Five Reasons Why This Gold Run is Set to Continue

by Melanie YoungGold has enjoyed a stellar rise in 2024 and many analysts believe the party is not over. When adjusted for inflation, the price of gold has still not hit an all time high even as it currently trades at $4,011.96, with silver at $47.61 and platinum at $1502.66. For the Australian investor, breaking the $4,000 barrier is a significant psychological marker with many waiting to see if gold’s upward trajectory can be sustained. There is significant evidence that gold is set to continue the increase as we move into 2025, with major banks supporting this notion including Goldman Sachs, JP Morgan, Bank of America, Citibank, UBS making up the choir. Let us unpack five reasons below.

Credibility and solvency among nations

As a response to Basel III reserve banks have been hedging themselves against potential financial crises by increasing gold holdings for many years. This is good news for gold investors as the Basel Committee on Banking Supervision (BCBS) had upgraded gold classification from a Tier 3 asset to a Tier 1 asset with a 0% risk weighting. This is expected to continue to have a positive effect on precious metals moving forward.

As an example, Poland is one of the fastest growing economies in Europe and has stated intentions to increase their gold reserves to 20% or their portfolio. In 2020 Poland’s gold holdings were less than 10%, it currently stands at 14.9% and they aim to meet their gold targets in the near future. Echoing BCBS sentiments, their reason for the increased gold holdings is to position themselves as credible and solvent economic partners in times of financial crisis. Indeed even smaller countries are preparing in a similar manner. For example the Czech National Bank has acquired 32.8 tonnes since March.

Read more about Russia, China and India’s related silver purchases HERE.

Lower interest rates

The Federal Reserve’s recent rate cut of 0.5% resulted in an increase in the value of gold and other metals. The lower interest rate provided confidence in the market and those seeking higher returns are flooding back into the market for metals. This in itself suggests a bullish outlook. And while the Fed suggests slow future cuts CBA believes the Reserve Bank of Australia is set to follow suite in the near future setting a somewhat ominous trend.

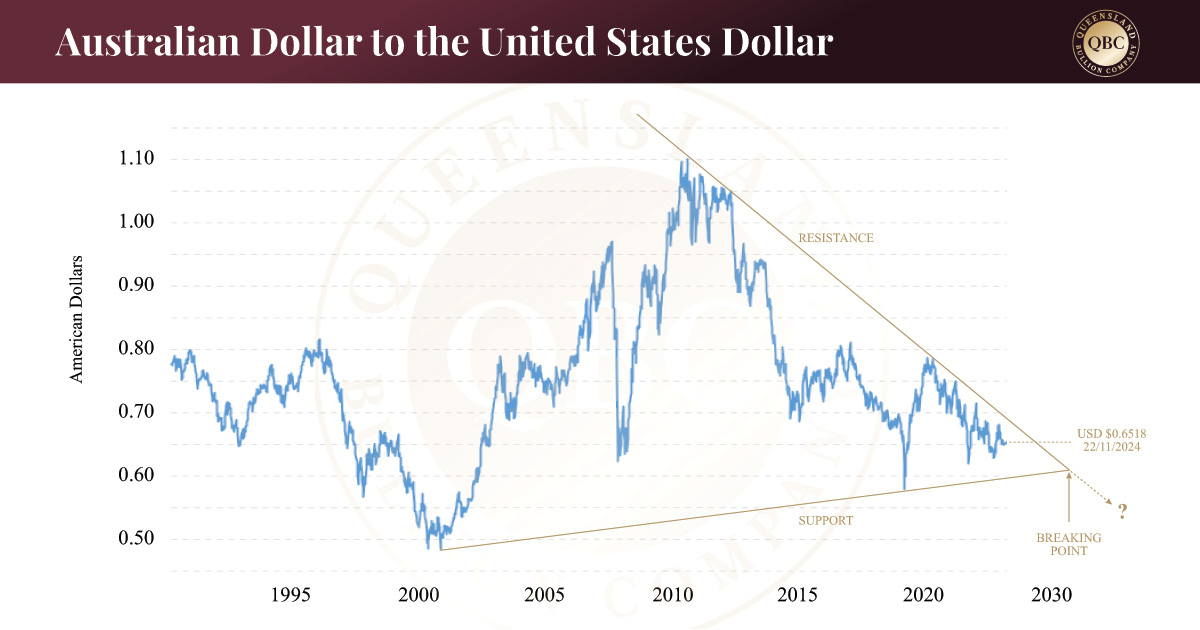

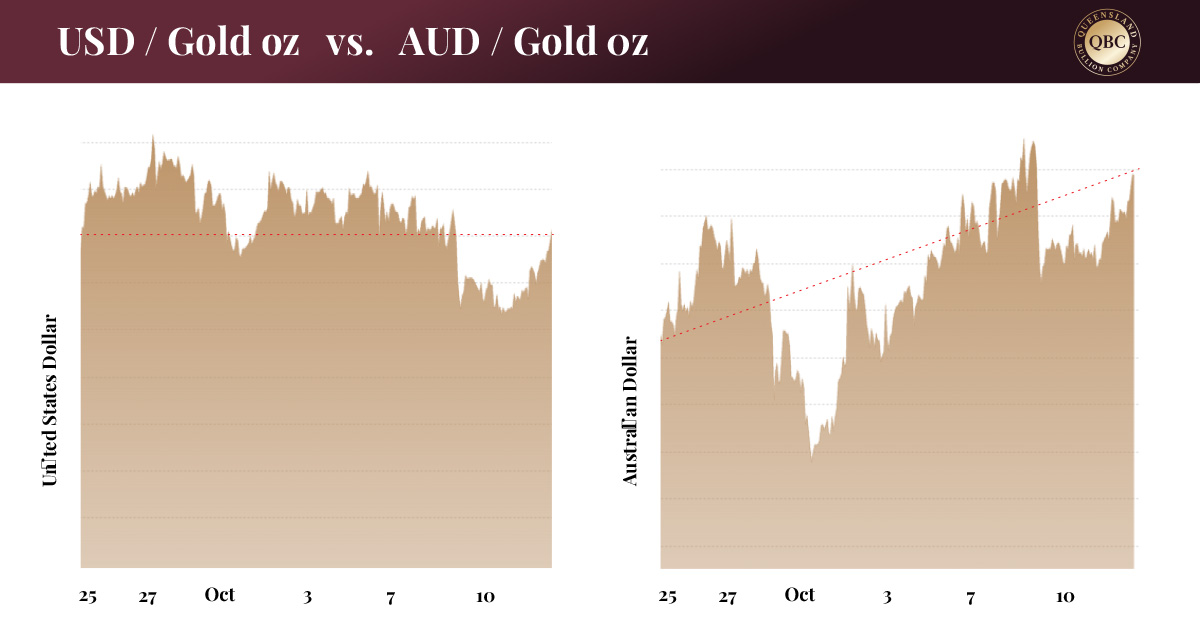

Current rise of the USD

As the top safe haven currency, the American Dollar is the natural go to as the world teeters on the brink of conflict. We have already discussed the implications of a rising USD on Australian gold prices in previous articles; however, what has not been explored is Europe’s potential role in the rising value of the Greenback. As Europe heads into a cold winter energy supply will once again become a hot topic (pun not intended). With America now the world’s largest supplier of oil, producing 13,308,000 barrels per day (bbl/day), and without access to Russian oil (who produces 10,272,000 bbl/day), the logistics of European oil imports are a little more complicated and expensive than they used to be. This feeds into the growing instability in the region as strong economies need cheap energy. Add the very real prospects of war with Russia and one could say that Europe is staring down the barrel of a very accurate rifle. As investors realise the implications of Europe’s position, a continued move away from the Euro into USDs looks probable, hence buoying the value of the USD longer than most anticipate.

Geopolitical conflict

While geo-political conflict appears to be going sideways both in Ukraine and the Middle East so too does precious metals. Israel’s recent promise not to bomb Iran’s oil reserves fits squarely into the fog of war category. More likely, any intention to bomb these reserves has been conveniently delayed until after the US elections when it can potentially happen on Trump’s watch.

Read more about the influence of geopolitics on precious metals HERE.

BRICS currency

Russia, as chairman of the BRICS Summit for 2024, is scheduled to make an important announcement during the summit held between 22 – 24 October this year. Current conjecture around the announcement revolves around the potential unveiling of the BRICS unit of currency that looks to be 40% backed by precious metals. As BRICS nations move towards trading in their own asset backed currency the value of gold and other precious metals will benefit from the built-in need for those countries to maintain high reserves to legitimise this new currency.

Summary

In summary, gold’s bull run may be just starting. There are a number of economic flashpoints that could tip the scales in favour at any one time. Already gold has increased over 30% in the last twelve months. The secret is to avoid the reactionary panic to such events and secure precious metals assets early. As those in the industry state, it’s better to be prepared early than slightly too late.