Forecasts and Fire Horses: Navigating Precious Metals Volatility

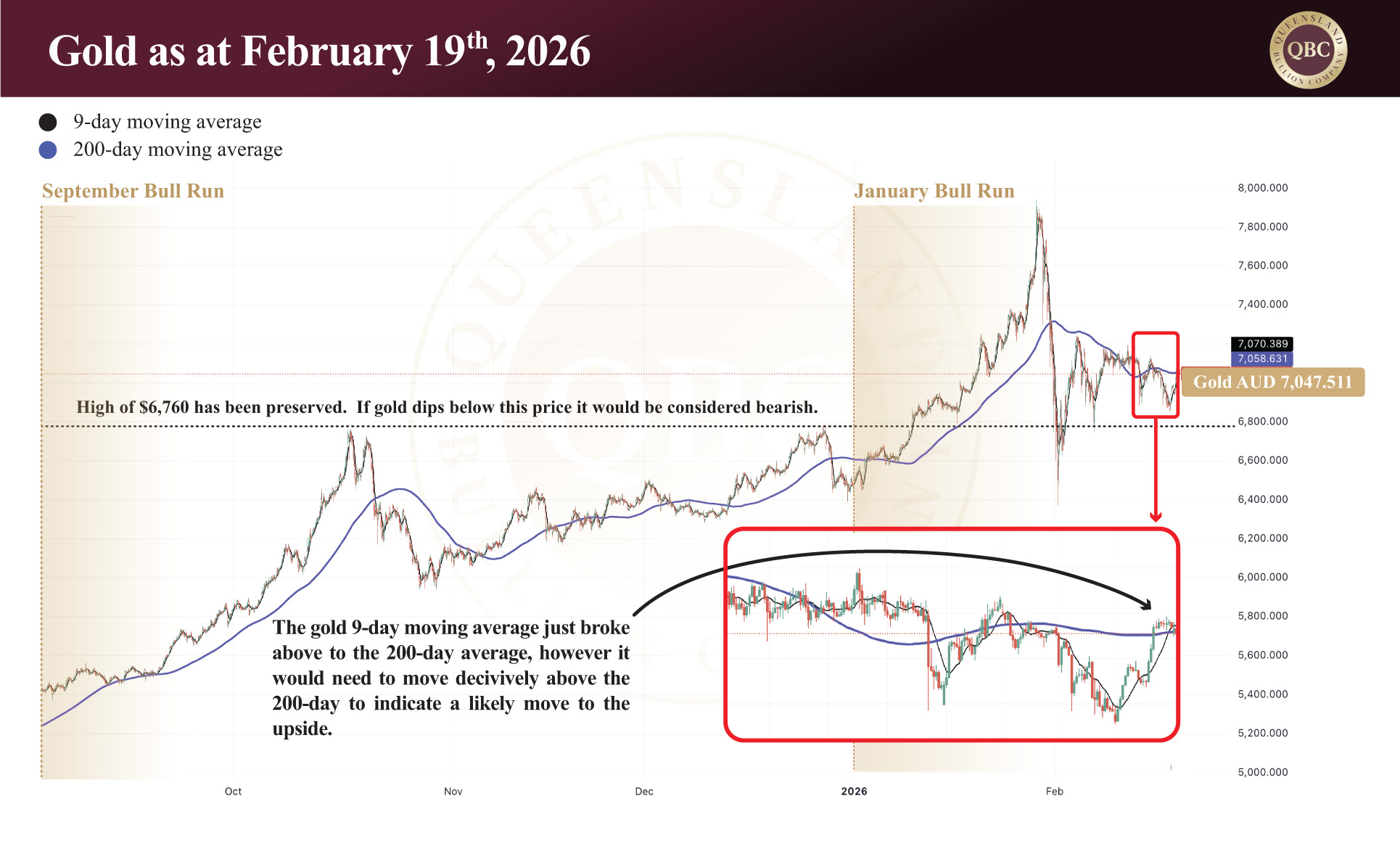

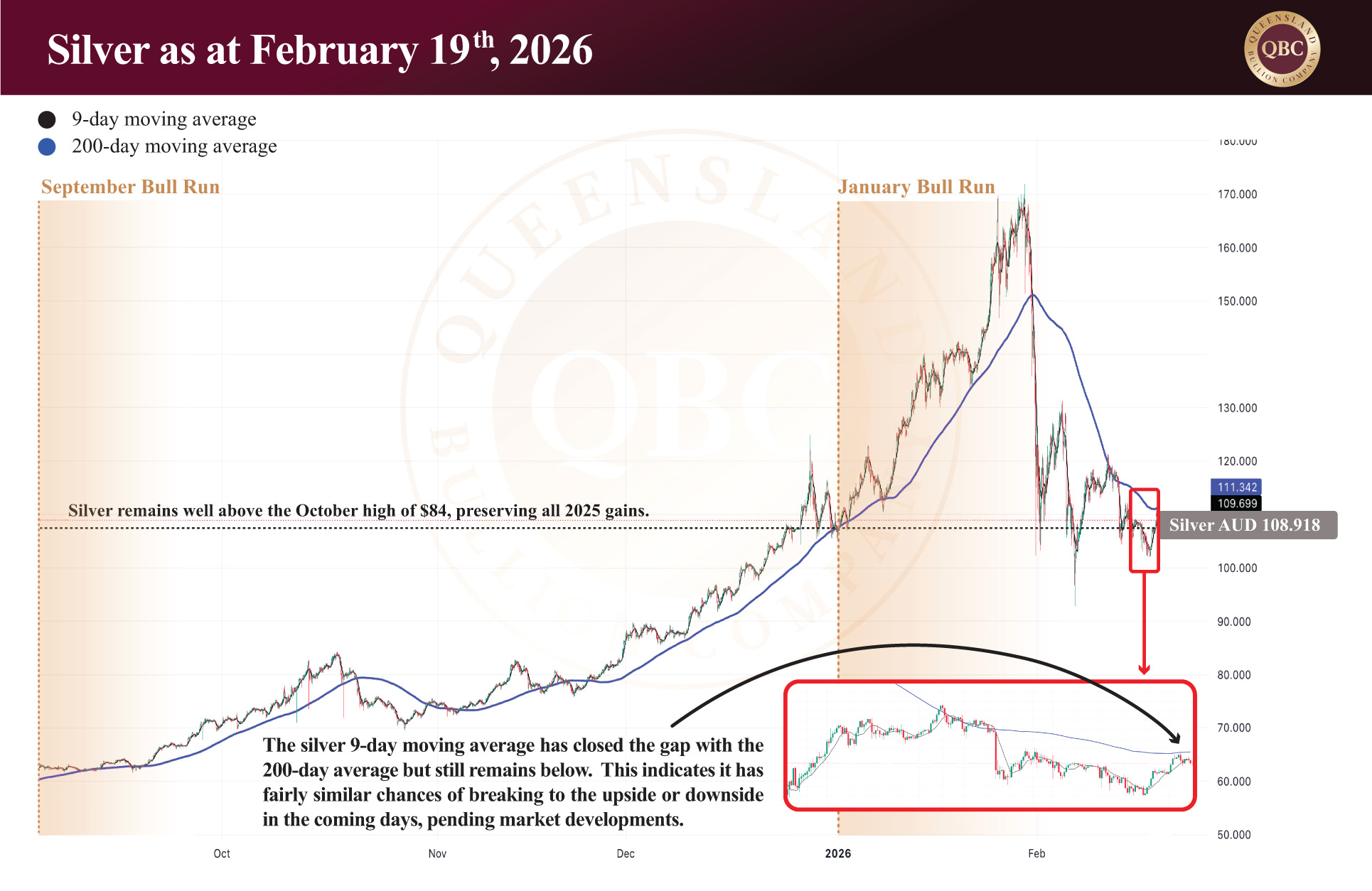

by Evie SoemardiShort-term volatility has once again taken centre stage in precious metals markets. After an extraordinary run into January, silver’s sharp correction, gold’s consolidation near recent highs, and renewed currency strength have combined to produce swift price swings in a compressed timeframe. At the time of writing, gold trades at approximately AUD $7,031 per ounce, silver at AUD $108.65, and platinum at AUD $2,943.

This article unpacks three key focusses: the Lunar New Year liquidity vacuum and associated volatility, and global gold and silver price forecasts for 2026. We begin with the immediate catalyst, the temporary withdrawal of Asian liquidity during the Lunar New Year, and why it matters more than many realise.

Lunar New Year Liquidity Vacuum and U.S. Data Risk

An additional layer of short-term volatility has come from the Lunar New Year holiday across Asia. Official announcements from the Shanghai Gold Exchange (SGE) and Shanghai Futures Exchange (SHFE) confirm February 15–23 as the core shutdown period in honour of the Spring Festival. During this time, physical markets, retail gold shops, and related bullion activity across Mainland China largely pause. When trading resumes, markets often experience volatility driven by pent-up demand and order imbalances accumulated during the break.

China’s absence is particularly significant. Mainland China, Hong Kong, Singapore, Taiwan and South Korea stepping away from trading creates a noticeable liquidity vacuum in global precious metals markets. With the SGE and SHFE offline, the so-called “Shanghai Premium” temporarily disappears, reducing one of the key physical pricing anchors for gold and silver. In thinner conditions, price movements become more sensitive to Western futures flows and currency shifts. It is easier to create larger ripples in a smaller pond.

With much of Asia celebrating the Year of the Fire Horse rather than participating in markets, influence shifts decisively toward U.S. drivers. This week’s calendar adds further fuel: the release of the Federal Open Market Committee minutes by the Reserve Bank (released today), initial jobless claims and trade deficit data (February 20), and advance Q4 GDP figures (February 21). In a thinner global environment, these events can amplify volatility. Strong growth data would likely pressure precious metals further, while signs of economic strain could trigger renewed safe-haven buying. Without Asian markets to absorb and balance flows, the reaction to U.S. headlines may be sharper than usual.

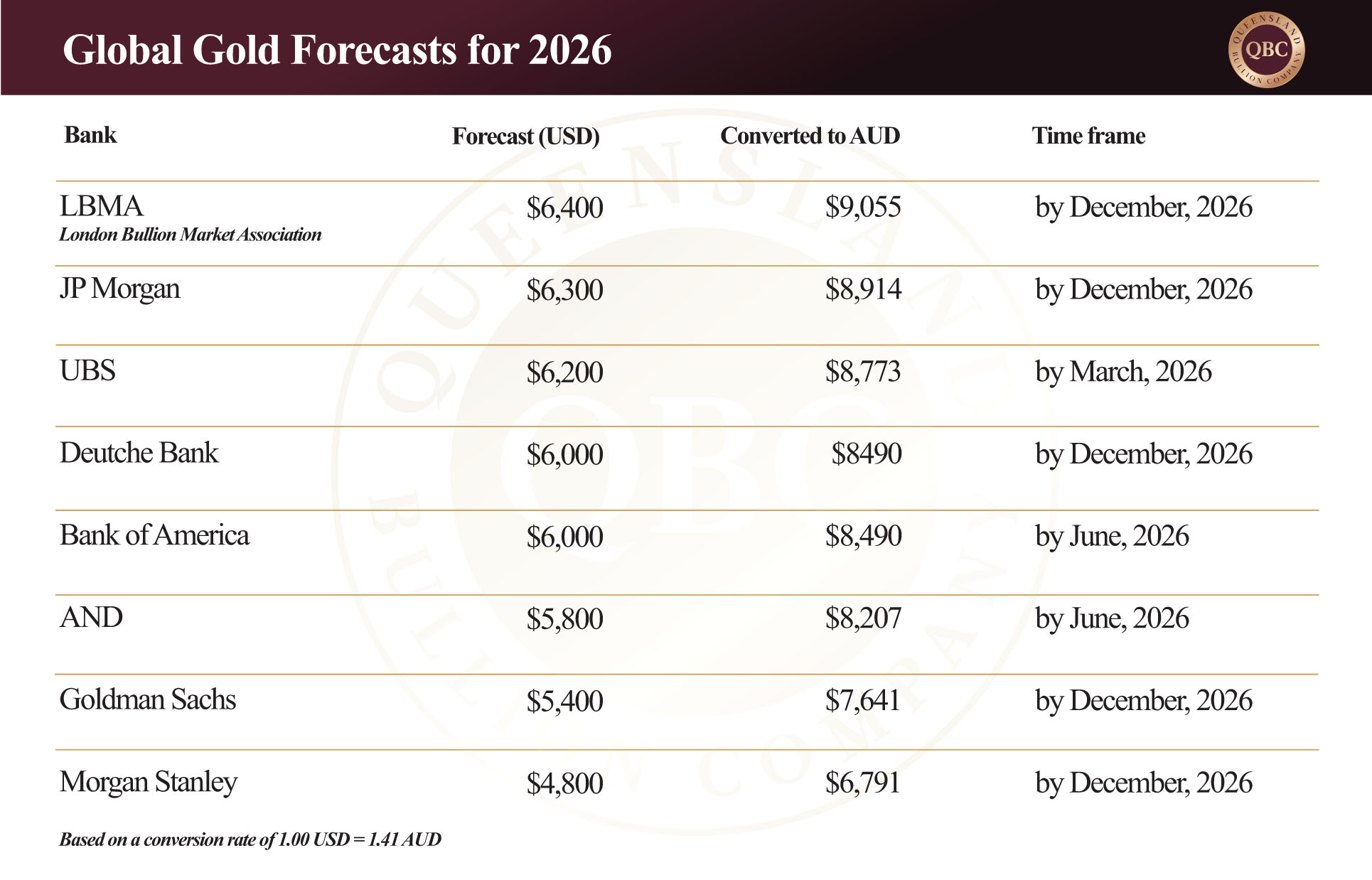

Global gold forecasts for 2026

Following gold’s recent intraday high of USD $5,600 (AUD $7,934), major global banks are now projecting a further leg higher over the next 12–18 months. Current institutional forecasts cluster well above recent highs, with several targets extending into the low-to-mid USD $6,000 (AUD $8,497) range and beyond into 2026. Even the more conservative outlooks still imply resilience from present levels rather than a structural reversal.

The consistency of these projections signals a broad institutional view that gold’s secular bull market remains intact. Geopolitical tension, persistent fiscal imbalances, central bank accumulation, and structural debt pressures continue to underpin long-term demand. In that context, the recent move through USD $5,600 (AUD $7,934) may prove less a peak and more a stepping stone within a larger multi-year advance.

Global silver forecasts for 2026

The updated silver projections reveal one clear theme: conviction is high, but consensus is not. On the bullish end, major institutions and global banks are forecasting a return to (and in some cases well beyond) the recent spike, with targets clustering around USD $150–$160 and even wider upside scenarios extending materially higher. These forecasts reflect the structural argument: persistent supply deficits, tightening physical availability, and the growing tension between paper leverage and real-world metal. In this camp, volatility is viewed not as a warning sign, but as a feature of an emerging structural repricing.

By contrast, the more conservative projections sit in a broad USD $75–$85 range, with some banks outlining trading bands rather than outright breakout targets. These estimates acknowledge the same supply backdrop but place greater weight on cyclical slowdowns, policy uncertainty, and silver’s well-documented tendency to overshoot in both directions. The unusually wide spread between bullish and conservative forecasts is itself a consequence of volatility. Silver has demonstrated its capacity for extreme price acceleration and equally sharp retracements, making forward projections inherently sensitive to timing assumptions. In short, the dispersion in targets is not confusion; it is a reflection of a market that has entered a high-velocity phase where long-term structural forces and short-term swings create an interesting juxtaposition. Time remains of the essence in such circumstance, being the only factor that can provide clarity moving forward.

In summary

Short-term volatility rarely arrives with warning, but it rarely changes the long-term trajectory either. The Lunar New Year liquidity vacuum has temporarily amplified price swings, U.S. economic data continues to inject headline-driven reactions, and the divergence in global forecasts reflects a market recalibrating after extreme moves. Yet beneath the noise, the structural themes remain unchanged: central bank demand for gold persists, fiscal pressures continue to build, and silver’s supply constraints remain unresolved.

Periods like this tend to test conviction. Liquidity thins, headlines dominate, and price action feels exaggerated. But volatility does not negate the secular trend — it simply accelerates sentiment shifts within it. As Asian markets reopen and U.S. data is absorbed, clarity will return. In the meantime, investors would do well to distinguish between temporary dislocation and structural change. Gold’s broader advance remains intact, and silver’s high-velocity phase underscores both opportunity and risk. In markets such as these, preparation and positioning matter far more than reacting to each ripple in a thinner pond.