Top Influencing Factors Affecting Precious Metals Prices in 2025

by Evie Soemardi2025 may see a convergence of factors that create perfect conditions for a financial crisis. With gold trading at $4,374.39, silver hovering just under $50 at $49.97, and platinum at $1,531.35 it’s not necessarily at the forefront of the consumer’s minds. Indeed, in America precious metals hit some psychologically important markers, again breaking through USD $2700 for gold and USD $30 silver which has investors looking up, as they should, given financial turmoil tends to support the price of gold and silver.

When peering behind the promising outlook for precious metals a grim reality stares back. This is a reality that serves as a stark reminder why it is more important than ever for consumers to take steps to develop wealth preservation strategies (regardless of how small it may seem) and, if possible, wealth investment goals.

We have covered the topic of recession and currency enough in past articles, but what about cryptocurrency management, shorting stocks and deregulation? How do these factor into the price of precious metals moving forward?

The Trump administration is upon us. President-elect Donald J Trump has not been assassinated and is only days away from hosting the most lavish inauguration event in history. When Trump takes office he is set to unleash a raft of deregulatory initiatives in the financial sector. But how did we get here when history has proven multiple times that deregulation ultimately leads to financial catastrophe? In the words of Dennis Kelleher, CEO of Better Markets (a Wall Street non-profit watchdog), “The financial industry uses its economic power to buy political power which it then uses to increase its economic power.”

Two examples of these deregulatory initiatives are the potential elimination the Federal Deposit Insurance Company (FDIC) and the Consumer Financial Protection Bureau (CFPB), both in place to regulate Wall Street and protect consumers. Watch to see if these bodies exist in the future. Ultimately, history illustrates that deregulation results in unsustainable artificially high levels of liquidity. And while economic crashes traditionally lag behind the aforementioned, it is an undeniable consequence that has been proven out many times over.

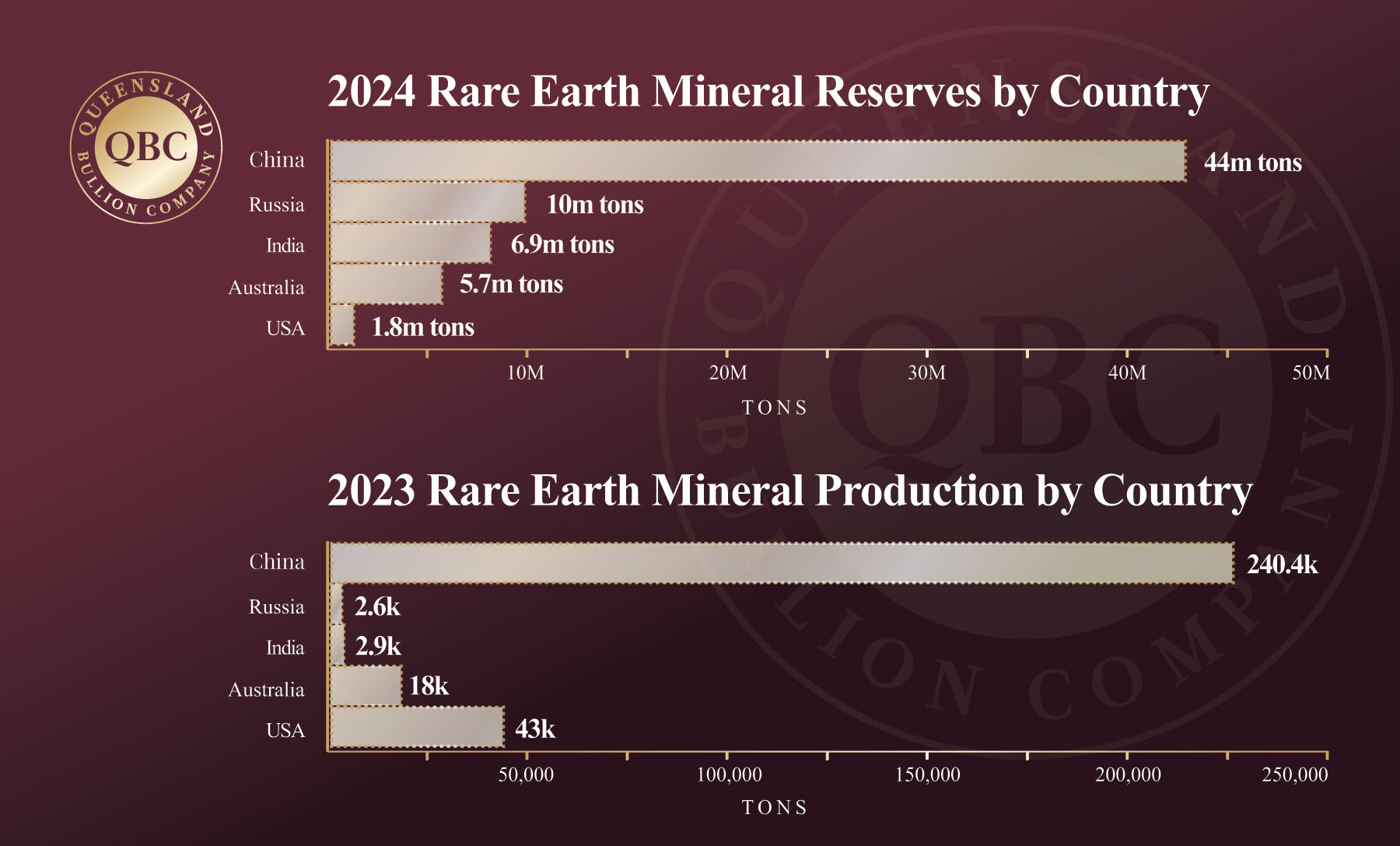

However, one initiative will have precious metals enthusiasts smiling. Trump has been advised to reduce red tape for mining companies by removing environmental impact reports. The aim is to reduce dependency on China for rare earth minerals which produces 90% of global supply. These minerals are necessary for the production of goods with in the solar panel, electronic, and electric vehicles industries, the same industries that have a heavy dependence on silver.

The graph below illustrates rare earth mineral reserves and production by country.

Additionally, it would be remiss to avoid mentioning that Trump has set himself up as the Bitcoin President. Since late July last year, after the Nashville Bitcoin Conference “Trump pump,” the price of Bitcoin rose over USD $30,000. Coincidentally, while the Bitcoin price is at all time highs, this week the Department of Justice in America approved a government sale of USD $6.5 billion of Bitcoin. This is a complete coincidence of course. Even more interesting is how the government acquired the Bitcoin. The government seized it from the Silk Road dark net marketplace. There is a narrative potentially developing here, wherein Bitcoin may be linked in the future to financial corruption, hence calling on regulation of the market. This is for two main reasons: less than one percent of investors hold Bitcoin; and, according to the FBI, 50% of financial fraud involves cryptocurrency. We remind the reader at this point that the Bank of International Settlements is well founded in instituting more prudential standards for crypto from January 1, 2025. These standards categorise cryptos into two groups with a tiered approach, the top classification being subject to certain capital requirements (for example, being gold backed). Moving forward banks are to apply a lot more scrutiny on high-risk assets held in their portfolio such as crypto-currency. Meanwhile, gold has long held its tier one position as a zero-risk asset.

Lastly, another change brought in at the beginning of the year is reporting requirements for large short positions on the stock exchange, including short positions on physical gold and silver. Rule 13f-2 of the Securities Exchange Commission (SEC) requires short positions exceeding USD $10 million or 2.5% of the company’s share to be reported on a monthly basis from now on. This is designed to promote transparency that allows companies to identify market manipulation against their stocks and mitigate systemic risk. Already momentum is building to punish those shorting stocks with a couple of high-profile initiatives already underway in this space. Trump Media is on the hunt for those naked short selling DJT stock, as well as the potential formation of a class action initiative against those shorting certain precious metal mining companies in Canada. It does not matter which stock sets a precedent. It could have significant repercussions in the gold and silver sectors given the almost unprecedented level of shorting against these two metals.

In summary, there are many factors that point to the rise of gold and silver and the crashing of the financial system at large, potentially as early as the latter half of this year. Those invested in precious metals have an advantage if such a scenario were to evolve and would do well to ensure that their loved ones are also looking into wealth preservation strategies as best as possible. The future could be full of opportunities or heartbreak for those on Main Street, depending on how well they are prepared.