Tracking the Shift: Precious Metals vs Tech, Crypto and Equities

by Evie SoemardiMarkets have entered a decisive phase as investors reassess where capital is safest, and where it can still grow. Two months of heightened volatility have sharpened the contrast between risk-on and risk-off assets revealing clear winners as global uncertainty persists. Last week we examined the theme of asset class rotation and how capital moves between risk-on and risk-off sectors as conditions evolve. Building on that discussion, today we compare how gold and silver are performing against major indexes and cryptocurrencies since early September and year to date. At the time of writing, gold trades at AUD $6,416 per ounce, and you can buy silver bars at AUD $79.89, and platinum at AUD $2,426. With these spot figures in mind, let’s explore how the rotation is playing out across markets.

Influencing Factors

One of the most interesting developments is gold’s resilience is the recent rebound in expectations for a rate cut. After the release of the U.S. Federal Reserve minutes from its November meeting, markets were reminded that rate policy is far from settled. While some Fed participants favour cuts if the economy progresses as expected, many others suggest holding rates steady for now. Chair Jerome Powell reinforced this when he stated that a December rate cut was not a “foregone conclusion.” However, since then there have been dovish comments from key officials. Recently, New York Fed President John Williams signalled there was “room for further adjustment,” and Fed Governor Christopher Waller deeming a December 25-basis-point cut “appropriate” due to persistent labour market weakness, downplaying the resilient September jobs data as likely to be revised lower and emphasizing employment risks over sticky inflation. The CME FedWatch probability for a December cut has surged to 85.1% as of November 25, up sharply from 42.4% a week ago and well above the post-minutes low of 33.6%. That renewed consensus and optimism means that gold’s earlier decline (triggered by an overbought market) is being reversed as the market refocuses on fundamental drivers, such as lower-for-longer rates supporting safe-haven demand, rather than immediate policy uncertainty.

That shift in sentiment is playing out across the asset spectrum. Lower rates typically move demand towards non-yielding assets like gold and silver. At the same time, the expectation of a rate cut means less new liquidity for risk-on sectors such as equities and cryptocurrencies. Because of this, capital is tending to favour safe havens assets.

What This Means in Practice

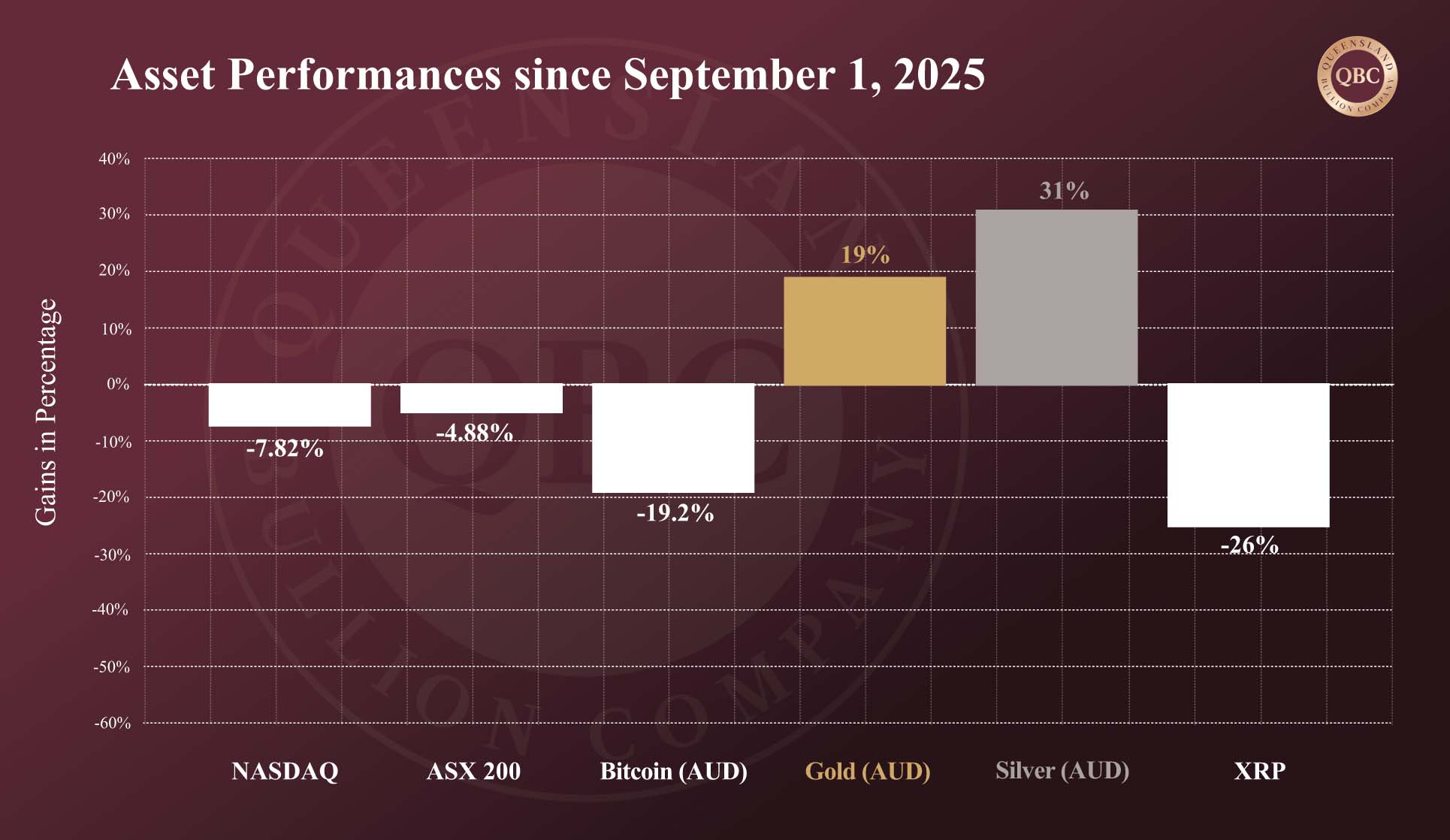

When interest rates are cut, the opportunity cost of holding gold and silver falls which makes them more attractive. Currently, with the probability of a cut reduced, precious metals are holding their ground rather well. Simultaneously, with fewer rate cuts expected, less new money is flowing into equities and crypto. This dynamic is visible in the performance numbers as at last Friday: the Nasdaq Composite started September at 23,951 and now sits at 22,078, down 7.82 %. The ASX 200 began the month at 8,865 and is now 8,432, down 4.88%. Meanwhile, Bitcoin fell from AUD $165,865 to AUD $134,003, a colossal 19.2 % drop. In contrast, gold climbed from AUD $5,306 to AUD $6,315 (+19%), and silver from AUD $59.76 to AUD $78.55 (+31%).

Performance Year to Date

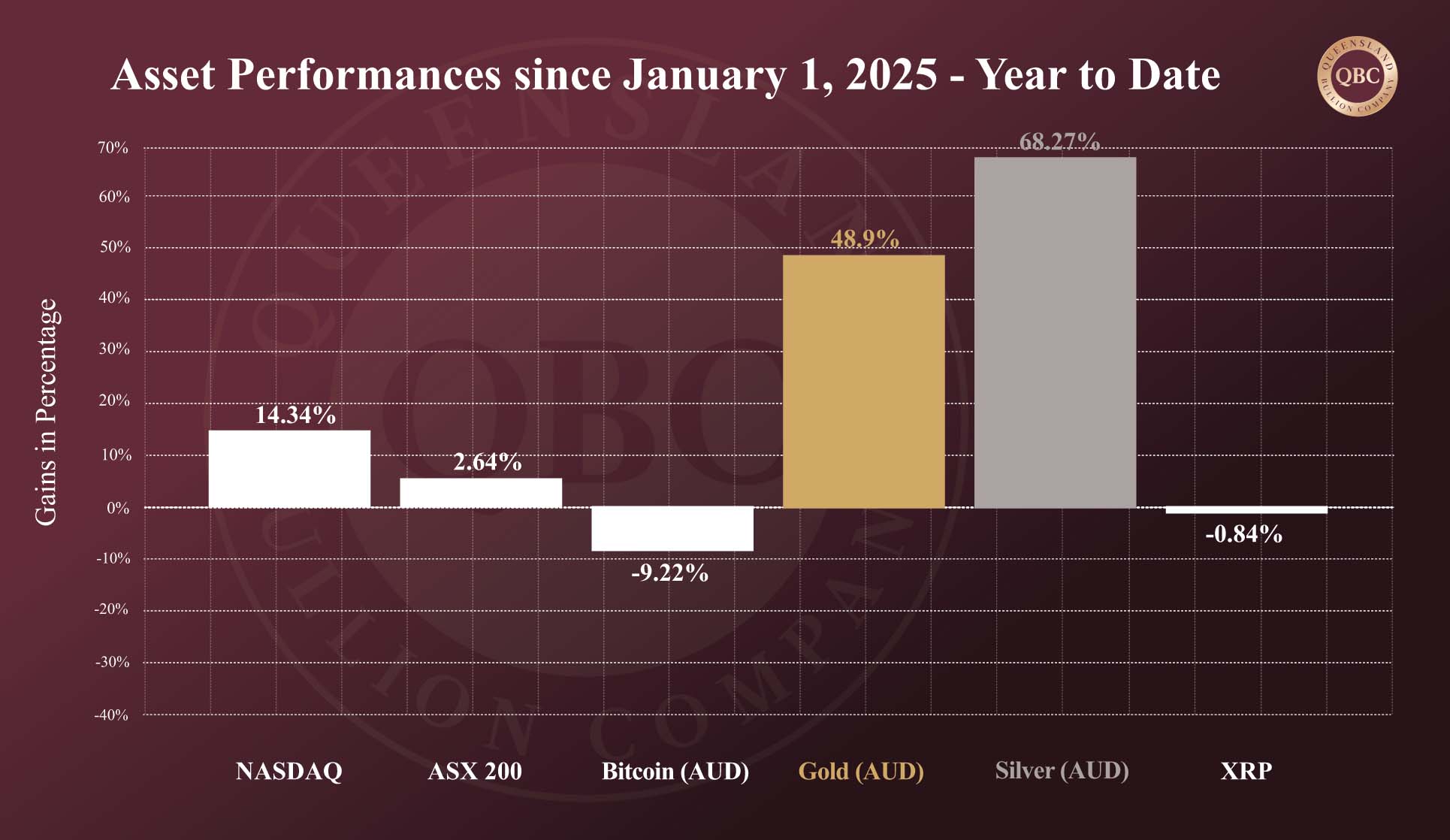

When we look at the full year, the contrast is even sharper. The Nasdaq began the year at 19,309, representing a 14.34 % gain to date. The ASX 200 opened at 8,215, up 2.64 %. Bitcoin began 2025 at AUD $147,610, incurring a loss of 9.22 %. By comparison, gold moved from AUD $4,241 to AUD $6,315, a 48.9 % increase. And silver posted an even stronger result, climbing from AUD $46.68 to AUD $78.55, a 68.27 % rise.

In summary

In a world of fluctuating confidence and shifting capital, the differences between asset classes have never been clearer. Equities and cryptocurrencies remain exposed to growth expectations and liquidity cycles, while gold and silver continue to demonstrate their worth during times of uncertainty. For investors focused on both wealth preservation and strategic growth, precious metals remain the go-to asset class. While no asset rises in a straight line, the relative strength of gold and silver suggests that their secular bull markets are still in the early innings, and that now may be a smart time to strengthen your position.