Gold Up 60% Since the Start of Russia’s Special Military Operation. What is Next?

by Melanie YoungGold continues to recover in the Australian market despite a distinct lack of movement in the United States. With gold currently trading at $4,118.97, silver at $48.95, and platinum at $1,489.77, it appears that the value of gold could move either way over the Christmas season, so let us take a close look at what has been building gold’s momentum both in the medium and short term. To read about the long-term implications for precious metals read our article on silver from last week.

Geopolitics is generally the most effective context to view medium-term trends in precious metals. Since the beginning of the Russian Special Military Operation in Ukraine, gold has increased 60% in the Australian market. This type of stellar performance is in part due to the conflict in Ukraine as a root cause. With the US and other Western countries freezing (and in some cases, seizing) Russia’s central bank assets, many Eastern nations chose to diversify away from the USD in favour of physical gold and silver, hence, driving the price up on precious metals in general. This driver will likely continue given the number of regional conflicts that could officially trigger World War III at any time (Russia vs Ukraine, Israel vs the Middle East, and China vs Taiwan to name a few, all of them, incidentally, potentially proxy wars for the US to justify resetting its financial system).

Another slow-burning issue affecting the price of precious metals is the elephant in the room that just won’t go away. “Recession” is an ugly word and it is used more and more in current times. Governments don’t use it lightly, but is it possible the West is already in one? It would certainly explain some of the provocative behaviour from the Democrats as they prepare to leave office in America. In the US, bankruptcies for companies holding USD $50 million or more in liabilities is on par with the statistics from 2008 Great Financial Crisis. This is filtering down to individual households that are defaulting on credit card, auto, and personal loans, in addition to mortgages. Some analysts suggest that recession in America technically started in April this year and that it should end at a similar time in 2025. Certainly the price of precious metals reflects this, but is this the end of the bull run for gold and silver? Put simply, the answer is no. If it really has started, fallout from recession would still need to play out, as would a financial reset, on a backdrop of global conflict. Chaos is always good for gold and silver.

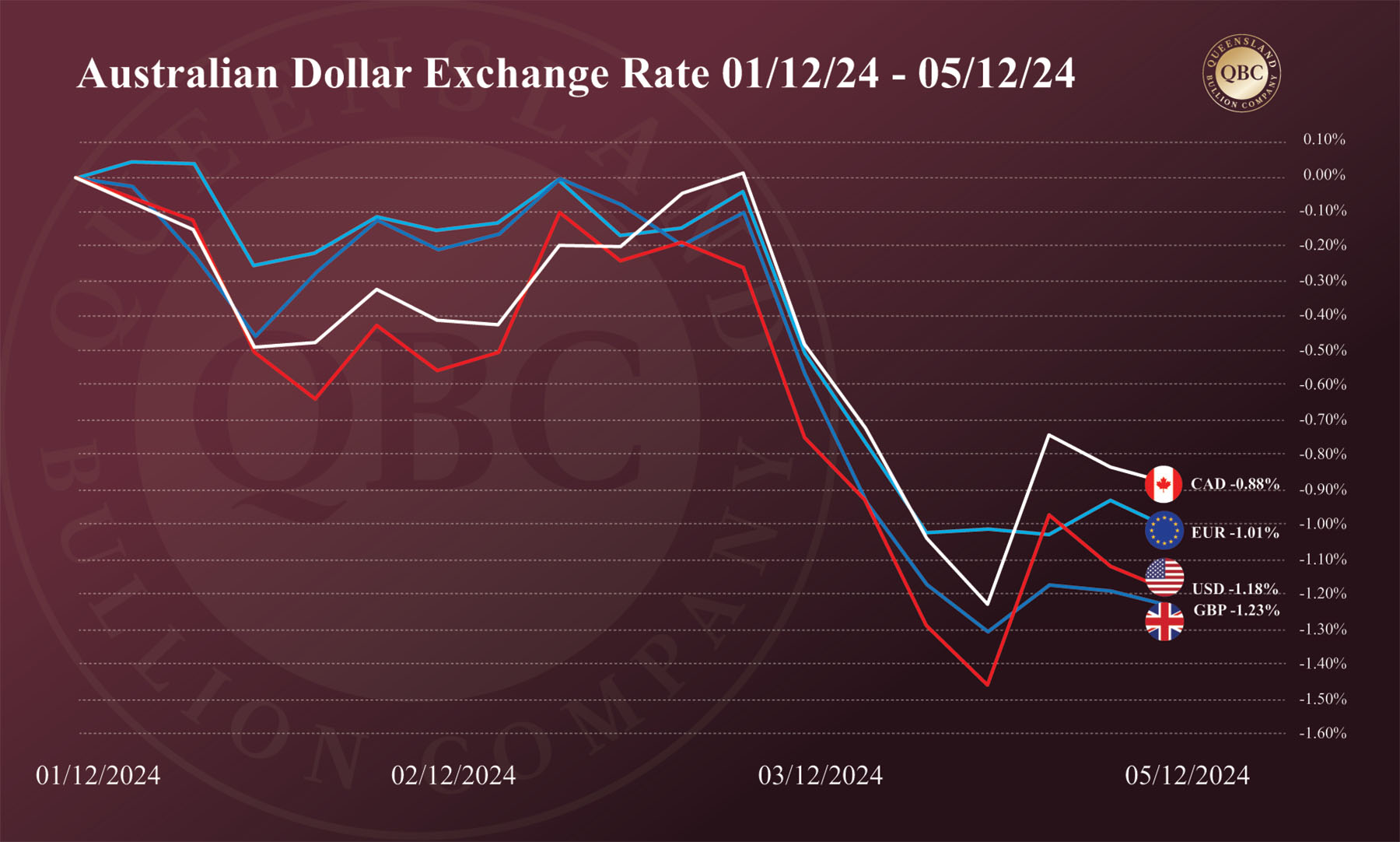

Lastly, and most importantly for Australian investors, is the immediate performance of our own currency. The AUD took a nosedive in recent days which, in turn, increased the value of gold in local markets. While the exchange rate against the USD is most important in affecting the price of precious metals in Australia, as per the graph below, it dived also against the British Pound, the Canadian Dollar, and the Euro in spectacular fashion. Further, the outlook for our local currency is fairly unfavourable. The Commonwealth Bank of Australia has warned that President-elect Donald Trump’s use of higher tariffs could turbocharge the Greenback’s rally and that the Australian Dollar could sink as low as $0.50 on the US dollar. This sentiment is echoed by National Australia Bank, with the writer expecting more banks to join the chorus over time.

With the weakening Australian dollar, recession looming, and global conflict sitting on a tinder box, travelling overseas may not be a high priority for Aussies in 2025. Although, if one does need to travel, any bullion investor would advise to buy some gold to offset the expenses.