What Does London and Fort Knox Tell Us About Gold Prices?

by Evie SoemardiTariffs, trade wars and geopolitical turmoil seem to be mentioned in every conversation regarding gold. More recently rumours swirl around whether both London and Fort Knox actually have the gold holdings they claim. With gold trading at $4,586, silver $51.65, and platinum at $1515, one wonders how all these pieces fit together in the future and what it means for the price of gold.

In order to make sense of London and Fort Knox, it’s essential to first frame it by considering gold repatriation by country. After World War 2, the US Dollar held the highest confidence globally and was hence pegged to gold. Storing a country’s gold assets in places more stable such as the United States was a sensible wealth preservation strategy. Today the financial landscape is very different. While the US Dollar is still strong it is no longer pegged to gold, has been subject to quantitative easing, and also weaponised against other countries. For various reasons, financial and political, not all countries in the world have viewed America as a safe haven for gold storage.

Since the 2008 Global Financial Crisis, reserve banks around the world have not only invested heavily in the precious metals but have also repatriated much of their gold holdings back to their homelands. Below is a table showing how extensive these moves have been detailing nineteen countries and their holdings.

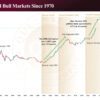

Note that these nineteen countries repatriated at least a portion if not all of their gold holdings by 2019. What happened in 2019? On the 29th of March, 2019, gold became a Tier One Capital Asset. What happened next was a significant bull run wherein gold went from AU $1819 to $2291, signifying a 25.9% increase in value.

Fast forward now to 2022 (the point when the West sanctioned Russia for their Special Military operation in Ukraine), and we see a similar pattern forming. In addition to the usual suspects, we also have emerging economies joining the fray such as Nigeria, Hungary, Serbia, and of course Poland who lead the charge in buying and repatriating their gold stores. Do these central banks know something the public does not? Are they once again positioning themselves for another massive gold rally as they did in 2019? It remains to be seen. But what does this have to do with London, Fort Knox and their ability to supply the gold they say they have stored in their vaults?

Thanks to the tariff and trade war narratives, America has drained London of gold and went from being a net exporter to a net importer. Said another way, America has received 12.5 million ounces of gold and 40 million ounces of silver since November, while delivery times in London have gone from Trading plus one day to Trading plus eight to twelve weeks. Concurrently JP Morgan has confirmed they are delivering US $4 billion worth of gold to New York for an unspecified client. Now Elon Musk has tweeted that he wants to personally conduct an audit of the gold at Fort Knox. All of these events are historic and unprecedented. Fort Knox is said to hold 147.3 million ounces of gold. Is it possible they needed a little top up before the audit?

So what happens if the gold at Fort Knox is audited? If it is not there, it will likely cause a run on gold and then silver, and the value of both metals should significantly increase while paper derivative contracts for both should become worthless or near so. If it is there, one possible scenario could bode very well for gold. United States Secretary of the Treasury, Scott Bessent (who’s largest position is gold), is on record as saying in the Oval Office that they would “monetise the asset side of the US balance sheet” within the next twelve months as part of the Executive Order for Sovereign Wealth Fund.

A number of analysts suggest that could mean revaluing gold to market value. The implications would be far reaching. Using US $2900 as a case study, a revaluation of the Federal Reserve Bank’s gold holdings would swell to $756 billion. It could also weaken the Greenback, an outcome Trump would welcome if he is to push tariffs seriously. It could increase volatility in the markets while investors adjust expectations to match the new valuation. And it could inspire a serious upward trend in spot price.

So at this point we come full circle and uncover a potential reason as to why so many central banks are not just buying gold (and even silver) over the counter and by other less transparent means, but also repatriating the metals to their homelands. If this scenario were to eventuate, the conservative gold bulls could afford to be a little smug as they remind their inner circle that, “If you don’t hold it, you don’t own it.” No matter how you slice and dice the outcome of a Fort Knox audit, gold and silver are almost assured to come out on top as will those who hold their own.