Silver’s Breakout: Unprecedented Gains, Structural Strain, and What Comes Next

by Evie SoemardiSilver has entered rare territory. Its recent surge is not merely strong; it is historic. October marked only the third time in the past fifty years that silver has reached a true cyclical peak, joining the explosive rally in 1980 (thanks to the Hunt brothers) and the post Global Financial Crisis (GFC) rally in 2011. Year to date, the metal has climbed an extraordinary 107%, rising from AUD $48.17 on December 17, 2024, to a historic intraday price of AUD $100. Over the past month alone silver has gained 28.77% (or AUD $22.23), pushing the gold-to-silver ratio sharply lower and reawakening long-dormant interest in the monetary metal. At the time of writing, gold trades at AUD $6,494.82 per ounce, silver at AUD $96.31, and platinum at AUD $2,821.40. With prices pushing deeper into record territory, the natural question is: what exactly is driving this spike, and what does it signal for silver in the months ahead?

This brings us to the core forces underpinning silver’s extraordinary performance, forces that extend well beyond short-term speculation and point toward deeper structural shifts now shaping global precious metals markets.

Why silver has spiked: the forces now in play

One of the most significant catalysts behind silver’s recent ascent is the growing tension between paper claims and physical availability. After five consecutive years of global supply deficits, investors in derivative markets are increasingly demanding physical settlement rather than rolling their contracts through for another term. Each contract on COMEX is typically based on 5,000 troy ounces. Yet industry estimates suggest that more than 300 paper claims may sit atop each of these original contracts. What this means is that the same ounce of silver may have multiple simultaneous claims in excess of 300 times, a structure that functions only as long as most traders do not ask for delivery.

That assumption is now being tested. Earlier this month when silver decisively broke upward, approximately 8,300 contracts (around 41 to 42 million ounces) were simultaneously open for delivery, prompting COMEX to halt operations for several hours due to what it described as a data centre outage. Bullion banks, including JP Morgan, are reportedly struggling to meet delivery requests, and concerns are mounting about COMEX’s ability to fulfil obligations into the March 2026 delivery cycle. Current estimates place the probability of operational strain at 70 to 80%, and the risk is not abstract. If delivery requirements exceed exchange capacity, the market could face an unprecedented structural shock.

Western paper claims have ballooned in recent years with silver derivatives thought to exceed USD $21 trillion today, potentially reaching USD $26 trillion by 2030. The paper market consists of futures, options, forwards, and OTC derivatives, a multi-trillion-dollar paper-based tower of leverage that references silver but is rarely backed by it. In contrast, China and India have quietly become the gravitational centres of the global silver market, absorbing between 10,000 and 20,000 metric tonnes of physical per year, with additional “unofficial” flows reportedly channelled into undisclosed state vaults.

Looking ahead, the March 2026 is of particular concern: more than 118,000 contracts are currently open, representing nearly 600 million ounces of silver. Even if just 10 to 20% of these stand for delivery demand would exceed the available float. With global supply deficits stretching into their fifth year the potential for a delivery crunch is significant. For silver investors, this dynamic is now moving from theoretical to structural, and the months ahead are poised to be critical.

The gold-to-silver ratio: a signal worth watching

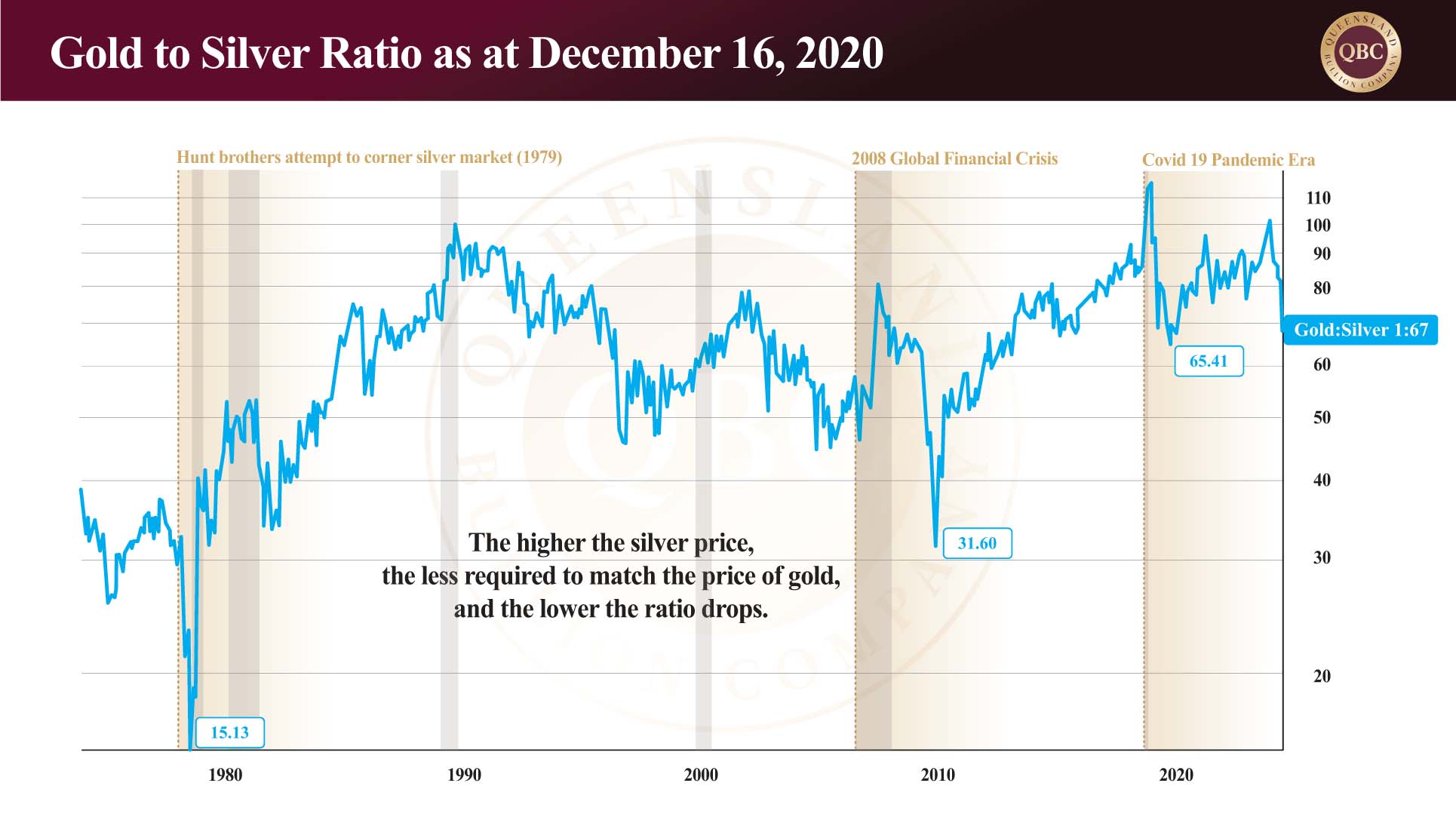

Another major development is the compression of the gold-to-silver ratio, now sitting at 65. This figure reflects how many ounces of silver are required to equal the value of one troy ounce of gold. Since 2000, the average has hovered around 80. During the previous century it oscillated between 50 and 70. In April 2020 it hit an all-time high of 114 at the onset of the Covid-19 Pandemic Era. More recently, earlier this year the ratio climbed to 106 before cascading downward as silver prices accelerated.

History shows that when silver outperforms gold aggressively it tends to do so for brief, explosive windows. After the 2008 GFC, when silver peaked at AUD $44.56, the ratio reached a low of 31, a moment that delivered exceptional returns for those who rotated from silver into either gold or cash. Silver advocates will be watching this ratio closely as it continues to contract, knowing that timing exits well during such periods can dramatically amplify portfolio outcomes.

The Australian Dollar: A Hidden Catalyst

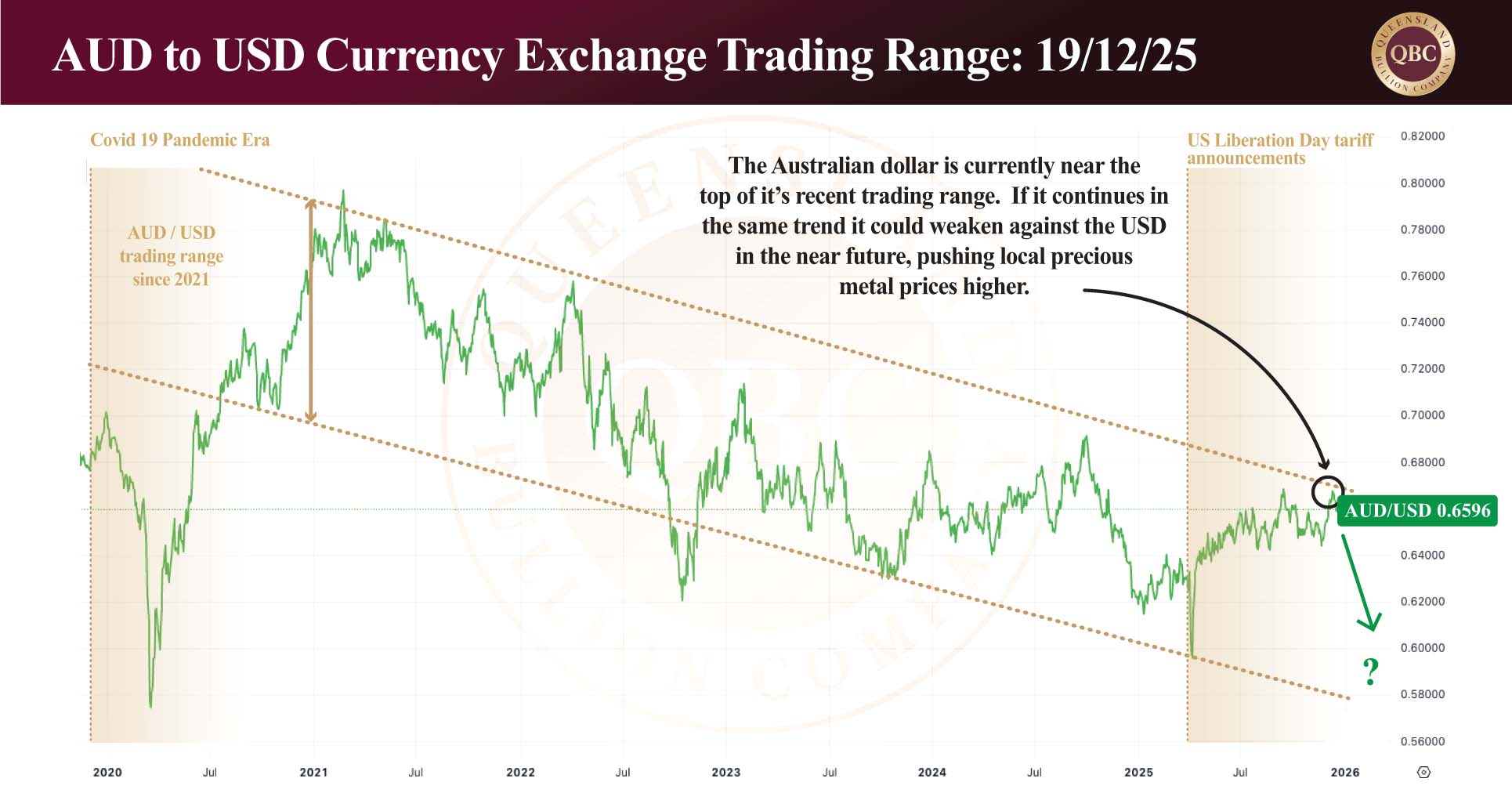

While much attention is placed on the price of the metal itself, currency movements are equally important for Australian investors. The AUD has traded sideways against the Greenback since late June but has recently strengthened from USD $0.6445 on November 20 to USD $0.6616 today, representing a $2.65% increase. Remarkably, silver is achieving all-time highs in the Australian market even with a strong local currency. The AUD is now at the upper end of its current trading range. Should the currency weaken (an outcome with precedence given Australia’s sensitivity to Chinese demand cycles) silver and gold AUD prices in would almost certainly rise from already elevated levels.

In summary

Silver has delivered one of the most remarkable years in its modern history. Its 107% twelve-month gain, its strong monthly performances, and the structural pressures building beneath the global derivatives market all point toward a metal in transition from undervalued secondary asset to a primary driver of safe-haven demand. The gold-to-silver ratio is tightening, the Australian dollar is providing additional leverage, and concerns over the resilience of Western precious metals exchanges are attracting unprecedented investor scrutiny.

For those already positioned in silver, the task now is vigilance. For those yet to secure exposure, the question is not whether silver is volatile (it always has been) but whether the structural forces now at play justify a strategic allocation despite the volatility. All evidence suggests that the conditions forming today could define the next major chapter in silver’s long and cyclical history.

If silver has indeed begun its next major secular move, preparation will matter more than timing. And right now, the opportunity sits squarely in front of us. If you are considering buying silver online, then visit this page for the latest pricing and sizing options.