When Will the Silver Squeeze Begin?

by Evie SoemardiThere has been an acute focus on gold as it continues its winning streak of over 18% gains since the start of the year. Even the recent pullback in the last few days is not enough to alter most investor’s bullish outlook for gold this year. With the price currently trading at $5,077, silver at $51.04, and platinum at $1,530, this sentiment is understandable. Even the World Bank has asserted that gold will be the standout asset in the commodity space for the next two years.

So where does this leave silver? While the World Bank anticipates a 16.7% increase in the average price for silver this year compared to last, it is not quite the 36% increase they have assigned to gold. In publishing these figures the World Bank has pivoted 180 degrees in saying that gold will now outperform silver. This article will address a singular question that we hear almost daily from clients, “Why isn’t silver keeping pace with gold?” The short answer is simply that, historically, it is not the right time yet.

Exposure to global economies

One of the most significant appeals regarding silver is its dual application of having industrial demand as well as being a store of wealth. Over 55% of silver demand derives from the industrial sector, unlike gold which currently has demand of only 10%. While such a high industrial demand builds in a natural price support that will likely increase in time it also exposes the it much more to the ebbs and flows of global economies and growth. Therefore it is natural for the price of silver to remain more sluggish during times of global economic slowdown- consumer demand softens which in turn decreases the demand for silver thus affecting price to a degree. For example, the largest demand for silver is for use in solar panels; if global consumer demand for these soften so does the demand for silver. On the other hand, one of the reasons that gold is a true safe haven asset is precisely because its exposure to industrial demand is limited. The point is that it is acceptable for silver prices to lag behind gold at this stage of the economic cycle.

Gold generally runs first. Will silver always lag behind gold? No. As retail investors are priced out of gold expect them to start investing in silver in a big way. This is one reason why, on a percentage basis, gains in silver could sling shot up to overtake gold. Add increased industrial demand and silver has two independent reasons as to why it will not flatline forever.

Timing the market

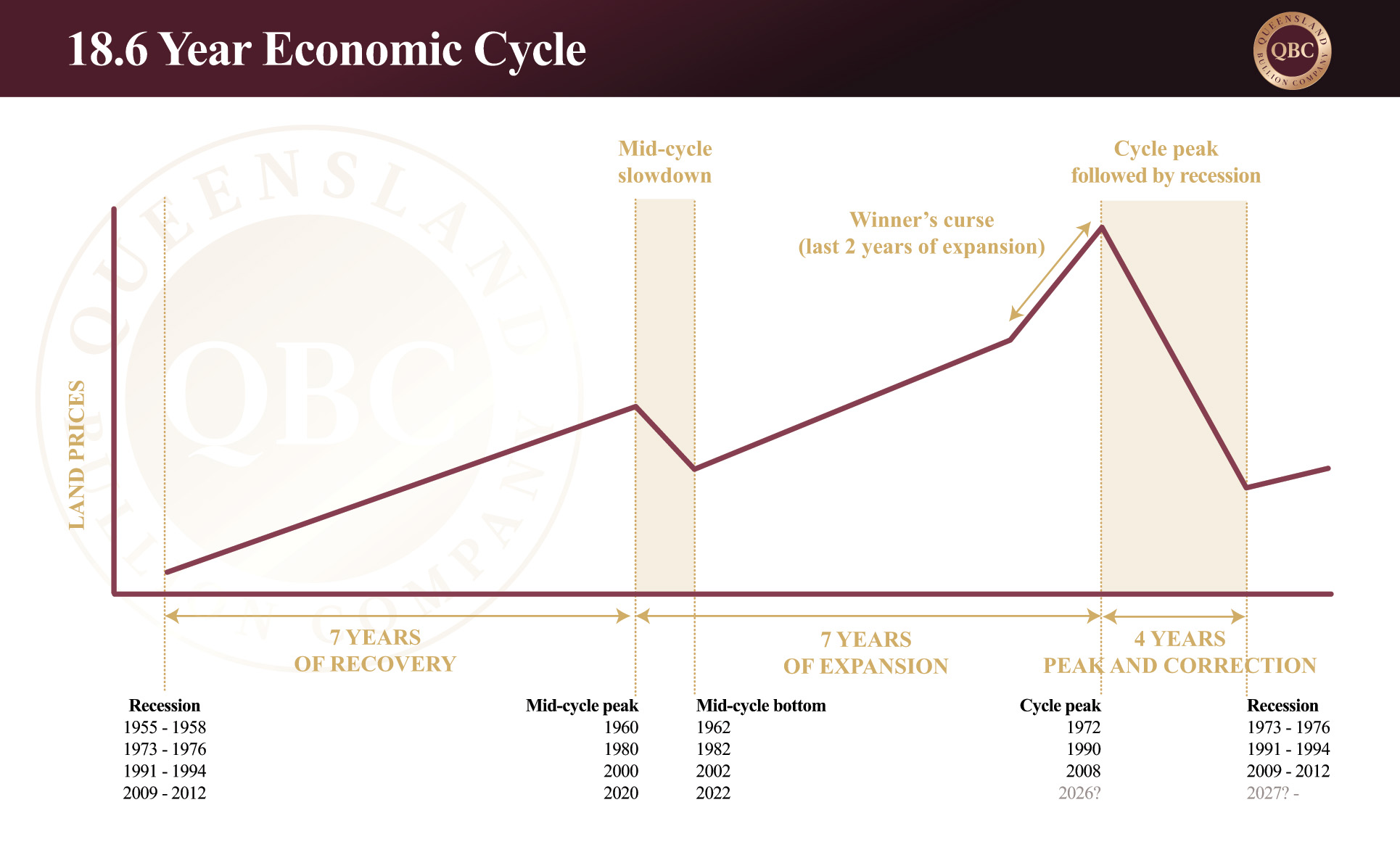

Let us consider silver’s plight in the context of financial cycles and other asset class performances. The 18.6 Year Economic Cycle is a well-established pattern that has been observed for over 200 years. The timing is generally reliable but the factors that allow it to play out can be as varied as any black swan event imaginable. In essence the cycle comprises of fourteen years of economic growth which is followed by four years of contraction. The fourteen years of growth can further be divided into two sets of seven-year growth periods that feature a mid-cycle slowdown between them. The first is a recovery phase after the contraction of the last cycle and the second being more expansive and aggressive. Below is how the cycle presents in principle.

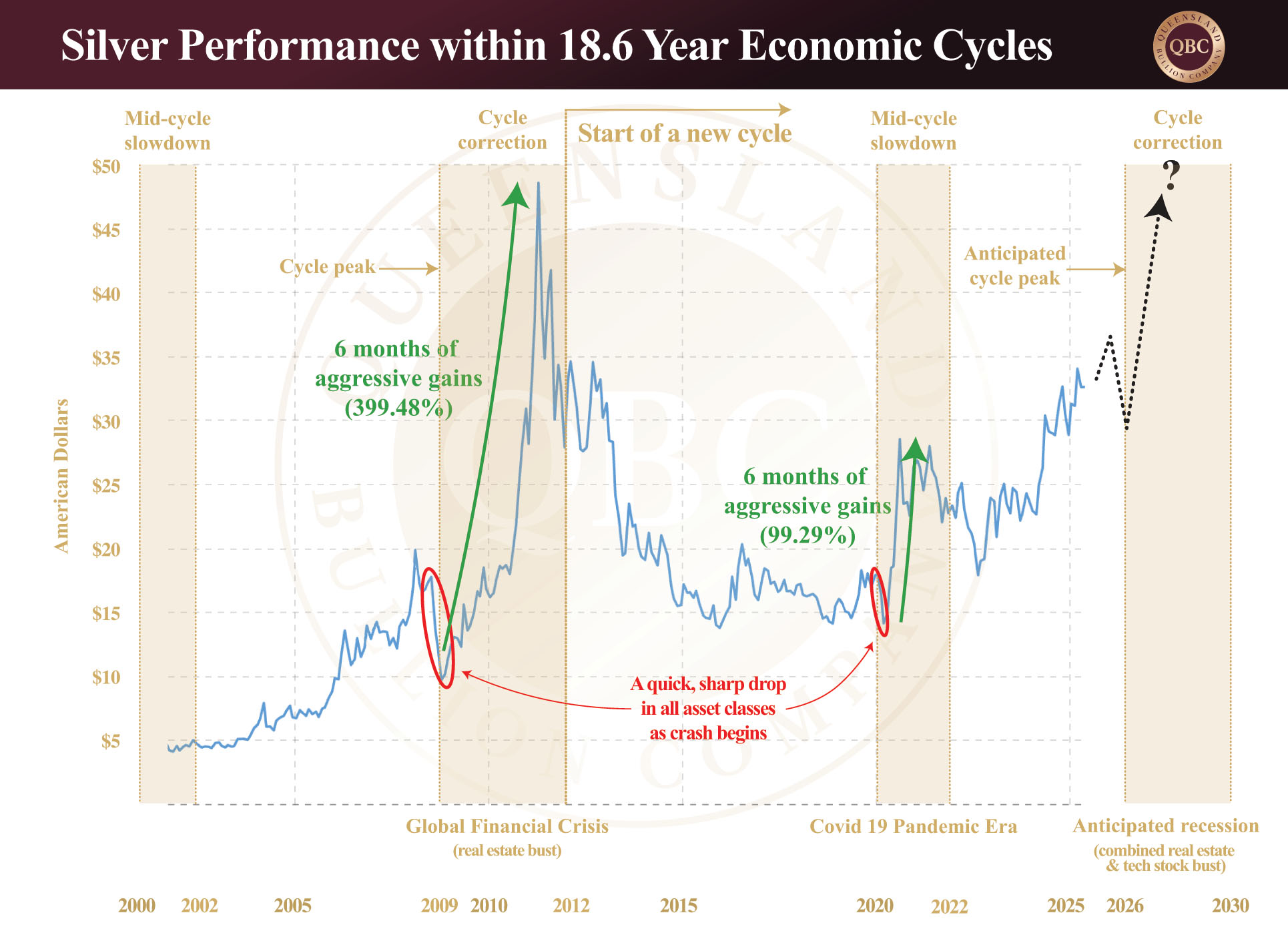

This financial cycle is due to end soon with the last four years of contraction that usually leads to recession almost upon us. If we study the last twenty-five years, we can see that the dot-com boom and bust of the year 2000 fits neatly into a mid-cycle peak and slowdown. After the dot-com bubble the Global Financial Crisis (GFC), being largely a real estate bubble, was the next major financial shakedown- this crash marks the same cycle’s main peak and following four years of correction. Moving to more recent times, the Covid 19 Pandemic Era aligns with the current cycle’s mid-cycle slowdown when we did experience a short recession. And we are currently in what is known as the Winner’s Curse, the last two years of the final expansionary phase and a dangerous time to be purchasing property (and some stocks) as an investment asset.

As mentioned in our article, Stocks, Real Estate and Precious Metals, the current cycle’s peak is manifesting in a combined real estate and stock market bubble (think dot-com and GFC together), and the current overvaluation of inventory in both sectors is nothing short of scary and stunning, somewhat resembling a house of cards in a slight breeze. The only factor overshadowing this is that, according to the 18.6 year economic cycle, we are on the verge of that slight breeze turning into gale-force winds as the house of cards tumbles and the correction begins.

So how does this affect silver? The metal has developed a pattern of behaviour that works in with the above economic cycle. During the last two major global financial events (GFC and to a lesser degree Covid), silver experienced an extremely swift rise to glory over approximately six months each time. In both cases, as has been the case for the last six bull runs, silver outperformed gold significantly; however, it is important to also observe the swift descent that followed. Hence accurate timing of an exit from silver is imperative if the goal is to capitalise for investment purposes. Study the graph below to appreciate how important this is.

Conclusion

Experienced silver bulls understand that the gold to silver ratio will be integral in timing an exit. The gold to silver ratio for last century averaged between 50 and 60. This century it has averaged around 80. The highest it rose during the real estate bubble that preceded the GFC was 104. This April saw a ratio of 106. After the GFC stock market crash in 2011 it dropped down to 31.6 before it started moving back up. The gold to silver ratio is inversely related to the price of silver meaning the higher the price of silver compared to gold, the lower the ratio drops. If these historical cyclic patterns hold and the ratio drops to the same level again it could possibly signal the top of the market for silver. If you have invested in silver, it is imperative to develop an exit strategy in advance to avoid emotional and reactive snap decisions when the tide turns for the grey metal. The gains to be made in silver compared to gold can outweigh the risk for the vigilant investor. As long as you are prepared, keep accruing while it remains discounted.