Gold and the Australian Dollar: A Two-Decade Story of Strength and Weakness

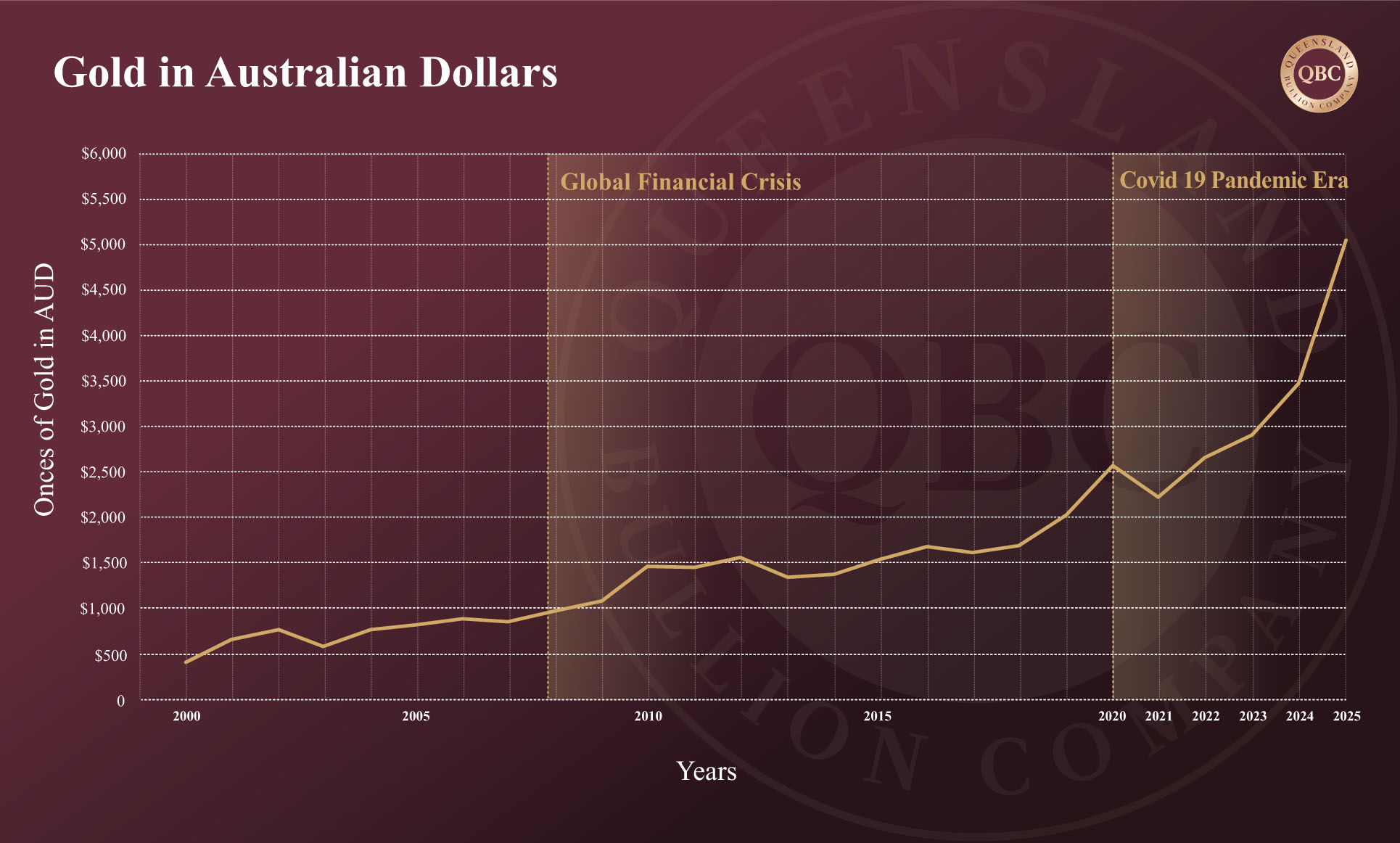

by Evie SoemardiGold has surged to record highs around the world since the turn of the century, and Australia has been no exception. Yet, for Australian investors, the value of gold is shaped not just by its international price but also by the performance of the Australian dollar. Understanding this relationship is crucial. Currency strength can magnify gold’s gains or dilute them, and over the past 25 years, it has been a decisive force in how local investors experience gold’s bull and bear markets. Currently, gold trades at $5,736, silver at $68.76, and platinum at $2,357.58. With the continuation of a bull run that could last months, possibly years, a close examination of gold’s history in the context of the Australian dollar is beneficial.

Gold and Currency Movements

For Australian investors, any discussion of gold would do well to include the local currency. In essence, when the Australian dollar is weak against the Greenback it means that local prices for gold and silver will increase. On the contrary, a stronger Australian dollar would equate to softer local prices, reflecting the inverse relationship between currency value and precious metals pricing.

In Australia we run two risks. We are subject to currency exchange and also the price of metal. Investors who are not based in America need to factor in both elements when assessing their local gold market. For example, if the market price of gold increases in the U.S. it does not necessarily translate to an increase in the Australian market; if the AUD and gold price increase simultaneously, then the increase in the AUD price will absorb some of that gain and it will not be as pronounced.

The below long-term chart for gold in AUD clearly shows an upward trajectory, underscoring the metal’s enduring value as a hedge for local investors.

The AUD’s Sideways Story Since 2000

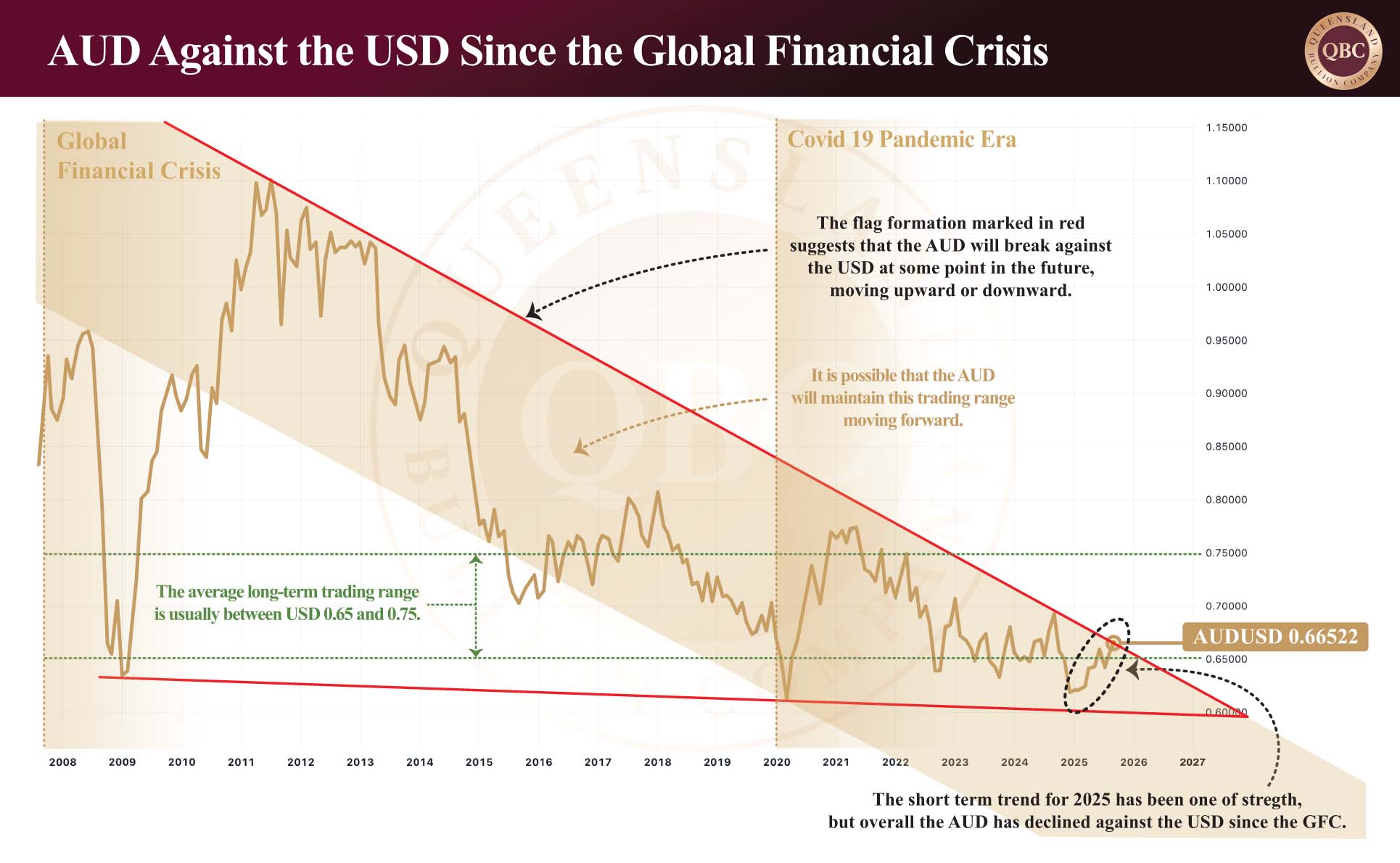

While the AUD-USD exchange rate has been volatile since 2000, it has effectively moved sideways over the longer term. In January 2000 the exchange sat at USD $0.6562 per AUD $1, while at the time of writing it trades at USD $0.6536 — virtually unchanged. Over the full period, the net result is a stable currency exchange against the Greenback. However, shorter periods tell a very different story.

Since the Global Financial Crisis (GFC), the Australian dollar has trended lower against the Greenback. Technically, the pattern in the below chart resembles a flag formation, implying that eventually the currency will break either to the upside or the downside. Assuming gold prices remain stable, let us break down possibilities on what may play out in the future if our local dollar was to move in each direction.

If it breaks higher, the AUD could move towards USD $0.75 and remain within its long-term trading range, which could shave around 13% off gold prices locally. The key question would then be whether gold in USD rises enough to offset that currency strength.

The Risk of a Break to the Downside

If instead the AUD breaks lower, more local currency would be required to purchase the same quantity of gold. This would likely push prices higher in Australian markets, even if gold in USD remained stable. Ultimately, the direction of the break will be dictated by confidence in both the Australian and American economies.

Australia’s dollar has long been tied to China’s demand for iron ore. From 2000 onward, China’s rapid industrialisation created robust demand which underpinned confidence in the AUD. After the GFC this support was especially strong. Today, however, China’s growth has slowed, and it is no longer the reliable buyer it once was. Should another major financial correction unfold (similar to or greater than the GFC), there is no obvious replacement source of confidence to support the AUD. Without this, as the AUD moves closer to the end point in the flag formation, the more likely outcome is a break to the downside — even if the USD itself also weakens against other global currencies.

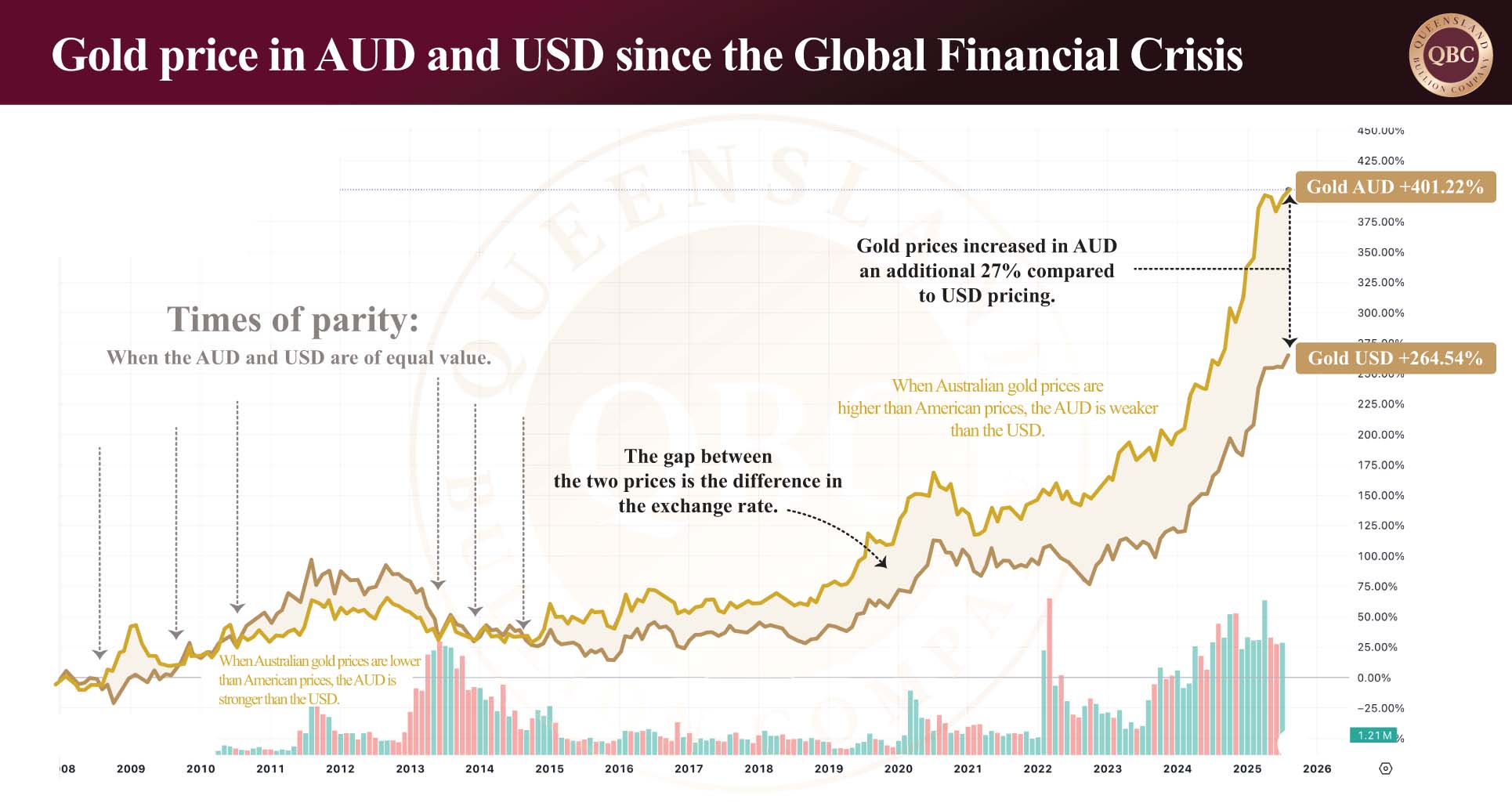

Gold’s Outperformance in Australia

Since the GFC the Australian price of gold has increased at a faster rate than if you were to buy in American dollars, underscoring gold’s role as a hedge against currency weakness. In August 2008, gold traded around USD $871 per ounce. By September 26, 2025, it had climbed 329% to USD $3,741. In AUD terms, the rise was even steeper (from AUD $1,092 to AUD $5,726 per ounce), providing an increase of approximately 424%. This disparity illustrates how currency depreciation has amplified the performance of gold for local investors since the GFC.

The chart below was produced prior to the current September rally and highlights this long-term trend. Its recent run only reinforces the story: for Australians, gold has been even more rewarding than the headline USD figures suggest.

Read another article that address’s gold’s relationship with the AUD here

A Hedge Against Currency Erosion

Gold’s enduring strength in Australian markets is not just a reflection of global demand, but also of the relative weakness of the local currency. As long as the AUD remains tied to uncertain demand from China, and with little to backstop confidence in the event of another global financial shock, the risks of a break to the downside remain real. For investors, this only strengthens gold’s case as a defensive asset.

In an economy exposed to external risks and subject to volatile exchange rates, gold continues to stand apart. For Australians looking to preserve wealth in an era of uncertainty, gold remains the cornerstone of stability.