West Gears Up for World Wide War

by Evie SoemardiIn an effort to “give EU citizens peace of mind” the European Union (EU) has just asked 450 million people to stockpile seventy-two hours’ worth of emergency stockpiles that are being referred to as “war supplies.” This is the European backdrop that sees gold and silver hit all-time highs in the Australian market. Gold currently trades at $4,856, silver at $54.91, and platinum at $1,571, and it seems the global geopolitical climate just increased the possibility of another run on gold and silver, albeit the timing is still in question.

According to the press release issued by the European Union, the reasons cited for such action include growing geopolitical tensions and conflicts, hybrid and cybersecurity threats, foreign information manipulation and interference, climate change, and natural disasters. Naturally Russia did not escape mention with the EU referring to the full-scale war in Ukraine as one of the reasons. In making the announcement, representatives of the EU mentioned that luckily they are not starting from scratch and that the Covid 19 Pandemic era was an experience that has already proven the value of “working together in solidarity and coordination within a EU framework [that] makes us more efficient.” Interpret the EU’s messaging and potential social engineering efforts as you will.

Meanwhile in America, from his International Golf Club in Florida, President Donald Trump announced a series of attacks on Houthi rebels in Yemen. The airstrikes killed fifty-three people as the President promised to use “overwhelming lethal force” until the Iran-backed rebels cease their attacks on shipping along a vital maritime corridor. The attacks came a few days after the Houthis said they would resume retaliations on Israeli vessels sailing from Yemen. The Houthis justify their actions based on Israel’s blockade in Gaza. Moreover, Washington has confirmed that every shot fired by the Houthis will be seen as a shot fired by Iran. Is Washington preparing its citizens for further, more significant attacks on Iranian infrastructure through this antagonistic rhetoric?

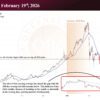

In just days it appears the West has ramped up for a potential global conflict. This is not the first time and history has valuable lessons for those who look. If we refer to the Iran-Iraq War which started in 1980, there was a sharp spike in the price of gold to the tune of 48.7% in a matter of months as it rose to USD $677.97. In US Dollars, gold then experienced massive volatility over the next decade and eventually went sideways until the early 2000s. In this time America conducted two operations against Iran (Operations Ernest Will and Praying Mantis) and experienced high inflation. Below is a graph illustrating how global conflict is a factor that directly correlates with spikes in gold value.

Conflict in the Middle East, high inflation, and volatile markets- anyone would think we were describing current events, not events from the 1980s. This time the difference is that a potential war in Europe is also on the cards. Just as the current stock market reflects a bubble in both real estate and tech stocks (read more about this here), multiple regions are shaping up to be the catalyst that could spark global conflict. The result is a perfect environment to facilitate a major shakedown in the financial world with dire repercussions, one that we may not have seen the likes of for one hundred years.

As the likelihood of geopolitical conflict ramps up, investors are looking to store wealth in safe haven assets such as the American Dollar, gold and silver. This may be why gold has not yet tested its new support at USD $3,000. While investors may not be able to affect the probability of war or a financial crash, they can prepare in order to place themselves and their loved ones in the best possible position to deal with such circumstances should they arise. Investing in gold and silver prior to conflict or financial instability is the best time to ensure wealth protection and even prosperity in a future full of uncertainty.