Trump’s Liberation Day Executive Order Spells Volatility for Precious Metals

by Evie SoemardiPresident Trump has finally revealed his latest Executive Order branded as part of his “Make America Wealthy Again” campaign. Chart in hand, he spoke in the White House Rose Garden of a baseline 10% tariff plus any additional reciprocal tariffs applicable to multiple countries. Both gold and silver whipsawed up and down as he spoke, with both up about half a percent by the end of the speech. With gold trading at $4927, silver at $50.71, and platinum at $1512, the last twenty-four hours has seen volatility in each market.

Tariff turmoil

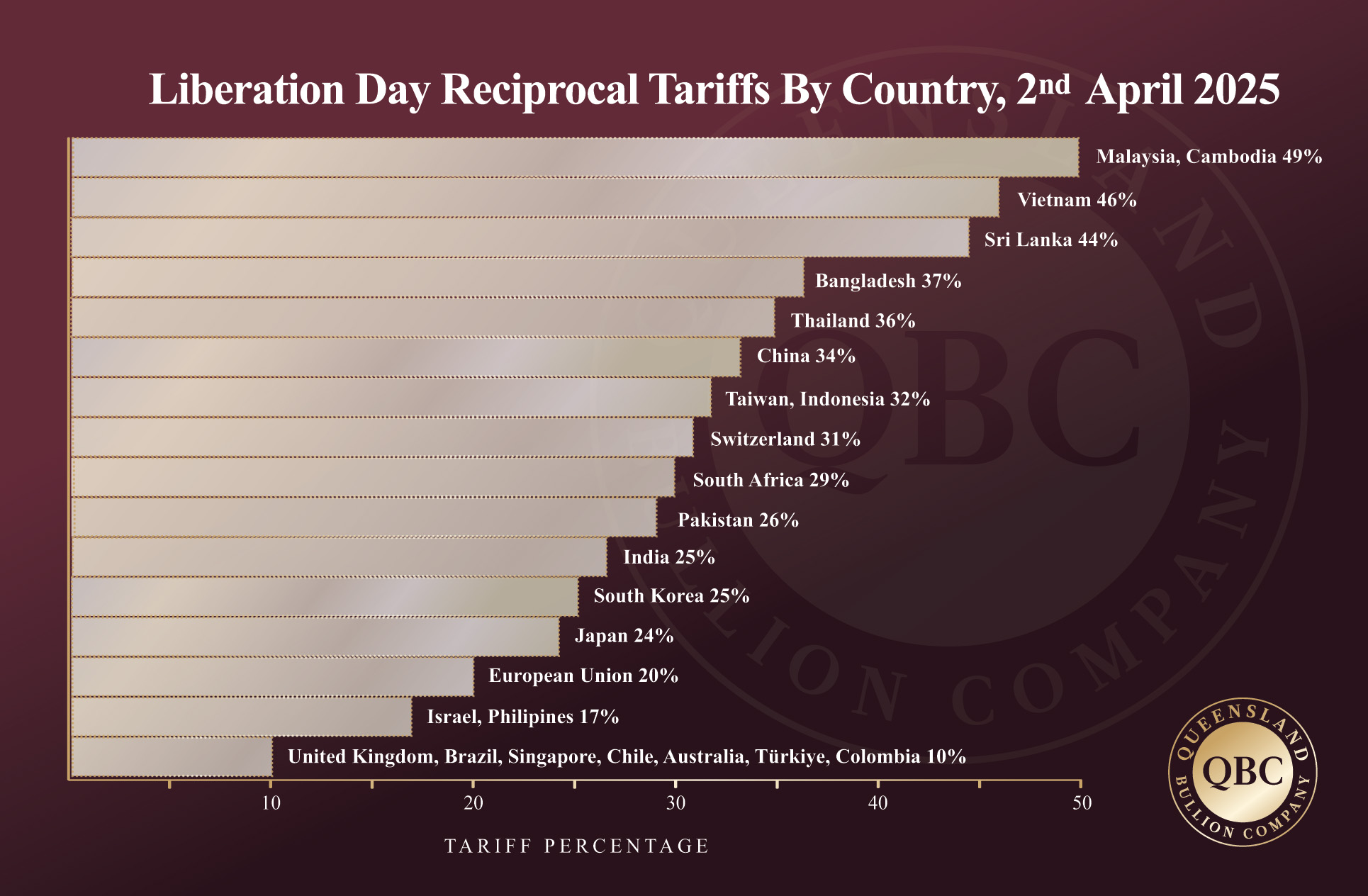

President Trump did not stop at an additional 10% tariff on every nation in his bid to make America wealthy again. He also announced reciprocal tariffs that would be imposed in addition to current tariffs that are in place. For example, China already has a 20% tariff imposed on its exports to the United States. They now have an additional 34% of reciprocal tariffs assigned to them making the total rate a massive 54%. Below is a table outlining reciprocal tariffs for countries of interest.

Keep in mind that tariffs will also affect the competitive edge for certain items exported to America. In the instance of Australian wine, the price just increased by 10% for American consumers; however, the price of European wine has increased by 20%. So while demand may soften in American markets due to higher prices in general, certain products could maintain a competitive edge according to country of origin and the associated tariffs.

Financial fallout

The financial fallout concerning the tariffs will play out over months. Expect retaliatory tariffs, supply lines to be disrupted and redirected, and a softening in consumer demand to eventuate in response to the “Liberation Day” trade policies. What is evident now, though, is that it will affect central bank decision making regarding interest rates. Local analysts are certain that the Reserve Bank of Australia (RBA) will now facilitate up to four rate cuts this year in total (as opposed to two or three prior to Trump’s new executive order). Indeed the RBA governor, Michele Bullock, has confirmed the board is open to rate cuts as a response to the consequences of tariffs if needed. Similarly, traders also expect the US Federal Reserve to make three quarter-point reductions by October. This is significant because of what it implies regarding recession. We have covered this topic in a previous article but to recap, successive rate cutting cycles are often seen as an indicator of a recession to come. Indeed some analysts have indicated that the likelihood this year is as high as 50% according to institutional banks including Goldman Sachs, JP Morgan and Deutsche Bank, and betting agents alike.

The implications for gold and silver in Australian markets

This kind of financial turmoil is always good for safe haven assets such as the US dollar, gold and silver. For as long as the tariffs are implemented the slowdown in consumer spending world-wide is an obvious outcome while the market adjusts. A slowdown in China could possibly mean a reduction in the Australian dollar (known as the Commodities Currency). As the AUD devalues the price of gold and silver increases in the Australian market. When you combine the impact of a potentially weaker local currency with the global market conditions of financial uncertainty, the likelihood of geopolitical conflict somewhere in the world (take your pick), multiple asset bubbles, and the various debt burdens among institutional bodies and consumers alike, it paints a picture of troubling times and stormy clouds. The only lining to these clouds is in the form of gold and silver. Protection of assets and wealth, no matter how large or small, requires preparation. Those holding gold and silver will outperform during these times.