Is AUD $7,500 Plausible in 2026?

by Evie SoemardiGold is setting new all-time highs while silver is trading at levels not seen since 2011 and surpassing the psychologically important marker of $2000 per kilogram in Australian markets. This week’s breakout may mark the beginning of the next leg up in a broad precious metals rally. At the time of writing, gold is trading at AUD $5,434, silver at AUD $62.72, and platinum at AUD $2,127. So what is behind the current rally and where does this place the price of gold in the next six months? As many Western traders return from Summer holidays abroad, let us unpack five major reasons why precious metals are once again on the move.

Expected Fed rate cut

A critical catalyst for the rally in gold prices is the market’s anticipation of a rate cut by the United States Federal Reserve on September 17, 2025. A 25-basis-point reduction is widely expected, although there is speculation the Fed could take a more aggressive step with a 50-point cut if incoming data continues to show weakness. The U.S. July jobs report revealed only 73,000 jobs created, well below expectations, with downward revisions for earlier months. Such figures underscore a softer labour market, which typically strengthens the case for rate cuts.

Lower rates support gold in two ways: they weaken the US dollar, making bullion more affordable for foreign buyers, and they reduce the opportunity cost of holding non-yielding assets. Together these factors add momentum to the current rally as capital shifts away from Treasury bonds to either higher-risk but higher-yielding equities, or safe havens such as precious metals.

Depreciation of the US dollar

Since President Trump’s return, the US dollar has depreciated by roughly 8% based on the U.S. Dollar Index. This reflects the Administration’s goal of incentivising domestic manufacturing to make it cheaper to export internationally, a mandate that President Trump campaigned on prior to his election last November. When the US dollar weakens, gold and silver often gain support as international investors see lower precious metal prices in their own currency. This depreciation has further fuelled global appetite for precious metals, reinforcing their status as preferred safe-haven assets; however, it is worth noting that since 2011 the Australian dollar against the Greenback has generally softened resulting in overall higher precious-metal prices in the Australian market.

Inflation and money supply growth

Another key factor is the expansion of the US money supply. After a rare contraction in 2022–23, the M2 money supply (available cash) has surged by USD $1.36 trillion since late 2023, reaching a record USD $22 trillion. Such growth is usually inflationary. Precious metals have long been viewed as natural hedges against monetary expansion, and gold has responded strongly to these conditions. Importantly, this trend is global, as central banks worldwide continue to expand balance sheets in response to economic fragility.

Rising US national Ddbt

The US national debt has now reached USD $37.19 trillion and is projected to surpass USD $40 trillion by the end of this year. Policy measures under the One Big Beautiful Bill Act (passed on July 4, 2025, America’s Independence Day) are expected to accelerate this trend, adding more than USD $3.4 trillion in direct spending and even more when accounting for interest. The relentless rise in debt erodes long-term confidence in fiat currencies, and perception of the Government and Fed’s ability to meet their debt obligations. This jeopardises the bond market (another safe haven asset), and strengthens the case for holding precious metals as insurance against monetary debasement.

Capital rotation out of equities

Perhaps the most significant shift underway is a gradual rotation of capital from equities into precious metals. The Dow-to-gold ratio broke below its long-term uptrend line in 2024 that has been in place since the Global Financial Crisis, signalling a structural change: momentum has moved from stocks to metals. Historically, such rotations last 10–15 years. With US equities trading at valuations even higher than those preceding the Dot-com bust and the Great Depression, a correction appears inevitable. The Buffett Indicator currently sits at 214%, far above its historical average of 86%. When this bubble deflates, what is currently a small trickle can potentially become a substantial flow of capital finding its way into gold and silver.

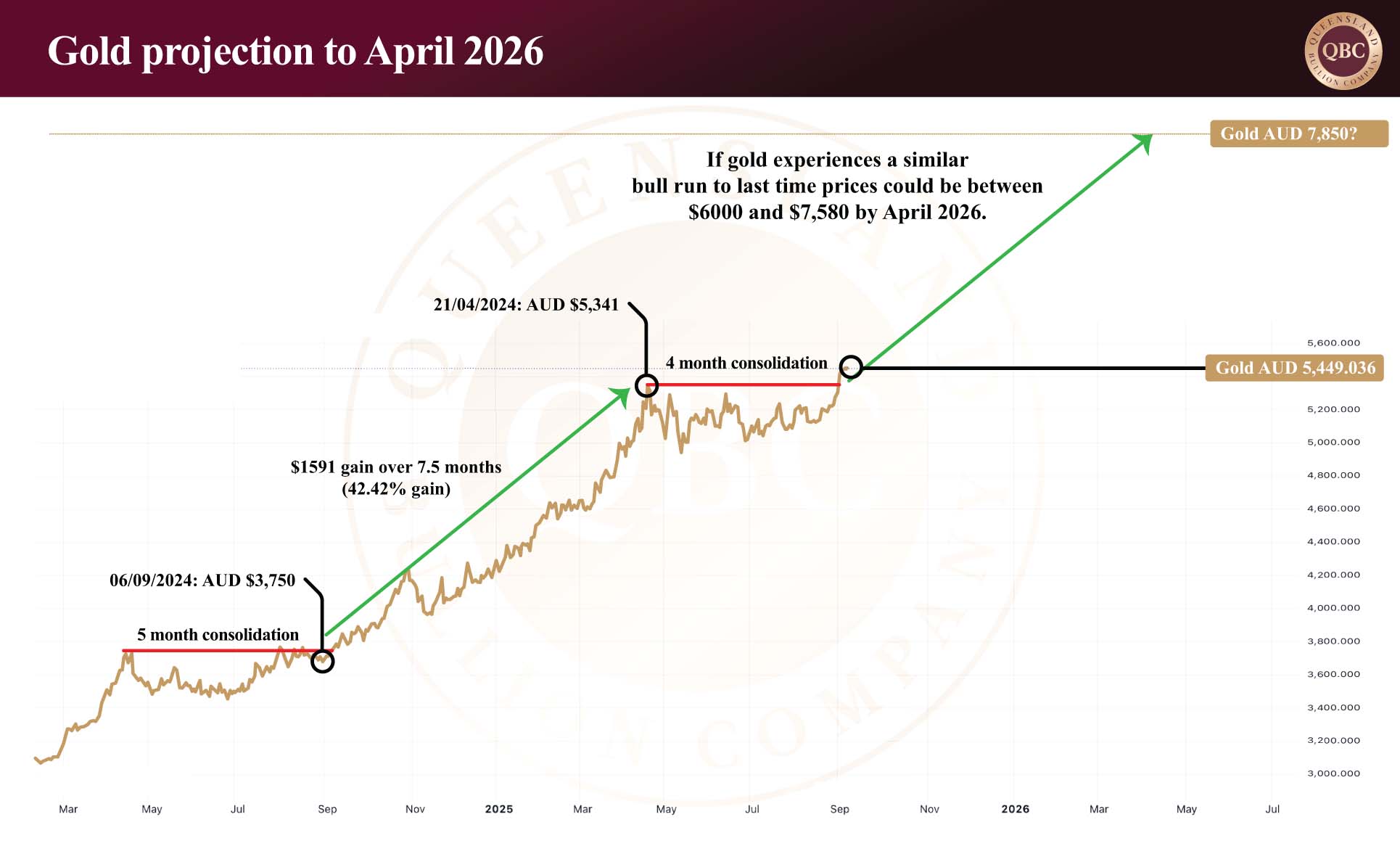

Australian Gold Prices in April 2026

The foundations for another bull run in precious metals are now firmly in place. The question is what comes next. History often provides the clearest guide to the future. Between September 2024 and April 2025, gold rose 42%, a gain of AUD $1,591. So far this year, the price has closely mirrored last year’s chart patterns (as detailed in our earlier article). If that rhythm were to repeat, another 42% increase would imply a potential price of AUD $7,584 by April 2026. Even a more conservative trajectory suggests a range between AUD $6,000 and AUD $7,580 is plausible.

This outlook aligns with major institutional forecasts. Both JP Morgan and Goldman Sachs project gold to reach USD $4,000 (around AUD $6,125) by mid-2026. Goldman Sachs has even suggested that USD $5,000 (AUD $7,658) per ounce cannot be ruled out under certain conditions. In this context, today’s highs may not be an end point, but the makings of a much larger move.

In summary

Gold’s bull market is still in its early stages, driven by a powerful mix of catalysts: the prospect of a US rate cutting cycle, persistent inflation, ballooning debt, and the beginning of a capital rotation out of stocks. For silver, the rally is amplified by its dual role as both an industrial metal and a store of wealth, with technical patterns suggesting there is still significant upside potential. For gold, central banks continue to accumulate at record levels, the metal’s role as the cornerstone of monetary security is being reaffirmed.

For Australian investors, these forces highlight why gold and silver remain essential holdings. With both metals outperforming equities over the past year, and with economic uncertainty unlikely to ease soon, precious metals continue to offer stability, protection, and long-term opportunity.