Gold Outpaces Property and Shares: A Long-Term View

by Evie SoemardiGold and silver have set new all-time highs in 2025 for Australian markets. For local investors, the question is not whether gold has risen but how it has performed relative to other key asset classes over the last two decades. When compared with residential property and the ASX 200, the results are clear: gold has outperformed both, offering superior wealth preservation in an era of rising costs and uncertain economic growth.

A snapshot of Australia

Australia’s economy continues to show mixed signals. Annual GDP growth sits at 1.82%, a modest pace for a developed nation. Inflation is currently 2.09% — at the lower end the Reserve Bank of Australia’s target range of 2% to 3%. Unemployment is holding at 4.19%, reflecting a long-term trend for reduced unemployment. Against this backdrop, gold is trading at $5,528 per ounce, silver at $64.26 per ounce, and platinum at $2,123 per ounce.

These figures highlight the resilience of precious metals compared to the broader economy. While economic growth is sluggish, inflation sticky, and labour markets uncertain, gold continues to provide premier net purchasing power protection despite Australia’s fiscal and financial situation.

Gold versus the Australian real estate market

From 2000 onwards, a divergence between Australian residential property prices and wages became clear. The Australian House Price Index climbed from under 40 in early 2000 to 196.15 at the start of 2025 — a 390% increase in twenty-five years. Over the same period, average adult wages rose just 40%, from $803 to $2,011 per week. This imbalance has priced many Australians out of the property market, pushing them into long-term rental arrangements.

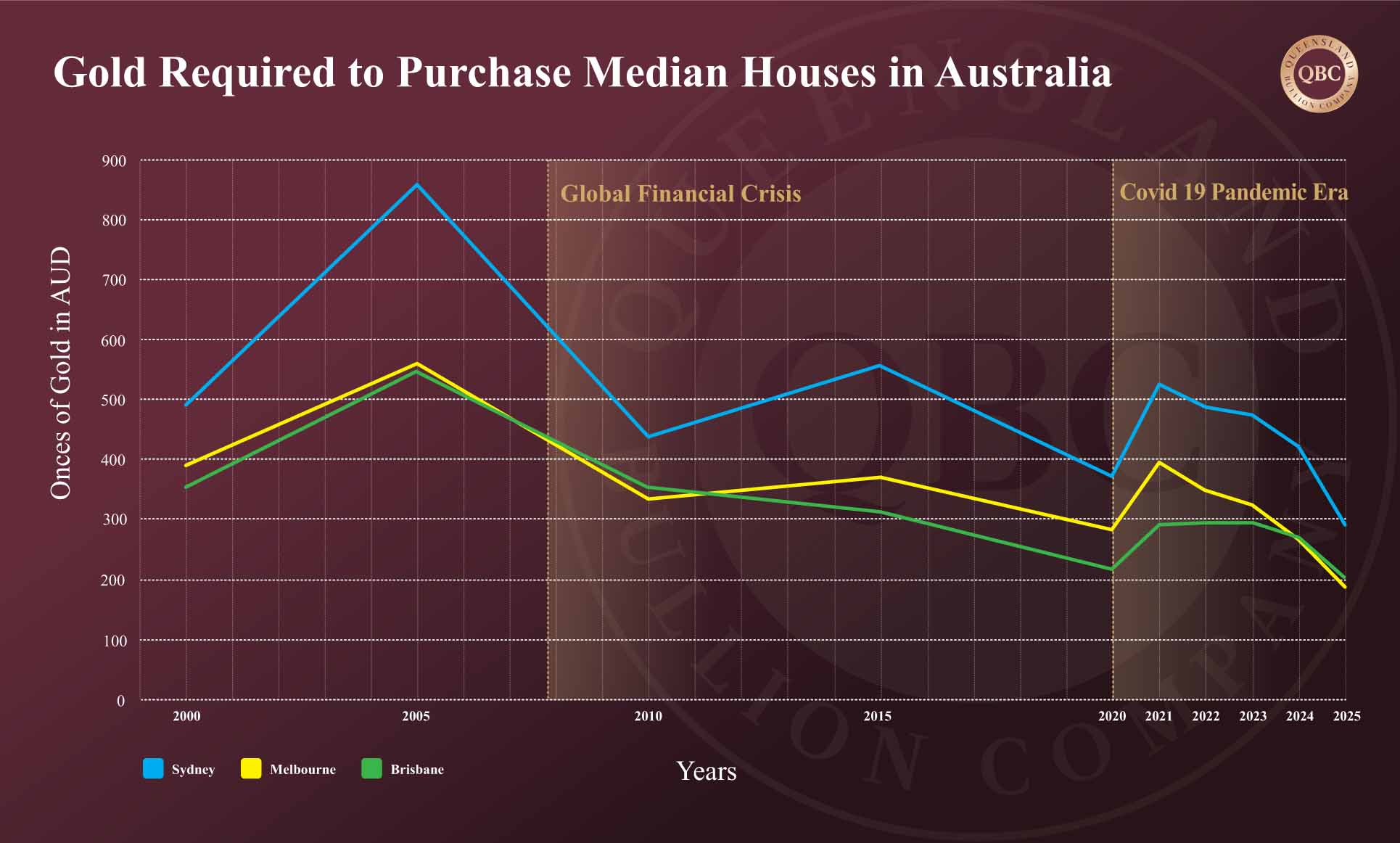

The 2008 Global Financial Crisis (GFC) revealed the resilience of Australian housing compared to overseas markets: while the United States saw prices collapse by 27.4% (with 50 to 60% reductions in harder hit areas), Australian residential property fell only 8.5% in eleven months. Today, however, with property prices having so far outpaced wages, the risk of a deeper correction looms.

So how has gold compared? The median Sydney property price is $1,500,543. Melbourne sits at $949,232, and Brisbane at $ 1,021,395. In percentage terms it means that from the year 2000 Sydney prices have increased 422%, Melbourne 396%, and Brisbane 500%. Yet gold has risen 1,046% on today’s spot price. If property prices had matched gold’s growth, Sydney’s median house price would stand at $3,002,020, Melbourne at $ 1,997,860, and Brisbane at $1,778,200. From a household affordability perspective, it is fortunate that residential property has not risen in line with gold. Yet when viewed purely as an investment, gold has consistently outperformed.

From the perspective of capital growth, 2025 Sydney and Melbourne median property are five times the value than what they were in 2000. Brisbane median property prices are six times higher. Yet gold is more than ten times the value in the same period. Had gold been chosen over property for investment purposes, it is possible the investor could be approximately twice as wealthy. It should be noted that rental income and ownership costs have not been included in the above comparisons. These factors vary widely between cases, and in many instances, the expenses associated with ownership can outweigh the rental income received.

The long-term chart below shows that fewer ounces of gold are required each year to purchase a property in Australia’s major cities, despite housing prices rising exponentially relative to wages.

Read more about how the majority of wealth around the world is held in real estate here.

Gold Versus the ASX 200

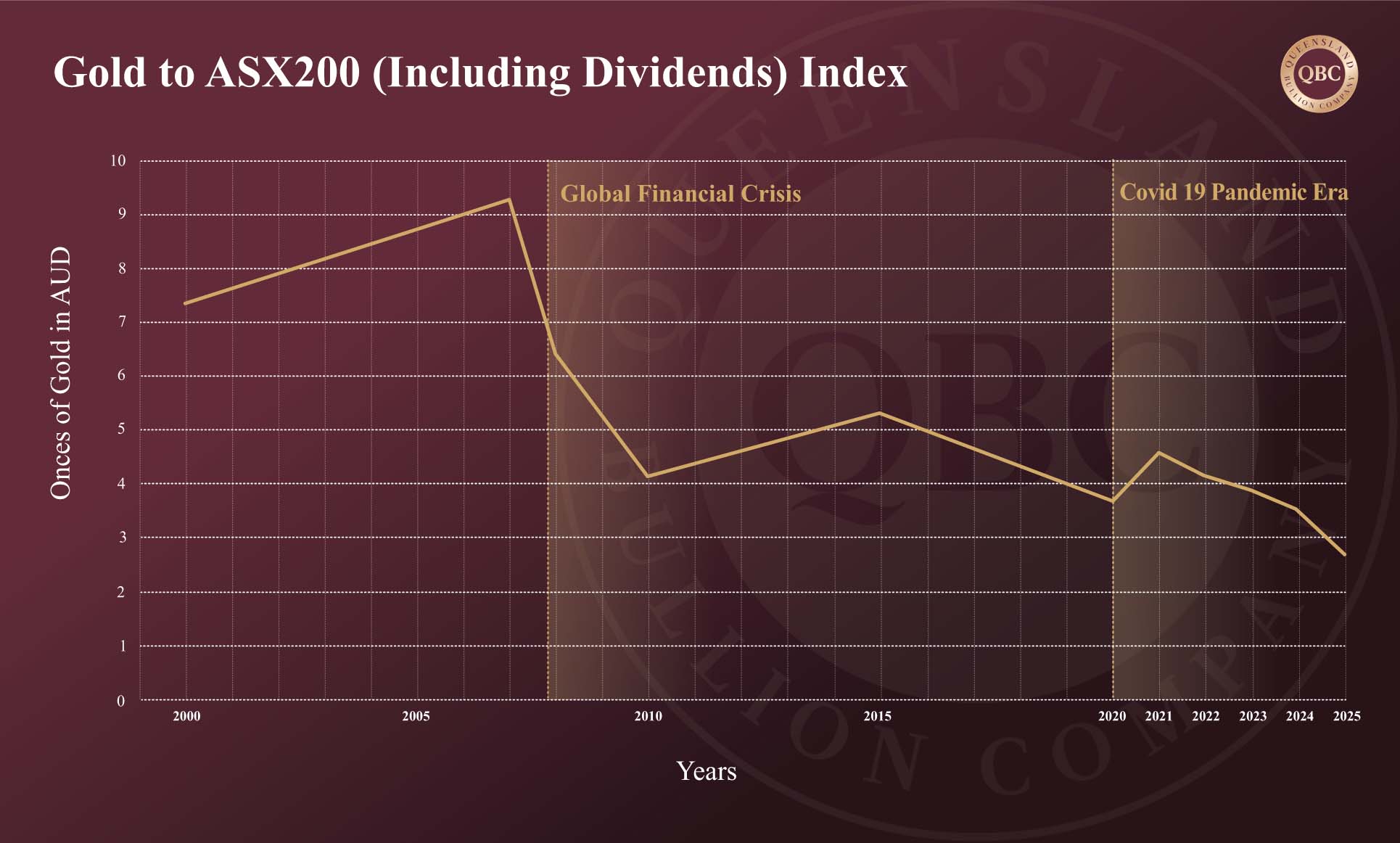

It is a similar picture when gold is measured against equities. The ASX 200 Index, considered the benchmark for Australian shares, was launched on March 31, 2000, at 3,133 points by Standard and Poor’s (a premier credit rating company in the United States). Today it sits at 8,825 points. The ASX 200 shows 181% increase over twenty-five years.

However, one of the fundamental differences between stocks and precious metals is that stocks can offer dividends. For a realistic and fair comparison dividends need to be considered. The average dividend on the ASX 200 Index between the year 2000 and 2025 is estimated at 4% per year. If we adjust the above to include dividend payouts, the ASX 200 would be closer to 13,667 points. This new figure shows an increase of 336%.

On paper, this is an impressive gain. But had the ASX matched gold’s 1,046% rise over the same period, the index would be trading at 142,956 points. In relative terms, gold has far outpaced equity markets.

The below data also shows that progressively fewer ounces of gold are required to hold the same position in the ASX 200. This demonstrates that while shares have grown in value, gold has grown faster and has done so without the volatility of equity markets or the reliance on dividend flows.

Gold’s Enduring Advantage

The evidence is compelling. Over the past twenty-five years, gold has outperformed both residential property and equities in Australia. While the housing market has surged beyond wage growth and the ASX 200 has delivered respectable returns, neither asset class has kept pace with the relentless rise of gold.

For Australians, the lesson is clear: gold remains a cornerstone of wealth preservation. It is a hedge against inflation and an outperformer against the nation’s two most recognised asset classes. In times of uncertainty, when growth is weak and markets are stretched, gold stands out as the asset that continues to deliver.