Is $5,400 Really on the Cards for Gold This Year?

by Evie SoemardiAfter a brief dip, Gold has maintained its bullish momentum above US $2,900. Currently trading at $4,634, silver $51.64, and platinum $1,630, many banks have changed their targets for the yellow metal this year. Those joining the choir of US $3,000 include, Goldman Sachs, Bank of America, JP Morgan, Swiss bank UBS, and locally, Commonwealth Bank of Australia. CITI Bank and multiple analysts point higher to US $3,300 for 2025. This is great news if you follow the market in USD, but what does it mean for Australian gold investors that need to factor in a USD to AUD currency exchange?

In short, it means Australian investors can afford to be even more bullish than their American counterparts. The above targets do not factor in currency exchanges. While banks and economists are generally mixed on where the AUD to USD exchange will move, geopolitical tensions and trade wars indicate a potential deterioration. Conjecture aside, the American Greenback has long been used as a safe haven asset globally. We suggest that last year’s outlook of a decrease in the exchange rate remains a more likely outcome given the global economy and politics.

Let us now take the scenario wherein gold is valued at US $3,300 by the year’s end, and the exchange rate with America sinks to 57 cents. In that specific case, gold could see $5,543 in local markets. While this is a bullish outlook, it must be acknowledged as plausible. Watch to see how close gold comes to this forecast.

So why is the currency exchange with the US likely to drop? Much of it has to do with China. Since the Howard era, the value of the Australian Dollar is correlated directly to the success of the Resource Sector (the single most important sector affecting the local economy). The reason for this is that our service sector is priced out of the international market, and our manufacturing has moved off-shore, leaving the Resource Sector as the only major factor underpinning our economy. Australia’s largest resource is iron ore. The result is that the demand for iron ore affects the AUD.

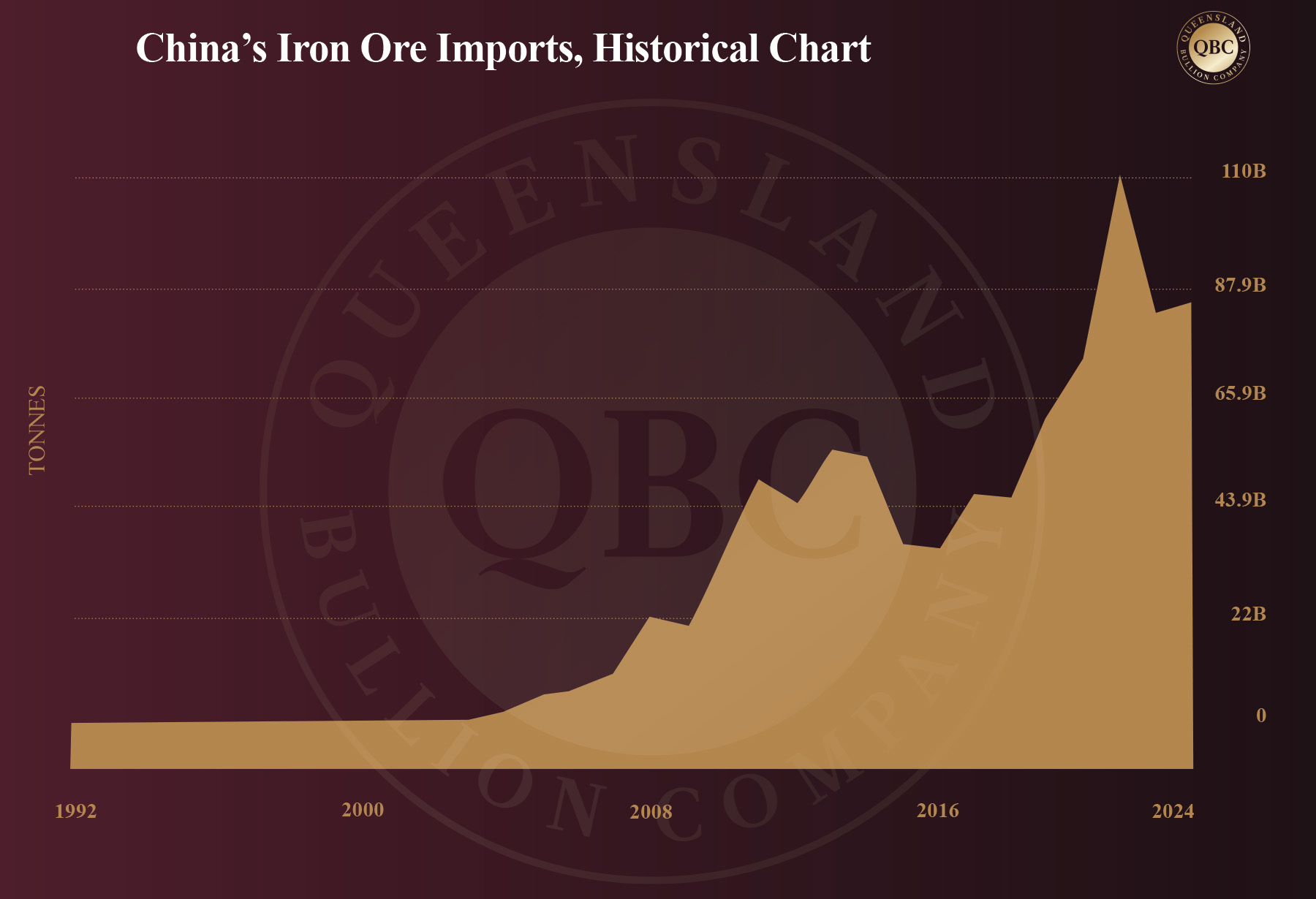

As Australia’s largest importer of iron ore, China has a significant influence over the value of our local currency. The unfortunate reality is that China is in severe economic turmoil. In 2023 it imported 1.18 billion tonnes of iron ore. In 2024 it increased to 1.24 billion. 2025 imports are set to be higher again. Superficially these figures are impressive, until intent is considered. On the ground, not all the iron ore is being processed, rather a portion is being stockpiled for future use. The consequences for Australia is that we may see a decrease in iron ore exports in the future, thus affecting our currency lower.

Below is a historical graph of Chinese iron ore imports showing an overall downturn despite the immediate yearly increases.

China’s economy is something akin to the cycle of the 2008 Great Financial Crisis (just a lot worse), hence the anticipated down turn in demand for iron ore. As a snapshot, an estimated US $18 trillion has been wiped out of household wealth. Recognising the soft economy, the government has allowed some of their largest insurance houses to invest up to 1% of their overall portfolio in gold. This could be an injection of US $27.4 billion into the international gold market. Chinese bonds are at record lows offering small yields, the government may be offering economic stimulus too little too late, and while all this translates to a weak Australian dollar, it also points to a gold bull market taking off in China in their spring.

The other factor affecting China’s demand for iron ore is US President Trumps’ threat of tariffs. Not only does he technically have 25% tariffs scheduled for Canada and Mexico, and 10% on China, on Wednesday he signed a memorandum directing his administration to threaten reciprocal tariffs on any trading partner that imposes levies on American imports. Importantly, none have actually been executed, but investors are still acting on the perceived threat and governments around the world are well trained to be ready for anything under Trump 2.0. If tariffs become real then a global softening in productivity can be expected, compounding Australia’s problem of a decreasing demand for iron ore.

To conclude, gold investors have plenty of reasons to remain bullish moving forward, and to consider adding to their portfolio. If the currency exchange with America drops, if there is a trade war, or if geopolitical conflict ignites again… gold wins each time.