Government Shutdown Erodes Confidence: Precious Metals Rally in Response

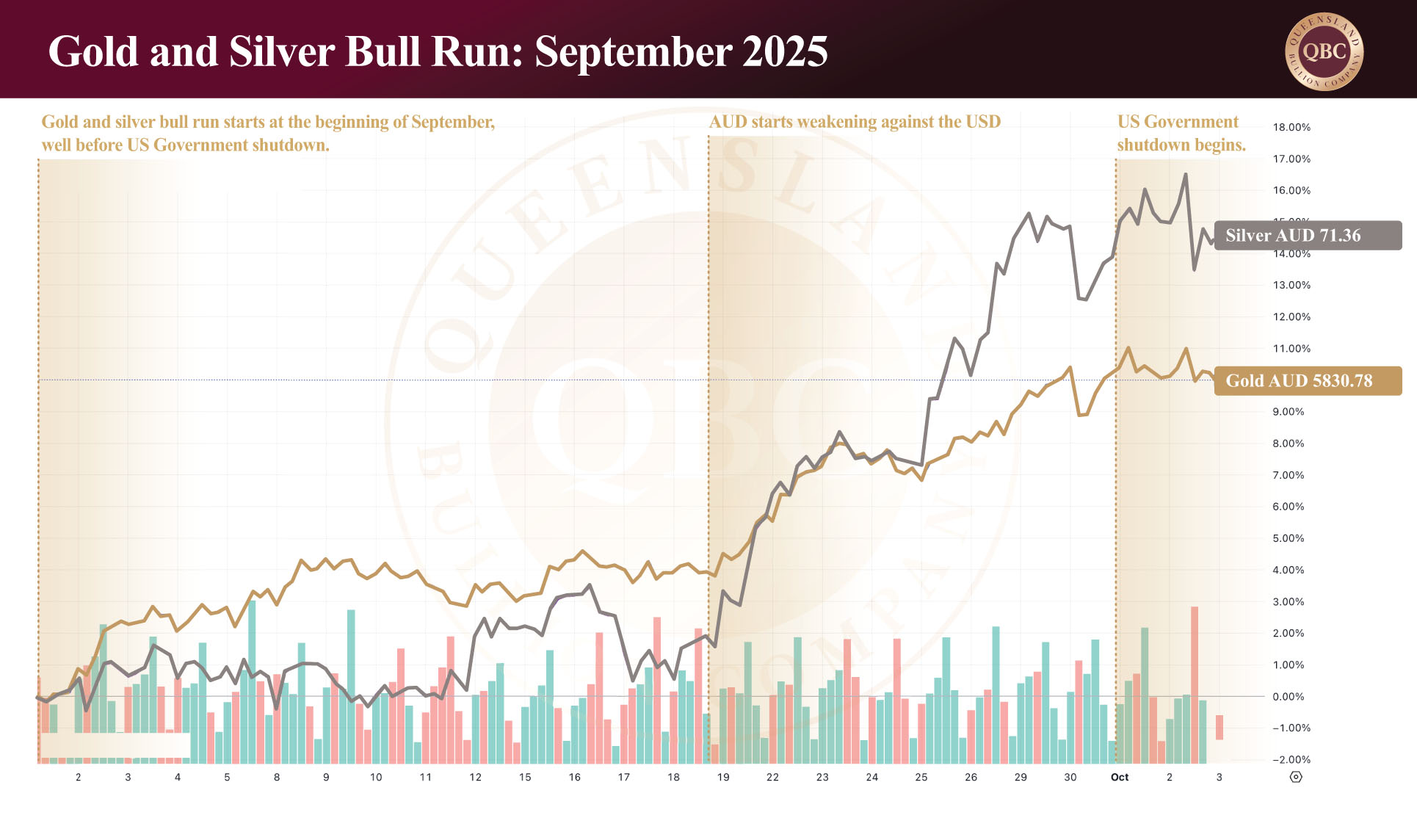

by Evie SoemardiGovernment shutdowns have long been a feature of the American political landscape, but each episode leaves a deeper mark on global confidence. For investors, they highlight the fragility of the fiscal system in the world’s largest economy and raise fresh questions about stability. The latest shutdown, beginning at 12:01 a.m. EDT on October 1 in the US, has already rattled markets. At the time of writing, gold is trading at AUD $5,853.16 per ounce, silver at AUD $71.72, and platinum at AUD $2,420. Precious metals are once again proving their worth as safe-haven assets while investors brace for further turbulence.

What triggers a government shutdown?

The immediate cause of the current shutdown is a familiar one: political gridlock. Congress failed to agree on either a comprehensive budget or a stopgap funding bill, with negotiations collapsing over fundamental disagreements on welfare structures, tax reforms, and federal spending priorities. As a result, non-essential federal agencies closed their doors at the start of October. The House of Representatives passed a temporary measure, but Senate Democrats blocked its progress through a filibuster (where the minority refuses to end debate), preventing the bill from reaching the required 60-vote threshold. This latest standoff reflects an increasingly entrenched divide between parties, with little sign of compromise on either side.

The immediate fallout for America

The immediate effects of the shutdown are significant. Approximately 750,000 federal workers have been furloughed without pay (with backpay due upon return) and non-essential services are now suspended. Analysts estimate the economic cost of the Government shutdown is approximately USD $400 million daily.

Unlike prior shutdowns, this impasse lands at a time when global markets are already on edge. Inflation remains above target of 2% at 2.9%, growth is faltering, and geopolitical risks are multiplying. The impending delay in publishing jobs or inflation data now clouds the outlook for the Federal Reserve ahead of its next meeting, complicating monetary policy decisions. Meanwhile, threats from the White House to cut federal jobs outright only add to the sense of instability.

Lessons from past episodes

Government shutdowns are not new however their severity has varied. The 2018–2019 shutdown under President Trump stretched to 35 days, the longest in history, while the 2013 episode under President Obama lasted 16 days. Most shutdowns since 1980 have been resolved within one to three weeks. The current domestic political climate for the U.S. has experts suggesting a potentially prolonged stalemate due to political unwillingness to yield on core policy issues. This is playing out in an already fragile economic backdrop. If it does, the economic and financial damage will likely intensify, spilling into the global economic framework as uncertainty.

Gold’s historical response

Gold has often shown resilience during shutdowns with investors moving to hedge against both political dysfunction and economic uncertainty. The difference this time lies in the broader environment: political turmoil only magnifies the instability around high inflation, slowing growth, and colossal fiscal debt, all of which are fundamentals that existed long before the current government shutdown was even contemplated. While past shutdowns have produced mixed results for precious metal prices, the current rally stands out for both its speed and its scale and is more in response to underlying economic fragility than that of the shutdown itself.

The symbolism is as important as the substance. Each shutdown reinforces doubts about America’s ability to manage its own finances, eroding the credibility of both the US government and the US dollar as anchors of global stability. In this environment, gold, silver, and platinum are once again proving themselves as stores of value.

Confidence Under Pressure

Shutdowns deliver more than just administrative disruption. They deliver a psychological blow to global markets by highlighting dysfunction at the heart of the world’s largest economy. The US dollar remains vulnerable if confidence in America’s political system deteriorates further. This erosion of trust matters because the US still anchors international markets. Each round of brinkmanship (dangerous policy practice or political strategy) weakens that position. For international investors the signal is clear: political risk is no longer confined to emerging markets but continues to seep into the West’s sole superpower. It infects fiscal and financial systems with apprehension and uncertainty and spreads outward, carried through shifting capital flows – flows that lead to gold, silver and platinum.

The below graph illustrates that, while shutdowns are effective mechanisms of destabilisation and they contribute to a lack of confidence, it is not the primary cause of the current bull run in either gold or silver.

Conclusion

Even though gold, silver and platinum have increased considerably since the beginning of September, the political climate underscores the fragility of the financial system and adds yet another layer of uncertainty to an already volatile global environment. For investors, the message is simple. When trust in governments falter, and when political dysfunction threatens financial stability, gold and silver remain the ultimate safe havens.

As Australia navigates its own economic challenges, from currency weakness to reliance on external demand, precious metals offer a layer of protection that cannot be replicated by cash, bonds, or equities. In an era where shutdowns, deficits, and political gridlock are the new normal, the case for holding gold and silver has rarely been stronger.