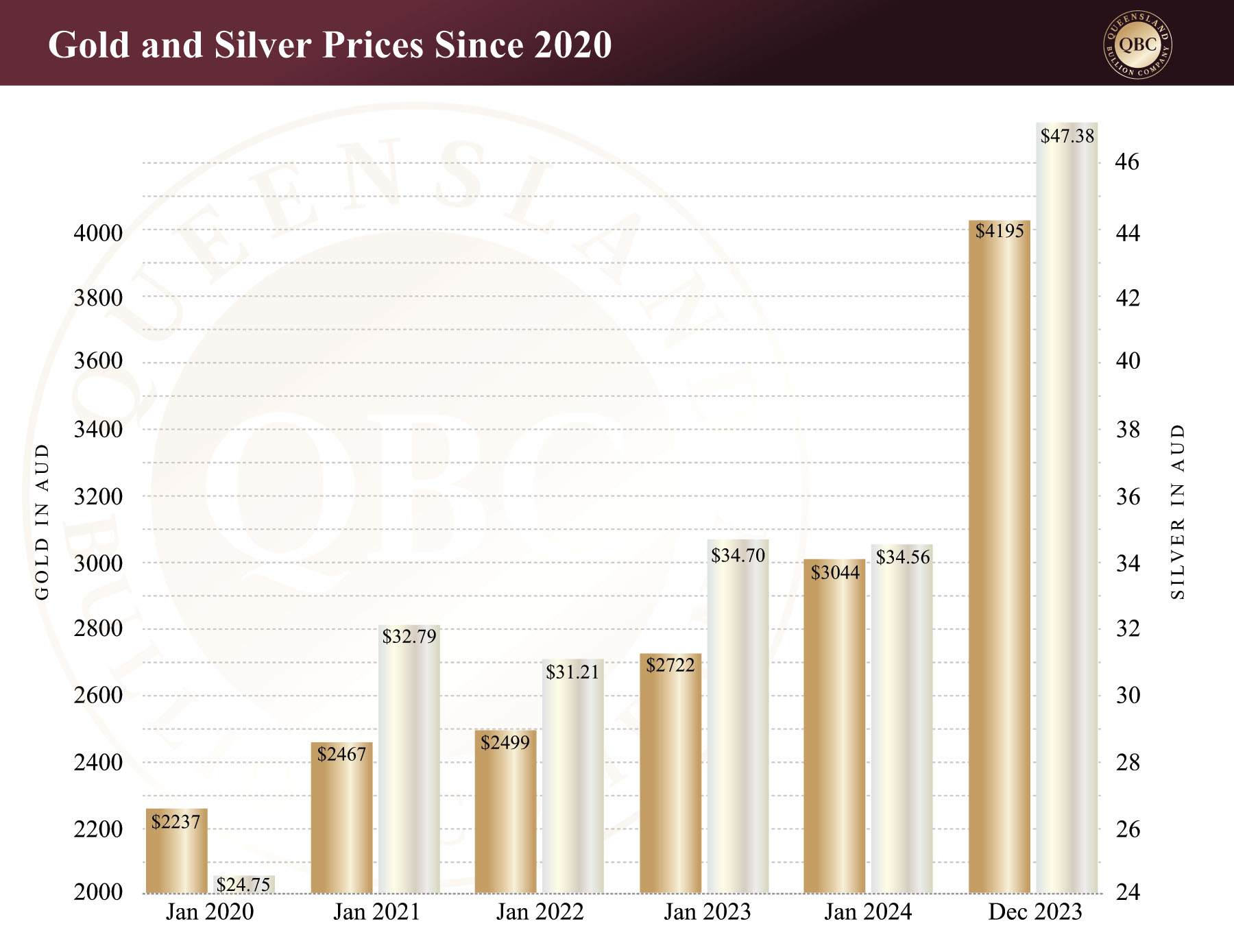

American gold prices took a hit this week since the Federal Reserve announced another 25 point interest rate cut, yet the value of gold in the Australian market has managed to hold firm despite its counterpart losing steam. With gold currently trading at $4,197.36, silver at $47.66, and platinum at $1,506.74, Australian investors need to remember that this is largely due to market fundamentals ever present in the background, and not simply Lady Luck blessing the Lucky Country.

Gold dropped USD $65 overnight in response to the rate cut. Federal Reserve Chairman Jerome Powell said, “I think it’s pretty clear we have avoided a recession… The US economy is performing very, very well, substantially better than our global peer group.” Needless to say, there are many economists that will remind investors that recessions are always declared post-recession when the data proves it out. The Fed also confirmed it has, at this point, revised down the number of rate cuts for 2025 and 2026 to only two, attributing the change in sentiment to higher inflation rates and global economic uncertainty. “It’s common-sense thinking that when the path is uncertain, you get a little slower…. It’s not unlike driving on a foggy road or walking around in a dark room with furniture in it.”

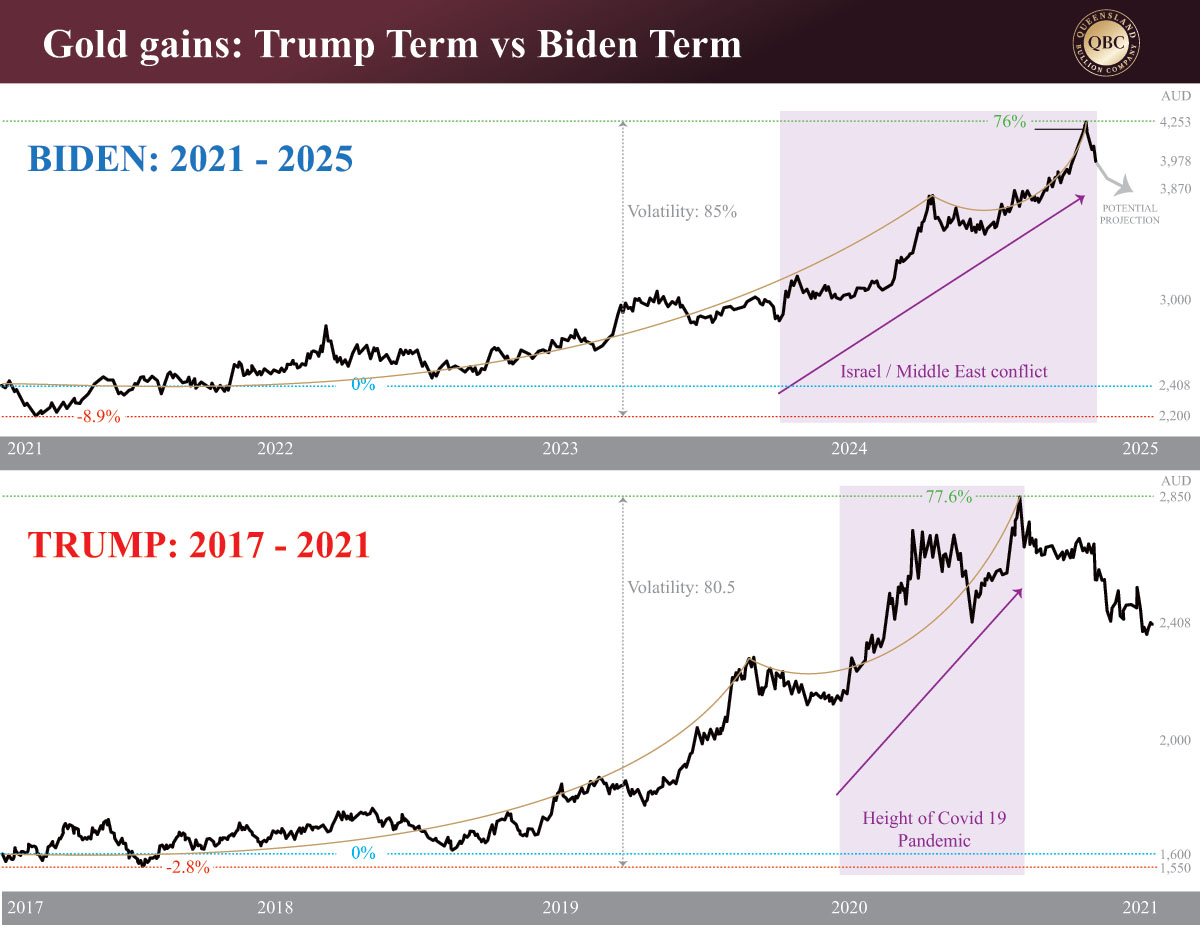

Yet American gold prices were not the only asset to slump. The S&P 500 fell nearly 3%, while the Nasdaq (Big Tech) plummeted 3.5%. The Dow Jones Industrial Average (DJIA) has also dropped about 1,100 points, or 2.5%, the largest drop since August. It is also the longest losing streak since 1974. It was in 1974 that the stock market experienced one of its worst years to date, experiencing a 45% loss in value. The devastating hit was the result of the continued conflict between Israel and the Middle East (headed by Syria and Egypt). The conflict triggered an oil embargo on Israel, the United States and other countries in support of Israel, the economic consequences resulting in the aforementioned historic dip in the stock market. All of this sounds strangely familiar to the events unfolding in Syria today with the Isreali Defence Force claiming to have destroyed around 80% of the Assad Regime’s military capacity. Let’s hope the West does not experience another oil embargo (post Inauguration Day) as we did before.

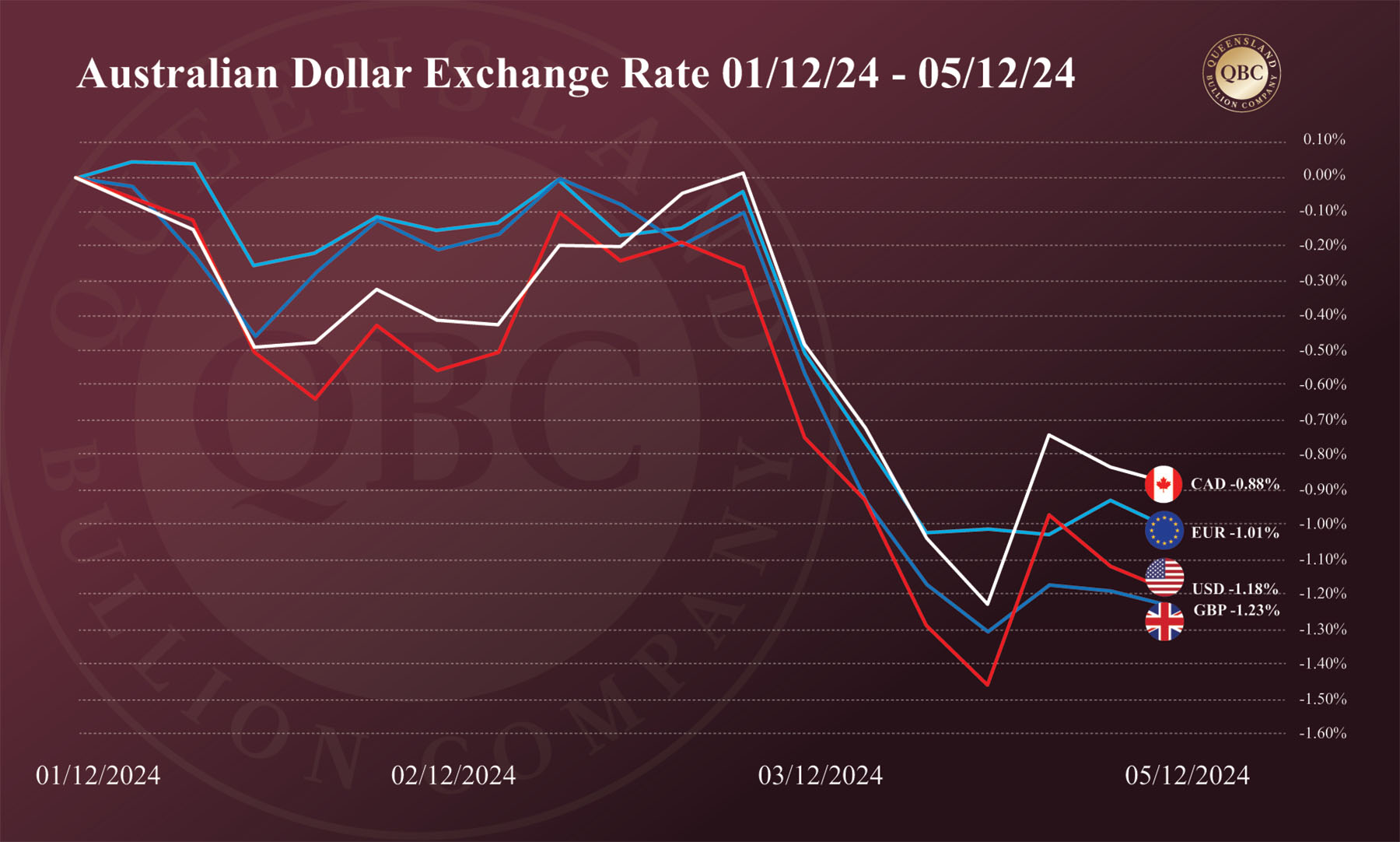

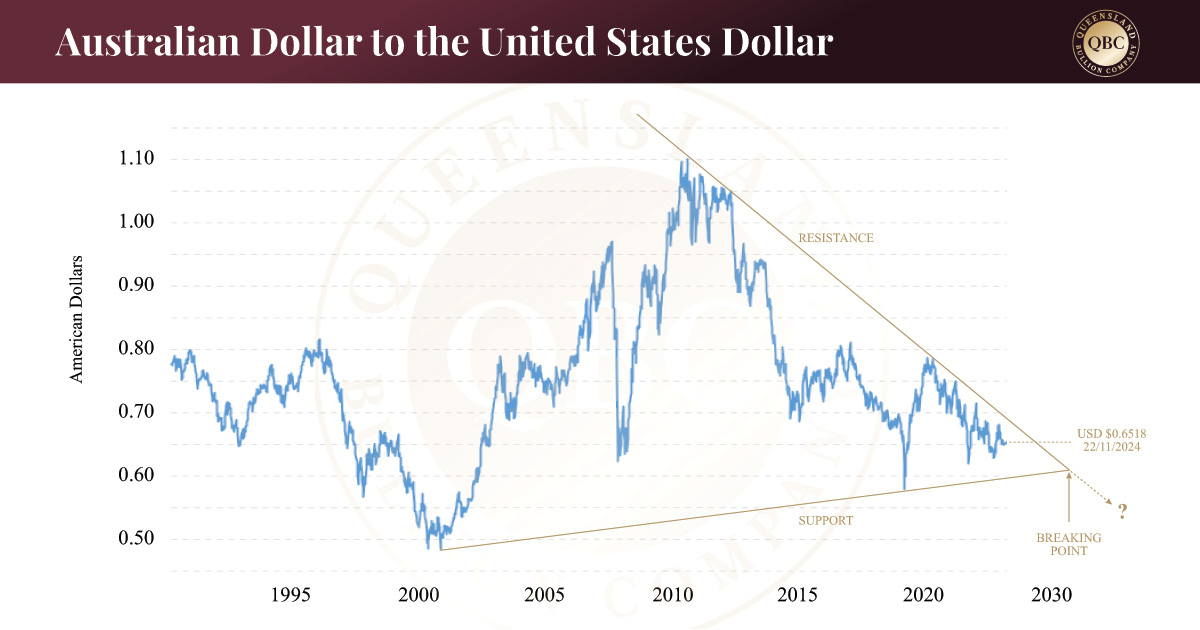

While American gold prices are not alone in experiencing a pullback, the Australian market has avoided the correction to date. The main reason is the AUD to USD ratio. Gold against the Greenback has lost value, but our local currency has lost value even more thus buoying local prices. Indeed the Australian Dollar and the Euro appear to be competing to enter “crash” territory, while the American Dollar and the British Pound remain in positive territory. If the Euro and other significant currencies tank look to a strengthening American Dollar as investors seek safety, and observe if Australian gold prices continue to benefit. Regardless, the below graph illustrates the safe and steady climb of all gold bulls’ favourite metal.