact that the Dow Jones Industrial Average has lost in excess of 7% and the NASDAQ more than 12% in the last thirty days. This is not great news for the 62% of Americans who are invested in the stock market, so let us take a closer look at the economy where the next global recession will start before it unfolds worldwide.

Tariffs

Hot on the press is Trump’s use of tariffs more as a sanction rather than a tax. While tariffs as a consumer tax is appealing in principle for some people, the reality is that the way Trump has applied them has created much volatility and uncertainty in the markets. It could be that this is simply a technique to meet certain goals. Recently threatening 200% tariffs on European alcohol, he has already imposed 25% tariffs on steel and aluminium (this affects Australia). The 25% tariffs for Canada and Mexico came into effect on March 6, 2025 with a few minor adjustments. Additionally, Trump has also initiated a “Fair and Reciprocal Plan” on trade wherein any country with unfair tariffs or taxes applied against them will see it reciprocated in kind. The result of such policies could see an economic slowdown as supply chains are disrupted, and retaliatory tariffs and trade restrictions are implemented. Ultimately, inflation could be the likely end result that will push America closer to recession with some analysts convinced that the likelihood of such for this year is as high as 60%.

Real estate

The current state of American real estate is much worse than it was in 2008 at the height of the last boom. Mortgage applications are down more than 60% (compared to 30% during the GFC). Housing affordability has reached its lowest in 40 years. In the early 1970s the average price of a home was 3 times the average median wage; in 2008 it was 4.7 times, and now it is a staggering 6.8 times. Current prices are 80% above the historical norm, whereas in 2008 it was 35%. Average days on the market has ballooned out 200% since 2022. It is increasingly obvious that vendors are requiring to reduce asking prices in order to sell. Housing construction contract cancellations are on the rise. Demand has collapsed, sellers have capitulated, forced sales are on the horizon, and when the market collapses by 25% analysts expect that institutions will join the chaos and start selling off massive amounts of stock. All these market indicators paint a dire picture. As the world’s best salesman, when President Trump says he will make housing affordable for a single income family again, he has effectively sold the country on the after effects of a major real estate crash.

Stocks

The stock market has been covered extensively in a prior article. To summarise, we remind you that, according to the Stock Market Capitalisation to GDP Ratio, it is currently at 188% meaning that it seems seriously overpriced. To put this into perspective this ratio was only 106% just prior to the GFC. Below is a graph showing the difference in investment value had an investor chosen stocks in the NASDAQ 100, as opposed to gold in 2025 alone.

Inflation

Our last article established how the US Federal Reserve has lost the war against inflation. While tariffs threaten to make it worse, it is clear that real estate and stock markets are sectors where inflation is rife. Consequently, consumer sentiment in America is down 22% since the beginning of the year. Expect gold and silver to benefit as other asset classes struggle. Any future consolidation in the price of metals should be seen as an opportunity to buy for investors wanting to enter the market for the first time. Seasoned investors who have long term goals know it is always better to accrue as capability allows.