Healthy Pause: Gold and Silver Pull Back After Historic Run

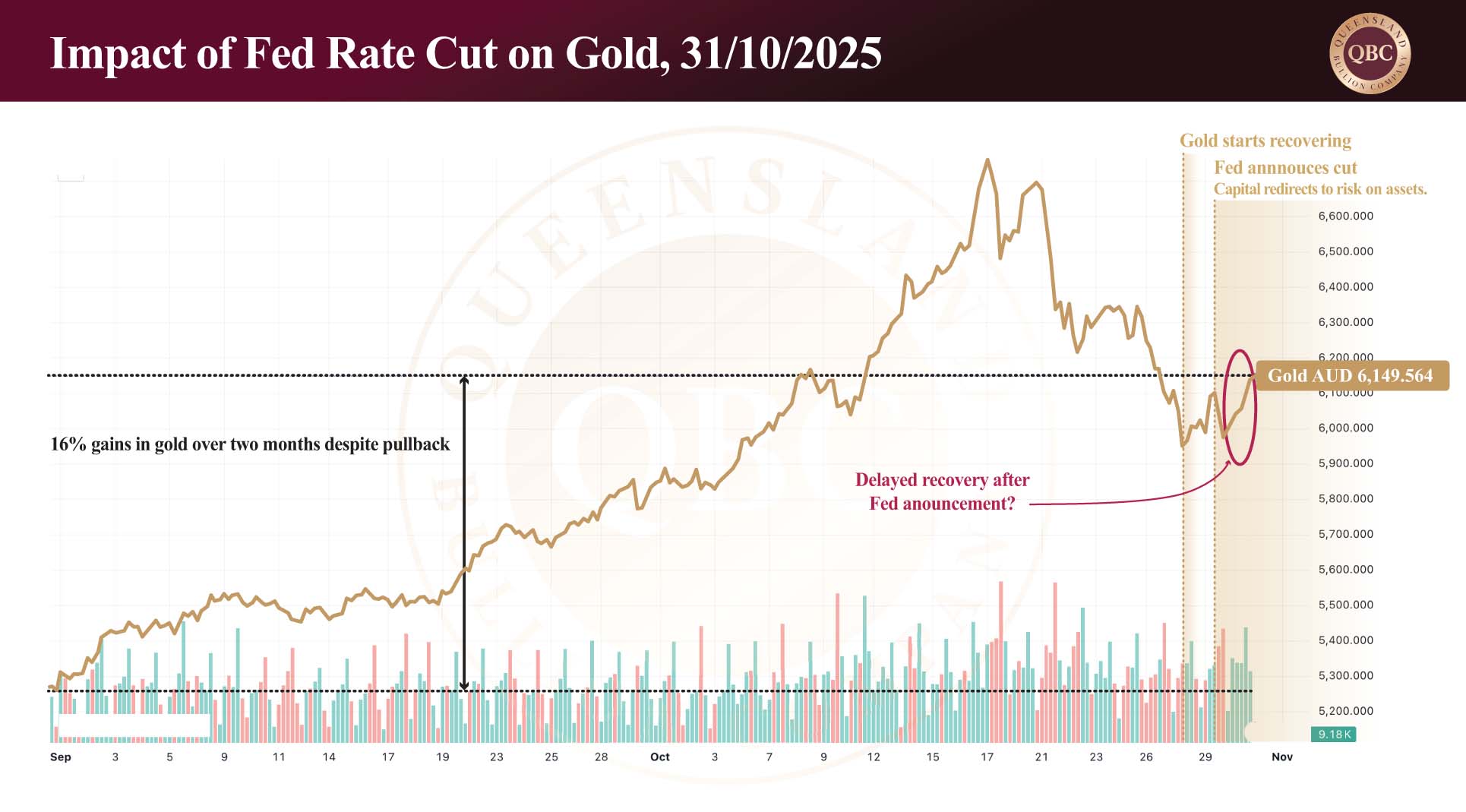

by Evie SoemardiAfter one of the strongest rallies since 1979, gold and silver are experiencing a brief but orderly correction. The pullback has taken both metals back to levels seen three weeks ago, yet prices remain well above their early September starting points. Gold is currently trading at AUD $6,107.60 per ounce, silver at AUD $74.80, and platinum at AUD $2,362.86. Even after the retracement, gold is still up over 16% since the beginning of September, an impressive gain that underscores the metal’s resilience. Technical indicators suggest that the short-term correction may be nearing its end, setting the stage for renewed strength in the months ahead.

Fundamentals remain unchanged

The key drivers supporting growth in precious metals have not changed. Geopolitically global tensions remain high. In the Middle East, conflict persists between Israel and Hamas despite President Trump’s public claim that the war is over. Russia continues its Special Military Operation in Ukraine, while trade friction between the United States and China persists under the Trump Administration’s tariff policies — tensions that are increasingly being framed as a matter of national security, particularly around critical minerals, a category that now includes silver. The world remains as fragile (and as uncertain) as ever.

From a fiscal perspective, America’s financial position continues to deteriorate. Economic growth has slowed to 2.1%, down 1% from this time last year, while the national debt has climbed beyond USD $38 trillion. Questions around Federal Reserve leadership add further uncertainty. With Chair Jerome Powell expected to be replaced in May of 2026, speculation about his successor has intensified, and the process (led by Treasury Secretary Scott Bessent, a noted gold advocate) is already sparking debate over the Fed’s independence. Political theatre around the appointment process is likely to inject additional volatility into financial markets over the coming year.

In currency markets, the AUD/USD exchange rate continues to trace a long-term flag formation, a pattern often followed by a decisive breakout once it nears completion. We maintain the view that this breakout is more likely to occur to the downside, which would support higher local pricing for gold and silver when it eventually unfolds. Read more about our AUD outlook and its implications for gold bullion pricing here.

The Federal Reserve pauses gold and silver’s comeback

This week’s Federal Reserve meeting confirmed market expectations with a 0.25% rate cut, bringing the primary credit rate down to 4%. Members voted unanimously despite limited economic data due to delayed releases of jobs, inflation, and housing reports. This is the first time the Fed has made decisions without a full suite of data since its inception in the 1930s. Prior to the announcement gold began recovering from its short-term pullback, gaining nearly AUD $100 in local markets; however, following the Fed’s decision, investor sentiment shifted toward risk-on assets such as equities, trimming some of those early gains. Silver followed a similar pattern though its response was more muted. As markets digest the policy shift, attention now turns to whether gold can reassert its upward momentum once the initial volatility subsides.

Short-term pullbacks within long-term bull markets

Historically, gold bull markets rarely move in a straight line. Sharp rallies are often followed by short periods of consolidation, a natural reset that allows the market to stabilise before advancing further. A similar pattern emerged this time last year when gold moved sideways for two weeks before resuming its climb. The current retracement fits neatly within this broader pattern and can be viewed as a healthy pause rather than a reversal. Bull markets thrive on momentum, and corrections like this one typically strengthen the next phase of the rally. Technical charts suggest that both gold and silver are near the end of this corrective cycle, with momentum indicators beginning to stabilise. Given the enduring strength of global fundamental positions the longer-term trajectory for both metals remains firmly upward.

In summary

Gold is currently trading more than 11% below its all-time intraday high of AUD $6,764, providing an attractive entry point for investors seeking to accumulate at lower levels. Silver, too, remains well positioned for renewed upside once short-term selling pressure subsides. The fundamentals that have driven both metals higher — geopolitical tension, fiscal weakness, and currency instability — are unchanged. In this context, the current correction presents not a reason for concern, but an opportunity. For investors focused on long-term wealth preservation, the window to accrue while prices are temporarily depressed may prove brief. In a world of ongoing uncertainty, gold and silver continue to stand as the most reliable forms of financial protection.