Is Rising Industrial Demand the Only Factor Supporting a Silver Squeeze?

by Melanie YoungIn recent months first China, and now Russia, have made aggressive moves to secure more silver in their Central Bank portfolios, enough to raise the eyebrows of Western investors who now speculate what effects this will have on the current Commodities Market moving forward. With silver trading at $46.42, Gold at $3902.19, and Platinum at $1,439.48 at the time of writing, this coordinated effort to secure the metal certainly deserves the attention it currently receives as a silver squeeze is a likely outcome.

Historically, Central Banks stopped accumulating silver in the mid 19th Century, with USA shortly thereafter opting for the gold standard. In contrast the Late Qing Dynasty in China embraced the silver standard in the mid 18th Century and did not move over to the gold standard until the 1930s when inflation forced them to. Likewise Russia was on the silver standard in the early 19th Century before transitioning to gold in the very early 20th Century. This provides context for current positions regarding silver among the world’s superpowers.

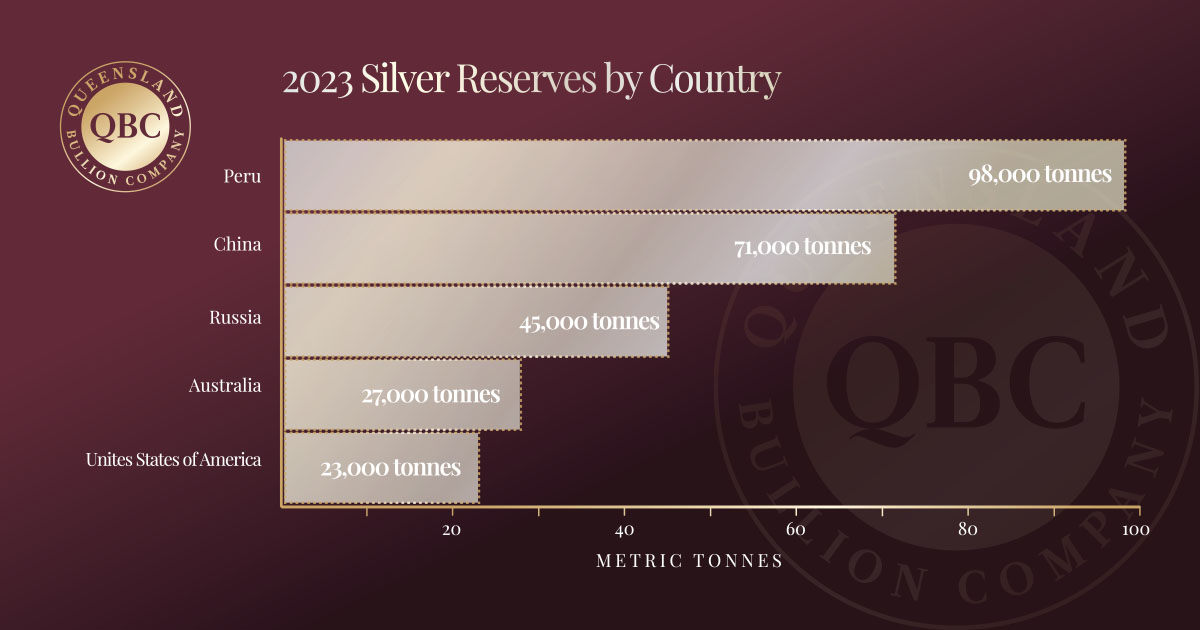

In 2023 China’s silver reserves were at 71,000 tonnes, second only to Peru at 98,000 tonnes (who is a silver-producing powerhouse in its own right). Russia held 45,000 tonnes, while USA lagged behind at 23,000 tonnes. Incidentally Australia’s silver reserves were at 27,000 tonnes in 2023. This reflects USA’s priority being placed on gold holding 8,133 tonnes as at the second quarter of 2024, while China’s gold reserves sit at 2,264 tonnes, Russia’s at 2,335 tonnes and Australia’s just shy of 80 tonnes. So why is China and Russia placing so much emphasis on securing silver in the current economic and geopolitical environment?

Is it really just the increasing demand on solar panel and electrical vehicle production in the industrial sector? China may well be getting ahead in this area as silver’s rise in price will increase production costs within industry; however, a fairly superficial glance at the nature of China’s silver purchases prompts one to consider that there may be other reasons for the large purchases. China has been buying unrefined silver concentrate directly from Latin American miners and refiners. This allows them to purchase silver without effectively affecting the spot price of the metal. This also crowds out Western investors from the Latin American markets and also raises concerns about price stability and supply of silver in the future.

Interestingly India, who purchased more silver in 4 months in 2024 than in all of 2023, may be adopting a similar strategy. India has been purchasing its’ silver through the United Arab Emirates (UAE) to take advantage of lower import duties according to the Comprehensive Economic Partnership Agreement signed by both parties in 2022.

In addition, according to what China has reported they have not purchased any gold for 5 months straight. Does anyone believe this? Is it more likely they are simply purchasing over the counter (OTC) in ways that have no direct effect on spot prices?

Enter Russia, who has just come forward with a consideration to spend RUB 52 billion (almost AUD $800 million) on precious metals over the next 3 years as per their Draft Federal Budget, of which it is said that silver is to play a significant role. Incidentally, they also produced 28% of the world’s platinum last year despite the harsh economic sanctions from the West.

So lets put some pieces together. China, Russia and India are increasing their silver reserves (amongst other commodities). And BRICS Nations are about to release their “unit” as a new currency that will be backed 40% by precious metals, thus allowing them to operate amongst each other outside the stranglehold of the USD. Is it really all about increased demand in the industrial use of precious metal? The answer is quite simply, no. The relationship between geopolitics, production industries and finance industries are weaving together so nicely that we could almost make a quilt.

In summary, silver is on the rise in the long term. A future silver squeeze is almost a done deal. There are multiple reasons, the BRICS Nations being but one.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Queensland Bullion Company Pty Ltd or any other associated entities. The author has made every effort to ensure accuracy of information provided; however, neither Queensland Bullion Company Pty Ltd nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Queensland Bullion Company Pty Ltd and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.