Why Is Powell Such a Big Deal for Trump?

by Evie SoemardiAs rumours swirl about Federal Reserve Chairman Jerome Powell’s potential resignation, investor sentiment has become increasingly fragile. Market volatility has spiked as concerns grow that the Fed’s independence may be under threat. Spot gold is trading at AUD $5,126, silver at AUD $58.79, and platinum at AUD $2,278, all buoyed by the growing sense of unease. At the heart of this turbulence is the escalating tension between President Trump and Powell, with the President publicly calling for immediate rate cuts and expressing open dissatisfaction with Powell’s neutral stance. Political interference in central bank policy is rare; open demands for leadership change are even rarer. The implications, however, are far-reaching and merit close examination.

Why Target Powell Now?

President Trump’s criticism of Powell is not new, but it has intensified markedly in recent weeks. The President insists interest rates should be at least 3% lower than their current level, down to 1.5% from 4.5%. The motivation is clear: lower rates would significantly reduce the cost of servicing the U.S. national debt, especially with $9 trillion maturing in 2025. In theory, such a reduction could save the Treasury tens of billions in annual interest.

However, cost control is not part of the Federal Reserve’s dual mandate, which is to maintain price stability and maximise employment. Cutting rates now, while inflation remains sticky and the labour market tight, could undermine that mandate.

There is also a secondary and possibly more important motive: a weaker U.S. dollar. Declining interest rates typically push the dollar lower, giving American exports a competitive boost — a longstanding Trump priority, and one that his administration relies on if their tariff policy is to succeed.

What Happens If Powell Leaves?

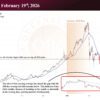

If Powell resigns and a new, more compliant Fed chair is installed, rate cuts would likely follow swiftly. This could trigger a rapid unwinding of U.S. Treasuries. If investors anticipate deeper or faster cuts, they may sell off bonds to avoid locking in low yields — especially if inflation is expected to rise. The result? A spike in yields, falling bond prices, and capital flight out of the U.S. debt market.

As Treasuries weaken so does confidence in the U.S. dollar. This typically pushes gold higher in American dollars, both as a hedge against inflation and as a store of wealth in times of monetary instability. A lower dollar also stimulates exports, helping the trade balance. But such gains come at the cost of long-term market trust in the independence and discipline of U.S. monetary policy.

What If Powell Stays the Course?

If Powell remains, and the Fed maintains current rates, it would signal a vote of confidence in the U.S. economy and the central bank’s independence. This would support the Greenback and likely put a ceiling on precious metals in the short term in US dollars; however we do know that a strengthening U.S. dollar is favourable for Australian investors. Treasuries would remain attractive, particularly to yield-seeking investors, and global capital flows would likely stabilise.

While this may temper gold’s near-term gains, it reaffirms the Fed’s commitment to data-driven decision-making. It would also buy time to observe how current inflation dynamics and fiscal policies play out — a prudent move given the Fed’s limited options in a high-debt, high-volatility environment.

AUD vs USD: Why It Matters Locally

From an Australian perspective, the USD-AUD exchange rate is critical. If the U.S. dollar strengthens, precious metals priced in USD become more expensive in AUD — driving local prices higher. Conversely, a falling Greenback can soften metal prices here, even if global spot prices remain stable.

Right now, the Australian dollar has slumped back below USD $0.65 following a surprise rise in unemployment to 4.3%. With 33,600 Australians becoming unemployed in June and the labour force growing only slightly, markets are now pricing in a 98% chance of a rate cut from the RBA as it was last month. Lower rates will likely weaken the AUD further, setting the stage for precious metals to remain firm in local terms.

The current standoff between Trump and Powell represents more than a political spat. It signals a broader clash between fiscal ambition and monetary integrity. Should Trump succeed in reshaping the Fed to suit short-term political or fiscal goals, the consequences for Treasuries, the USD, and precious metals could be profound. For Australian investors, the interplay between these forces may well determine whether this is a moment to wait, or to act. When central bank independence is under siege, gold, silver, and platinum become more than just commodities; they become a lifeline of certainty in an increasingly uncertain world.