Where the World’s Wealth Really Sits And Why the Skew Matters

by Evie SoemardiPrecious metals like gold, silver, and platinum have served as anchors of value for centuries, yet today they occupy only a fraction of global wealth. Spot prices currently stand at AUD $5,145 for gold $58.76 for silver, and $2,098 for platinum — levels that, when viewed against other asset classes, suggest precious metals have a long way to go despite enjoying record pricing. Meanwhile, vast sums are concentrated in asset classes where valuations are flashing warning signs.

Real Estate – The Global Asset Juggernaut

Real estate remains the preeminent asset class worldwide, often seen as an essential first goal for most retail investors. The industry totals at an estimated $300–400 trillion. This includes everything from owner-occupied homes and farmlands to multi-billion-dollar commercial developments. Although real estate is traditionally viewed as a stable, inflation-protected asset, there are emerging vulnerabilities. Post-pandemic, office spaces face structural demand shifts, and financing costs are tightening as central banks recalibrate interest rates. Demographic shifts and a mixed outlook for commercial use further cloud the picture. Added to this, the 18.6 year economic and real estate cycle suggests there could be up to another twelve months of high times for estate agents as they squeeze the last commissions out prior to the expected correction. As a case in point, Sydney now “stands alone” as the most expensive city in the world for housing. Extrapolate this around the country and it suggests the real estate bubble in Australia could be the largest elephant in the room.

Bonds – A System Under Strain

The global bond market remains the second largest financial asset class, valued at $130–150 trillion, encompassing government, corporate, and municipal debt. What’s particularly striking is how the debt ceiling has evolved from a legal limit into a baseline expectation for perpetual government spending. With central banks expanding their balance sheets and inflation proving sticky, policymakers appear trapped, facing a lose-lose between maintaining credibility and ensuring solvency. These are problems that cannot simply be printed away and this, in turn, chips away at confidence in fiat currency systems.

In this context, traditional safe-haven assets like U.S. Treasuries lose their appeal as yields drop. In comparison, physical gold and silver (non-counterparty, tangible, and historically resilient) emerge as rare stores of value that are not subject to the same fiscal pressures. And despite not offering regular yields, they don’t rely on sovereign promises and are immune to default or devaluation risk, reinforcing their role as essential portfolio hedges. As central bank interest rate cutting cycles ramp up look to see if there is a transfer of capital away from bonds and into precious metals.

The Equity Bubble – $100–120 Trillion

The global stock market, valued at USD $100 to 120 trillion, is not just large — it is historically expensive. A Bank of America survey indicates 91% of global fund managers believe U.S. stocks are overvalued, the highest since 2001, reflecting widespread concern about a potential bubble. The Buffett Indicator (total stock market capitalisation divided by GDP) is now above 170% globally and over 210% in the U.S., far beyond the long-term average of approximately 100%. This signals a market priced for perfection to take profits but also highly vulnerable to economic shocks.

U.S. equities dominate with USD $50 to 60 trillion in value, and a staggering 55% of that is now tied to technology and tech-related companies. The “Magnificent Seven” alone account for 34% of the S&P 500’s total market capitalisation, up from 12% just a decade ago. Such concentration not only inflates valuations but also magnifies systemic risk; if one sector falters, the ripple effect could be severe.

While equities are celebrated for their growth potential, the current valuations imply minimal margin for error. For investors seeking safety, this is a time to question whether they are overpaying for future returns.

Precious Metals – The Overlooked Hedge

Despite their enduring role as stores of value, gold and silver account for just 2 to 3% of global financial assets (approximately USD $12 to15 trillion), with physical bullion holdings representing a tiny 0.1%. Retail investors typically allocate about 1% of their portfolios to gold, with silver allocations even smaller; professional wealth managers often hold none at all.

This low allocation stands in stark contrast to expert recommendations of 10 to 20% in precious metals. The material reality is that financial advisors simply do not recommend physical metals to retail investors because there is no commission on offer. And if an investor prioritises regular yields (as opposed to wealth preservation) then capital gains may not be appealing enough to recommend.

Historically, gold and silver have preserved purchasing power through recessions, inflationary spikes, and market collapses. With stocks trading at historically stretched valuations and sovereign debt at record highs, the opportunity cost of holding bullion has rarely been lower. For patient investors, precious metals may be one of the few undervalued, time-tested safe havens left.

The Bigger Picture

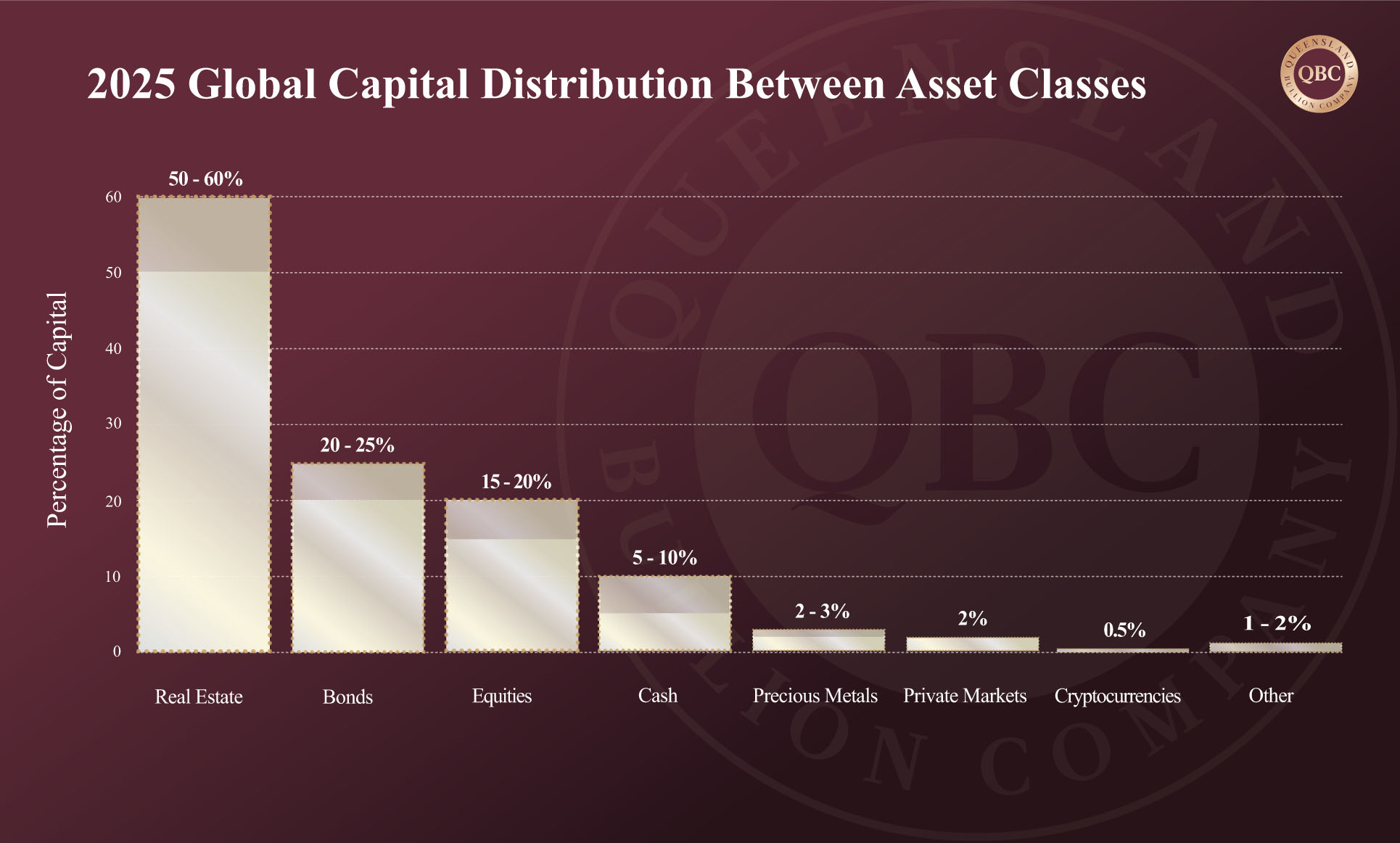

Currently capital is skewed towards risk-on assets. Of the estimated $500 to 600 trillion in global financial assets, the vast majority is concentrated in real estate (50 to 60%), bonds (20 to 25%), and equities (15 to 20%). Precious metals occupy a fractional share, far smaller than cash, private markets, or even cryptocurrencies. Given the extreme valuations in stocks and the lowering yield prospects for bonds, this imbalance raises a simple question: when the tide turns, will capital flow back to the one asset class that has proven itself for over 5000 years?