2025 Outlook for Gold: Risk vs Reward

by Melanie Young2024 has been a volatile yet satisfying year for gold which has ultimately enjoyed a 38.9% increase in value year to date. This past week it experienced a record high and the outlook remains promising for 2025. With gold currently trading at $4,226.04, silver at $48.97, and platinum at $1,489.09, we look to next year, eyes wide open, and assess the bullish and bearish influences on gold moving forward.

If there are any bearish reservations concerning gold one cannot avoid pointing the finger at Donald Trump. As President-elect of the world’s largest superpower his chaotic and unpredictable style (whether driven by impulse or a carefully-crafted strategy) creates uncertainty for gold investors. Election night showed that Trump can impact the price of gold quickly. Once a clear victory was evident gold prices dropped as investors moved to high-risk assets. Almost a month later gold has rebounded to outstrip the highs established on election day. Look to 20 January, 2025, for a move in precious metals depending on his strategy moving forward.

Trump’s promise of tax cuts, looser regulation and trade tariffs have investors worried about inflationary consequences. This is because tariffs could drive higher inflation which is generally positive for gold prices. However, next year will likely provide a backdrop of recession, in which case, different rules could apply. Normally, higher interest rates can increase the demand for a country’s currency due to the yield investors can receive. In the US a strengthened dollar has little impact on gold, but in Australian markets the value of gold priced in AUD will benefit accordingly. It becomes clear that Trump’s economic strategy will affect many moving parts that influence the price of gold, creating a murkiness that clouds predictions in the future.

On a positive note for gold investors, the “Bitcoin President” may need to rethink his promises in the coming year as new regulations are implemented by central banks regarding crypto currencies. The Group of Central Bank Governors have endorsed the Basel Committee’s global prudential standard for banks’ exposure to crypto assets. Central Banks must have these standards implemented by 1 January, 2025. This tighter, high-level scrutiny of crypto assets is good for gold which is already accepted as a zero-risk Tier 1 asset by central banks, highlighting a marked difference in how the Bank of International Settlements views the two extremely different assets.

Beyond the US, the economic world keeps ticking with central bank gold purchases to form the fundamental basis for higher gold prices in 2025. Eastern nations will continue leading the way after having witnessed how America weaponised its currency when they sanctioned Russia in 2022. Some Eastern countries have adopted fairly creative strategies that are outside the normal scope of over the counter (OTC) purchases when diversifying away from the dollar into hard assets such as gold and silver.

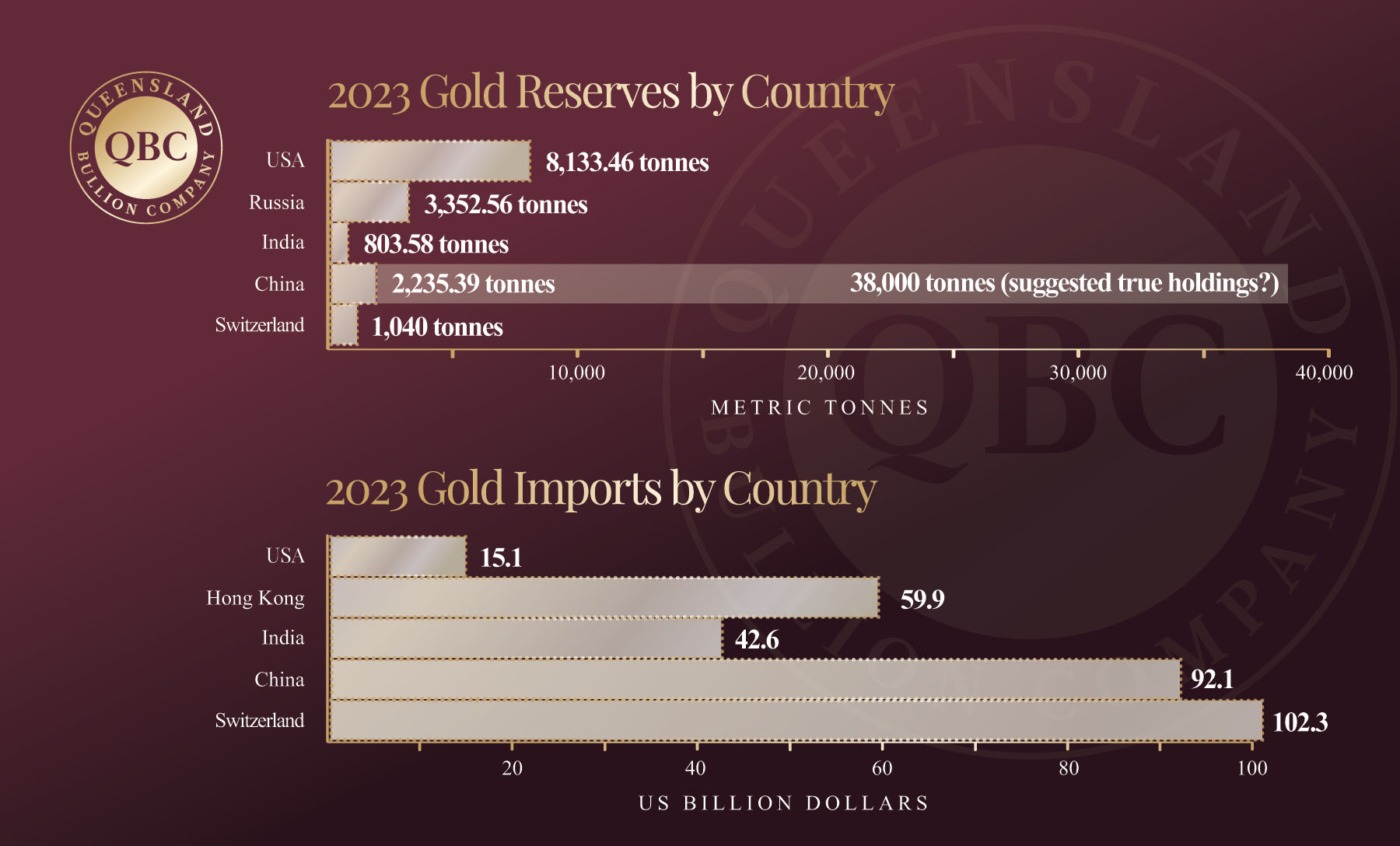

China is the perfect example. Not only is China the world’s largest producer of gold, they are also one of the largest importers (second to Switzerland). The Oriental Superpower has recently announced more economic stimulus meaning industrial demand for precious metals could increase. The graph below shows how much key countries held and imported in 2023.

China is also buying gold OTC after an official break of six months, but did they really stop? When official OTC transactions dried up the largest Eastern nation was still purchasing gold and silver in less than transparent ways by purchasing large amounts of unrefined gold cast bars directly from minors (mostly in South America). This makes assessing China’s true gold holdings fraught with danger; however, economist Alistair McLeod suggests that it could be as high as 38,000 tonnes. The World Gold Council puts China’s official holdings at 2,264 tonnes… If true, one must ask if the Chinese are prepared to invest so much in gold over time, what does this mean for the average investor. The answer is obvious.

In closing the gold’s general outlook for 2025 is positive to say the least, with some experts expecting spot price to average AUD $4,390. The more conservative analysts suggest that while gains made will be more subdued next year gold still has a lot to give. Other analysts suggest it could run up to AUD $4,630, an amount hot on the heals of AUD $4,709, the figure that a number of commercial banks forecast earlier in the year.