Is Silver Undervalued?

by Evie SoemardiSilver achieved a new all-time high when it reached AUD $59.91 last Monday, igniting hopes among investors for a climb to $2,000 per kilogram, or approximately $62.20 per ounce. The rally places silver, currently trading at $58.47, firmly back into the spotlight, joining gold ($5,088) and platinum ($2,201) as metals of increasing strategic interest. But is silver still undervalued at these levels? A deeper look into monetary supply, mining trends, market ratios, and chart patterns may suggest the answer is still yes.

M2 Money Supply

One useful framework for evaluating silver’s worth is by comparing its price against the U.S. M2 money supply. This indicator is the U.S. Federal Reserve’s estimate of liquid assets including cash, money in bank accounts and other deposits that can be readily convertible to cash. This ratio reveals whether silver is keeping up with the expansion of fiat liquidity or falling behind. If the value of an asset increases more quickly than the M2 money supply then it is more likely to experience a correction in price; conversely it is also true in that if the value of an asset lags behind the M2 money supply indicator then it will likely experience an increase at some point. Since the mid-2010s, silver has lagged M2 growth, as it did before the Global Financial Crisis (GFC). This is a potentially bullish signal for silver.

In short, while central banks have aggressively increased currency in circulation, the price of silver has not kept pace. If past patterns hold, the metal may be entering a prolonged phase of strength as it plays catch-up with inflationary expansion.

The Paper vs Physical Divide

Few markets are as distorted as the silver market. The current ratio of 375 ounces of “paper” silver (via ETFs, futures, and other derivatives) to every 1 ounce of physical silver is staggering. Investment banks hold extensive short positions, many of them naked (meaning they’re not backed by actual metal). These short positions give the appearance of there being much more silver in circulation than there really is. As the market is flooded with silver paper contracts, it suppresses the price which leads to an undervaluation of the metal.

If silver prices continue rising, short sellers may be forced to close their positions en masse, triggering a short squeeze. For every $1 gain in silver, bullion banks collectively face losses exceeding $262 million. A $10 rally would create billions in losses — and panic buying to cover those shorts could push prices to extraordinary levels, particularly in the physical market where supply is tight.

Supply Deficits and Rising Demand

Silver mining production in 2024 totalled just 25,000 metric tonnes, a figure dwarfed by rising demand in the industrial, solar, and investment sectors. According to The Silver Institute data, the market is on track for a fifth consecutive annual deficit in 2025.

This supply imbalance is unlikely to correct quickly. Much of the world’s silver is mined as a by-product of other metals like zinc or copper, limiting miners’ ability to increase output in response to silver-specific demand. In developed countries mines take approximately five to ten years to wind up once a project is approved. And it is likely that additional projects may not be considered until the price of silver increases. Hence, the setup is clear: tightening supply, increasing use cases, and insufficient investment in new production capacity.

The Gold to Silver Ratio Speaks Volumes

Perhaps one of the clearest signals of undervaluation is the gold-to-silver price ratio. Based on 2024 mining production quantities of gold and silver, for every one ounce of gold mined approximately 7.5 ounces of silver is produced. Yet the ratio is 1:86.31 at the time of writing. This is still high compared to the historical average and suggests that the most recent increase in silver is likely at the very least sustainable, if not suggestive of further gains to come.

During historic silver bull markets, the ratio has narrowed significantly. April saw the ratio at 1:106; prior to the GFC it peaked at 1:104; and during the Covid 19 Pandemic Era it made history when it reached 1:124. It dropped as low as 31.6 during the Global Financial Crisis in 2011 and dipped as low as 15.1 during the 1980s silver rush. Should silver return to even half of that historical compression, its upside potential becomes dramatic. What does this mean? The ratio simply reflects the relationship between gold and silver, in that if the price of silver increases faster than gold the ratio reduces. If the price of gold increases faster than silver the ratio rises. If they both rise or fall together the ratio generally reduces but at a slower rate. For example, if the ratio is 1:80 would mean that for each $1 silver increases, gold would need to increase $80 to maintain the same ratio.

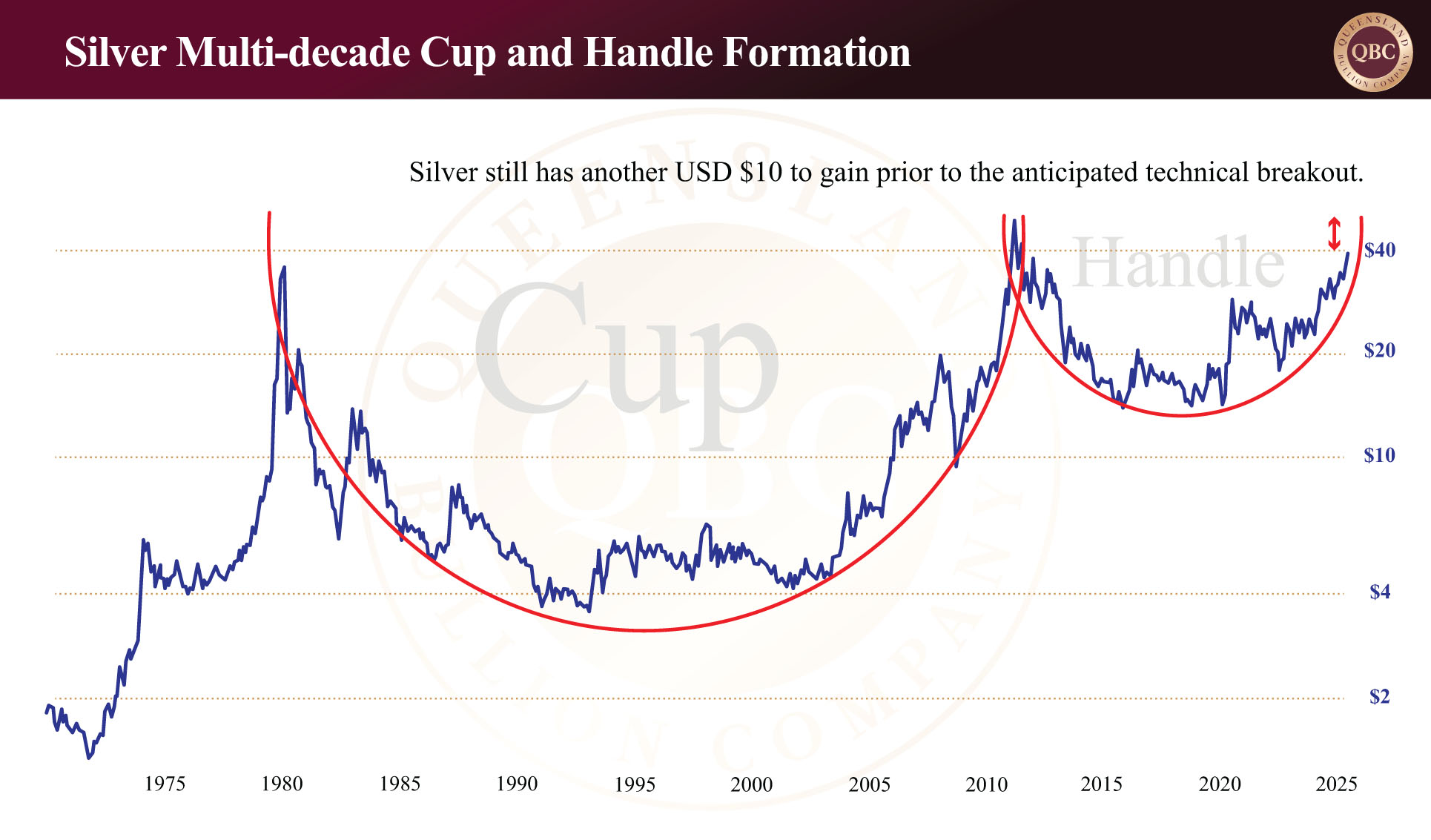

Charting the Future: The Cup and Handle

Technically, silver is nearing the final stages of a multi-decade cup and handle formation, one of the most powerful bullish setups in market history. Currently trading at USD $39.19, it is $10 short of its all-time high of $49.21 reached in 2011. Then silver hit the $40 threshold and1 it only took one month to breach $49. If the metal clears the psychological marker of $50, chartists anticipate a powerful breakout, potentially ushering in a fresh multi-year bull market with targets far above $60. If silver plays catch up to gold, the gold to silver ratio will reduce as it did when it peaked in 1979 and 2011. And this is when many silver bulls will look to take profits.

A Market Poised to Move

When measured against money supply, mining fundamentals, market ratios, and historical price action, silver still appears undervalued. A strong technical setup, combined with growing industrial demand and a fragile paper market, adds fuel to a potential surge.

For Australian investors, the implications are significant. As the USD-AUD exchange rate fluctuates and the global appetite for physical assets rises, silver remains a compelling candidate for strategic accumulation. Whether you prefer coins, bars, or both, the question may not be whether silver will rise, but when. To read more on the timing of silver’s anticipated bull run read our previous article When Will the Silver Squeeze Begin?