How the USD is Supporting Spike in Gold in Australia

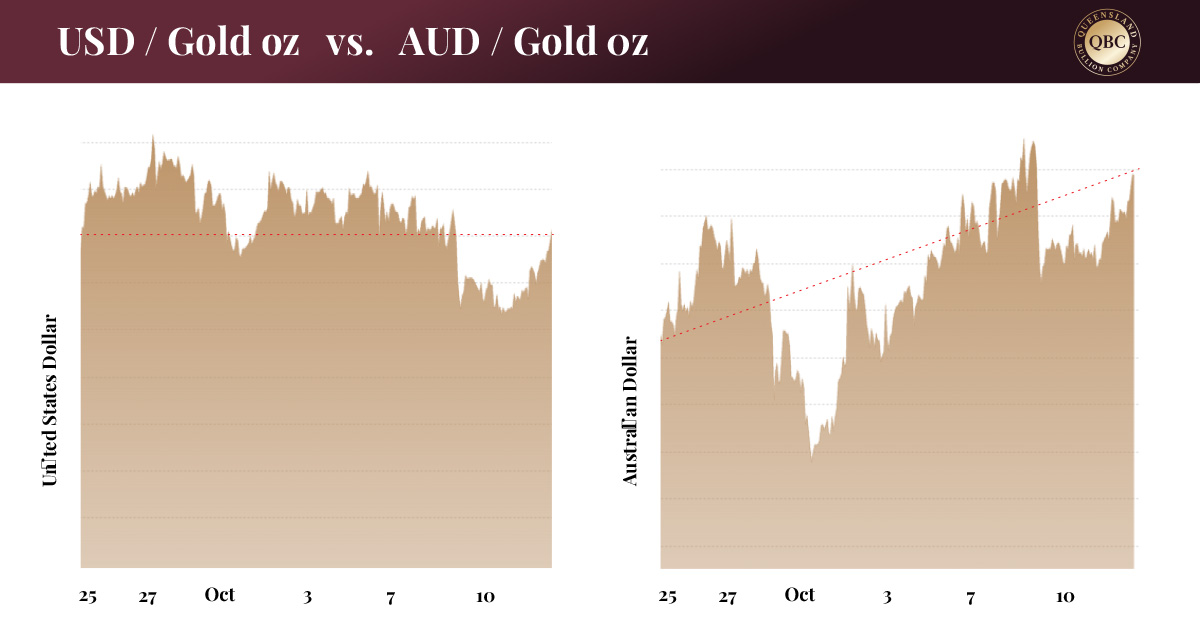

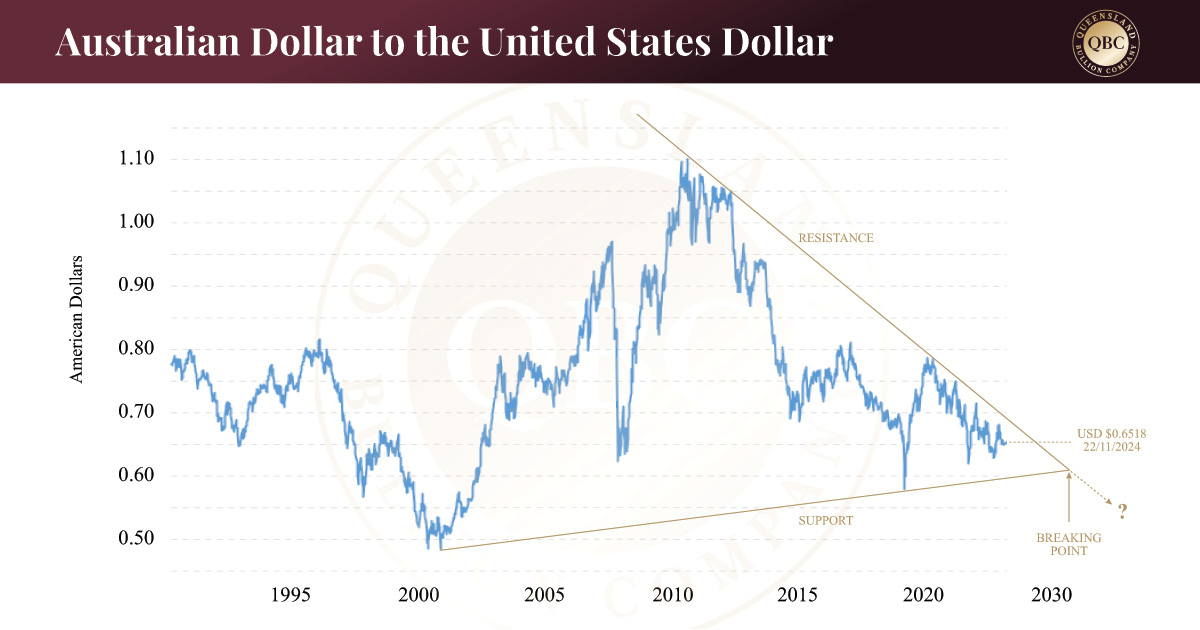

by Melanie YoungIran’s recent missile attack recently broke through Israel’s “Iron Dome” affecting markets around the world. The geopolitical conflict in the Middle East has driven Western investors to the traditionally safe United States Dollar. As investors exit high risk investment and flock to the safety of the dollar the value of the USD increases; however, the value of the Australian Dollar remains relatively unchanged. Hence, the gold price in the US has effectively traded sideways September 25, yet Australia’s price has risen 3.3% in the same period. As a case in point, at the time of writing gold currently trades at AUD $3,905.87, silver at $46.18, and platinum at $1,444.57.

So why is the USD considered a safe haven currency? Simply put, because it always has been. It has enjoyed no competition to this point. Historically the US has generally been the world arbitrator, the ultimate negotiator, and more importantly, they generally are on the winning side. It has been a genuinely safe hedge against volatile markets and has the track record to prove it. But there is a growing alternative perspective based on geopolitical conjecture.

The USA today is not the same USA that entered World War 2. The bulk of the war was paid for via the introduction of Victory taxes wherein revenue tripled and even quadrupled at times. After that the Roosevelt Administration sold Victory bonds to citizens. Despite the war coming off the back of the Great Depression people still had enough savings to fulfill their patriotic duty fund the war via these bonds. Confidence in the USD was also peaking due to being gold backed.

Contrast this to the USA today. Not only does the petro dollar hold fiat currency status alongside a consumer driven culture. Public and private debts are at all time highs. And while the Fed says inflation is at 2% and employment levels are healthy, the harsh reality is that the US government and their citizens are not in a position to fund a war, and yet, they are. The table below demonstrates military grants and loans to Israel and recent amounts are staggering.

So how does the US perform this seemingly impossible task? The main option is simply to print more money. What is clear is that war and inflation will be inseparable, and in the context of war inflation will support the price of gold.

In summary, the USD has never been challenged. Western investors who lean toward tradition and historical evidence flock to the USD. The sophisticated Western investor will also factor in the rise of BRICS and its’ emerging currency with 40% backing in precious metals and the ensuing implications. Ultimately it is wise to remember that gold is the true safe haven in war, it is what provides confidence in currency. Gold has a much longer history than the USD. Those with the foresight to remember this will place themselves accordingly as geopolitical conflict ramps up.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Queensland Bullion Company Pty Ltd or any other associated entities. The author has made every effort to ensure accuracy of information provided; however, neither Queensland Bullion Company Pty Ltd nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Queensland Bullion Company Pty Ltd and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.