Who Will Pull the Silver Squeeze Trigger and Send Physical Silver Skyrocketing?

by Melanie YoungThere is plenty of talk about increasing silver prices in the current market and it is not hard to understand why. At the time of writing silver trades at an all-time high of $51.72, as does gold $4,239.12, and platinum at $1,562.06. The expectation is that all metals will continue to rise to new heights, with analysts citing various reasons especially for silver that include a rise in demand, a shortfall in supply, and the inability for derivative silver markets to maintain momentum under current geopolitical pressures. It is an interesting convergence of circumstances. Let us unpack them one by one, saving the best for last.

Part of silver’s intrinsic value is linked to its use in various industries. Some of the attributes that create an industrial need include use in green technology, electronics, medicine, optics, corrosion resistance, reflectivity and heat conductivity. Industrial use accounts for 56% of the demand for silver over the last five years, with the largest consumers including America, China, Russia, India, Canada, Japan, Germany and South Korea. Modern life does not exist without silver’s industrial applications and this builds in a solid fundamental basis when considering silver for investment purposes.

Additionally, the military appetite for silver is not to be ignored. Some applications of silver in the defence industry include use in radar systems, night vision equipment and munitions. However, information is scant at best given government agencies generally do not report on silver inventories. But even still, what is known is that the US removed 430 million ounces of silver from West Point Bullion Depository for the purposes of military applications. Actions like these that do come to light lead many investors wary of government-released information on its usage of silver.

Most physical silver holders are aware there is a shortfall in silver supplies. Several factors contribute to this constrained position. Firstly, global production peaked in 2016 and has declined ever since. Secondly, only 25% of physical silver is derived from primary silver mines. And thirdly, new deposit discoveries have decreased by 50% over the last 10 years. When considering that geopolitical tensions are driving an increase in demand it becomes obvious that, as a depleting asset, the supply-demand imbalance is poised to worsen with no easy fix in sight.

So humanity finds itself in a unique position wherein, whilst every effort is made to develop sustainable energy and green technology, we also actively indulge the bellicose part of our nature and threaten to blow each other up with nuclear bombs. What is the common thread? Silver. And while we lose ourselves in this real-life tug-of-war like set of agendas, what do financial institutions do?

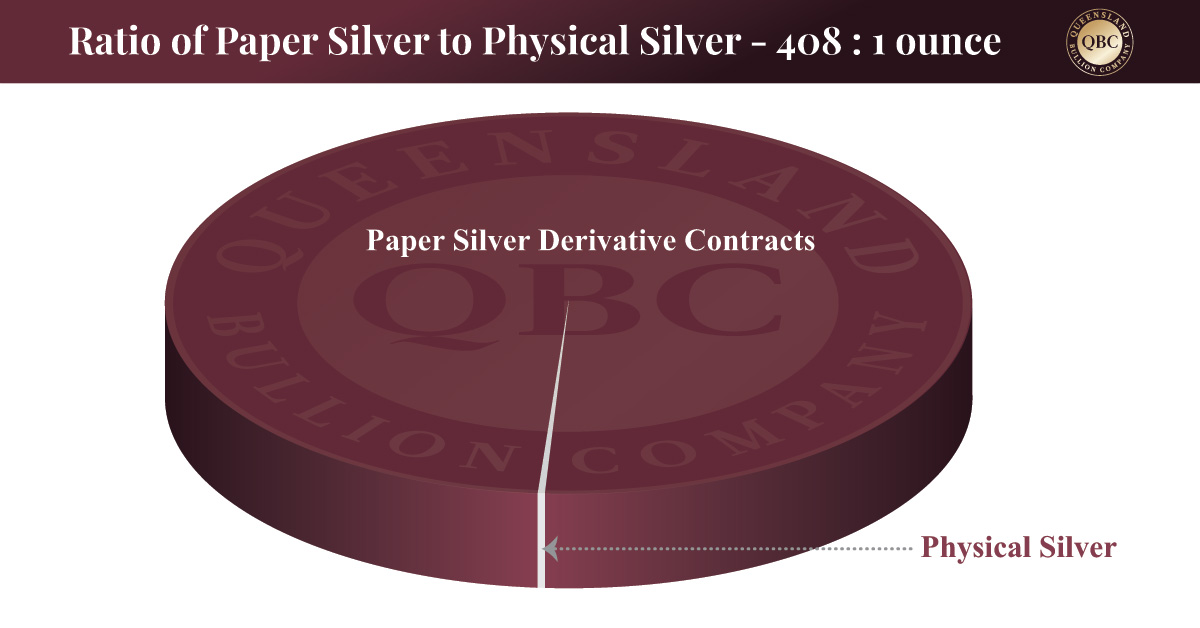

The financial institutions flood the market with derivatives that suppress the price of silver. They have been doing this since the crash in silver prices in 2011 from a high of $46.42 down to $16.92 in 2015. The disparity between the paper silver market and physical is almost inconceivable. For every one ounce of real silver there are 400 – 450 silver paper claims. This reeks of the same fractional-trading corruption found in fiat currency. Likewise, COMEX registered inventories are the lowest ever and less than 0.25% of futures contracts actually stand for delivery. Concurrently, in their quest to be Basel III compliant, major banks have developed a healthy appetite for silver that exceeds annual global mine supply.

It is now clear why the price in silver is rising. As it rises banks race to exit or reduce their short positions on paper silver derivatives. In turn this creates the very situation they seek to avoid, a rise in silver prices. To read about how BRICS central banks are placing upward pressure on silver prices read our previous article HERE. It appears things are finally catching up on the banks that have suppressed the price of silver. Factors outside their control are putting upward pressure on the price of silver and they are forced to reduce their exposure by decreasing their position in the silver derivative markets. As these markets contract so too does manipulation of the price of silver, allowing it to correct according to larger market influences. The end result is that the very banks who sought to supress the price of silver are now ushering in a new era for the white metal with more than just silver linings to look forward to for those backed with physical.

It is now clear why the price in silver is rising. As it rises banks race to exit or reduce their short positions on paper silver derivatives. In turn this creates the very situation they seek to avoid, a rise in silver prices. To read about how BRICS central banks are placing upward pressure on silver prices read our previous article HERE. It appears things are finally catching up on the banks that have suppressed the price of silver. Factors outside their control are putting upward pressure on the price of silver and they are forced to reduce their exposure by decreasing their position in the silver derivative markets. As these markets contract so too does manipulation of the price of silver, allowing it to correct according to larger market influences. The end result is that the very banks who sought to supress the price of silver are now ushering in a new era for the white metal with more than just silver linings to look forward to for those backed with physical.