Why Invest in Precious Metals?

The financial world is layered with multiple factors that influence the hip pocket of investors regardless of capital, status, location or cultural background. Some of these factors include inflation, interest rates, local economics, tax and legislation, in addition to broader influences such as geopolitics, conflict, and global institutions. These all contribute to a world where spreading investing capital across asset classes has become imperative in order to reduce risk and maximise gain.

At Queensland Bullion Company we applaud those who not only recognise the intrinsic value and zero-risk features of physical gold and silver bullion, but also actively seek out investment opportunities in this space. We make it our business to help first time buyers arrive at informed decisions when creating a strategy around their precious metal investments and look forward to cultivating long term relationships. The first step is often the hardest. What can start out as a daunting journey can end up in hind sight as life changing, and we aim to support you in that pivotal moment.

First Time Buyers Guide

Being only one percent of the market, information on precious metals can be harder to find when compared to other markets such as real estate or shares. We invite you to view us as your personal resource. Whether buying gold online, investing in pool allocated platinum, or purchase silver in person, we can walk you through all options and ensure you feel confident in your purchasing decisions.

To this end if you would like to speak to someone about your personal circumstances prior to making any decisions, feel welcome to reach out and set up a complimentary private meeting with one of our staff. Simply call our office to arrange a time. This is why we are here!

Free Online Resources

The Specifics on Making a Transaction

If you would like to know more about how to transact with a bullion merchant, what to expect, and what you need to bring, sign up for a series of five emails. We break this information down into easy-to-understand instalments that you have for your records via email.

The First Time Buyers Guide covers information on:

- gold and silver

- who we are and what we offer you as a bullion dealer;

- the benefits of precious metals;

- different ways to buy precious metals;

- independent online resources;

- the basics of purchasing precious metals;

- how much and what to buy;

- the different types of precious metals;

- best practices for storage; and

- who invests in bullion.

Sign up for the First Time Buyer's Guide

Basic Insights

Below is a curated sample of educational articles written by our in-house researchers. The selection is specifically chosen to assist First Time Buyers develop a fundamental understanding of the precious metals market, its relationship with the broader financial landscape, as well as gold, silver and platinum. While written in the context of the time of writing, they are designed to explain the overall context in a way that informs the reader of how the moving parts combine to create the financial environment that retail investors participate in. Build your understanding of the markets with us today.

Understanding the market

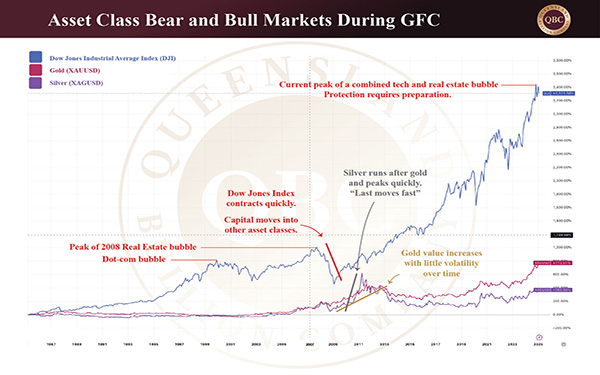

Stocks, Real Estate, & Precious Metals

Even though gold has dipped over the last couple of days, it has continued trading sideways for much of the month and decreased by only $10 from February 10th. This consolidation period is not uncalled for and allows gold to build a more solid foundation for moving forward. With gold currently trading at $4,625, silver…

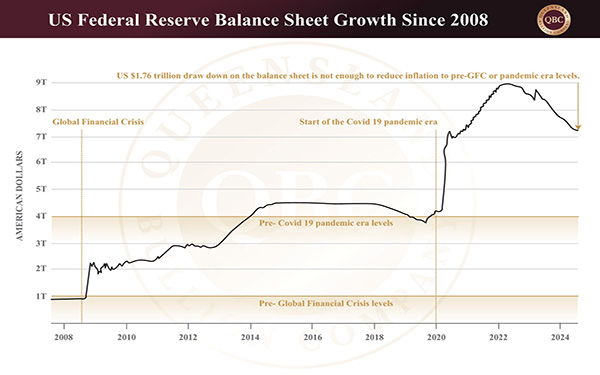

The Fed is Boxed In

Overnight gold and silver have experienced a spike in prices worthy of note. With gold trading at $4,751, silver at $54.01, and platinum at $1,617, volatility seems to be the top concern in the precious metals markets and global economies in general. While main stream media will emphasis that US President…

Crisis Assets in Times of Chaos

Gold and silver have long been viewed a crisis hedge (assets that hold or gain value when markets turn volatile). Over the last two decades, two major crises—the 2008 Global Financial Crisis (GFC) and the 2020 COVID crash—have tested this thesis. Gold currently trades at $5,210, silver at $58.81, and platinum at $2,092. All have…

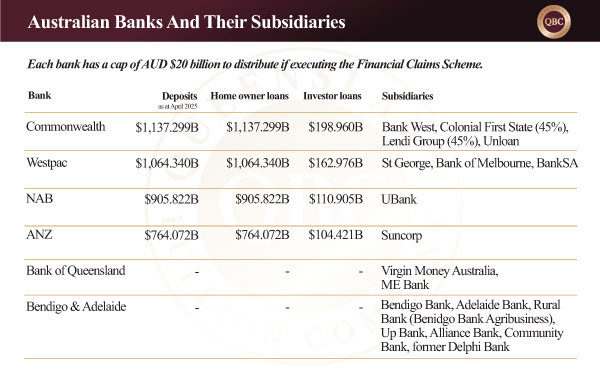

Is Cash in the Bank High Risk?

Gold finished strongly for the week. After early resistance near AUD $5,150, it pushed above $5,200, and currently trades at $5,189. Silver, on the other hand, saw a more volatile $2 trading range before reaching higher and is at $59.53. Platinum, at $2101, remained steady largely moving sideways…

Understanding Gold

Gold Outpaces Real Estate and Shares

Gold and silver have set new all-time highs in 2025 for Australian markets. For local investors, the question is not whether gold has risen but how it has performed relative to other key asset classes over the last two decades. When compared with residential property and the ASX 200, the results are clear: gold has outperformed both…

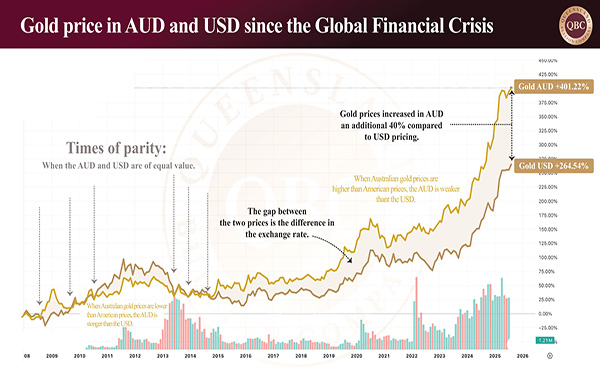

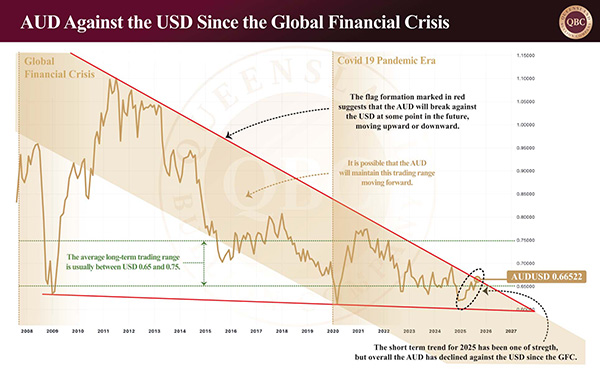

Gold and the AUD

Gold has surged to record highs around the world since the turn of the century, and Australia has been no exception. Yet, for Australian investors, the value of gold is shaped not just by its international price but also by the performance of the Australian dollar. Understanding this relationship is crucial…

Understanding Silver

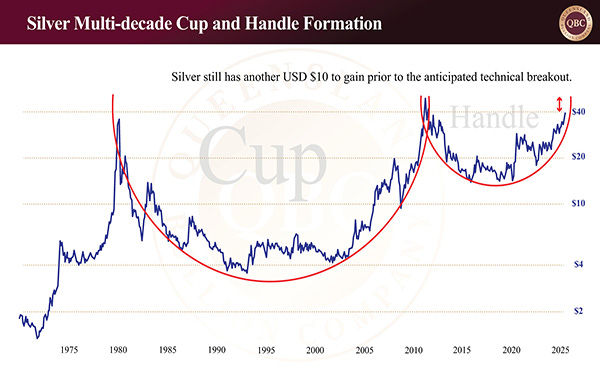

Is Silver Undervalued?

Silver achieved a new all-time high when it reached AUD $59.91 last Monday, igniting hopes among investors for a climb to $2,000 per kilogram, or approximately $62.20 per ounce. The rally places silver, currently trading at $58.47, firmly back into the spotlight, joining gold ($5,088) and platinum ($2,201) as metals of increasing…

When Will the Silver Squeeze Begin?

There has been an acute focus on gold as it continues its winning streak of over 18% gains since the start of the year. Even the recent pullback in the last few days is not enough to alter most investor’s bullish outlook for gold this year. With the price currently trading at $5,077, silver at $51.04, and platinum at $1,530, this sentiment is…

Would you like more content like this?

Build your knowledge of market fundamentals. Further reading is available under News & Analysis.

You never need to miss a beat. Subscribe and have articles emailed to you on publication.

Create An Account Today – It Only Takes 2 Minutes

- No Account Fee

- Transact Immediately

- Exceptional Pricing

Leave a Review

Quality of service is integral to our business. If you have experienced exceptional service we invite you to leave a five-star Google review. REVIEW NOW

Moreover, we are committed to continuously enhancing your experience with us. If you have suggestions of feedback we would appreciate your input.

Call on 1300 995 997.

You can also join our Facebook community where we post additional information and supporting articles about the precious metals markets.