Trump Win Sees Softer Gold and Silver Prices

by Melanie YoungVolatility was prominent as the world’s largest superpower headed to the polls to decide their future President on Tuesday with it continuing over the past two days. During the election gold traded between $4,042.00 and $4,232.9a, an increase 4.7%, and is at $4,051.75 at the time of writing. Not to be outdone, silver took a hit in the same range of 4.5%, currently trading at $48.34. It seems the betting agencies had a better finger on the pulse than mainstream media, with the outcome of the election dictating a major shift in foreign policy in an already tumultuous geopolitical arena. All this has a direct effect on precious metals so let us unpack the knowns and the unknown in the context of a confirmed Trump presidency.

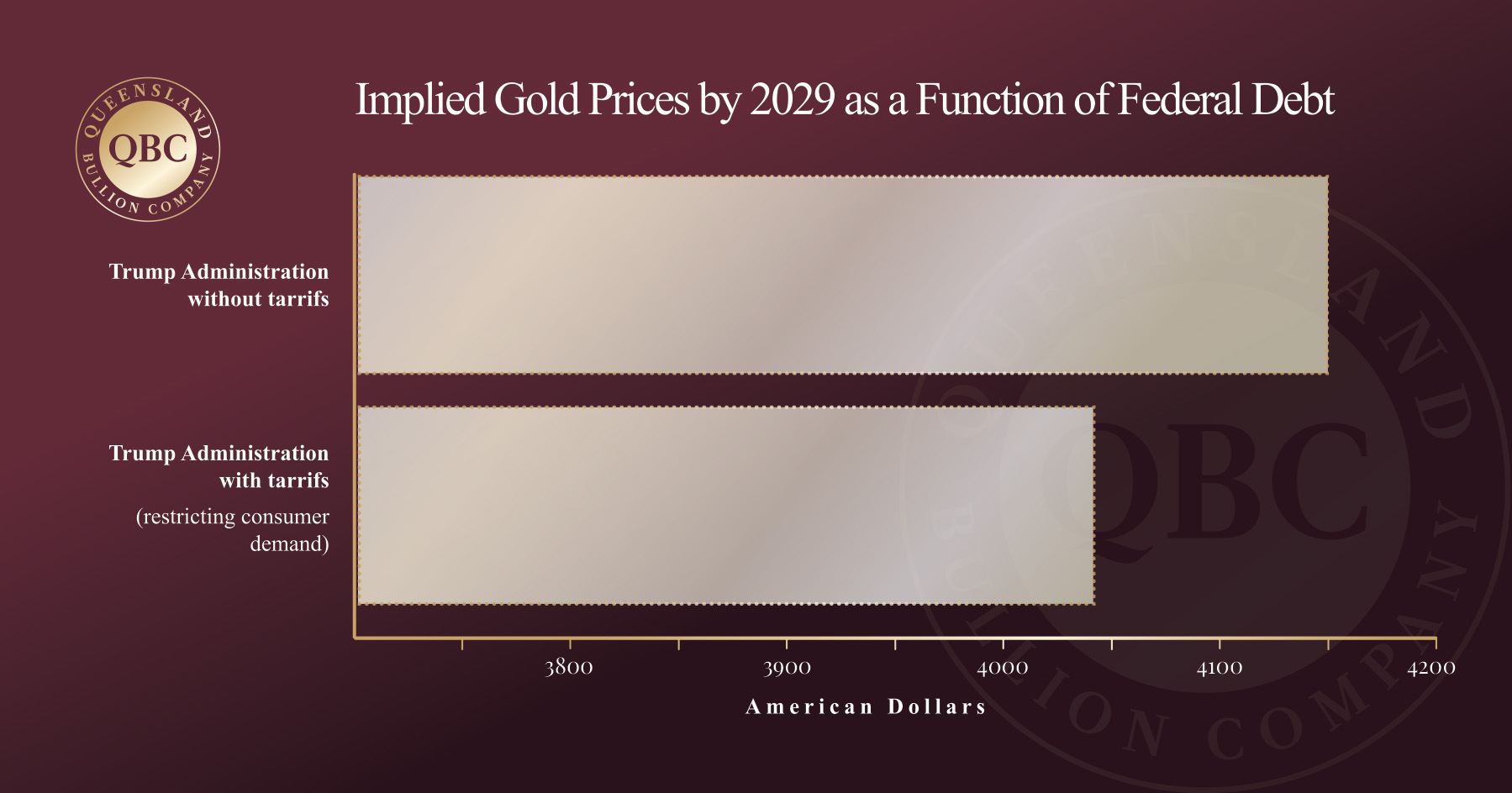

Ultimately the fundamentals for the US economy and precious metals are still the same. The National Debt Ceiling will still need to be lifted above $36 trillion, budget and trade deficits will continue to balloon, social security obligations will remain the number one cost on US books, and paper to physical ratios in precious metals will still be obscene. For precious metals, the markets are still poised to enter into a super-cycle that will challenge the bull run of the Great Depression dating in 2029.

The overnight pull back was a combination of weakening in metal pricing paired with a strengthening USD after the news of Trump’s victory. This put significant downward pressure on the price of gold especially when priced in Australian dollars. Stop losses triggering automatic selling would have further exacerbated the situation, and a correction was not so surprising given the rate of gold’s recent and rather speedy rise. Moreover it indicates that investors clearly have more confidence in a Trump administration’s ability to manage America’s economy. Evidently, investors using gold and silver to hedge against inflation and uncertainty will move back into more high-risk and high-yield asset classes now that a Harris administration has been ruled out. Whether Trump can control inflation is yet to be seen.

Below is a graph of anticipated gold prices at the end of Trump’s second term based on federal debt levels.

As mentioned, foreign policy is what will pose the biggest catalyst for precious metals. Trump came out with fighting words during his campaign which included 100% tariffs on countries dumping the Petro-dollar and showing strong support for Israel in their aggressive campaign in the Middle East. Indeed this is reflected in how the news has been received internationally, with Netanyahu one of the first to congratulate Trump while Putin refuses to do so directly. One does wonder at this point how much of the strong man’s words is pure bluff. Some analysts believe that much of it is actually more representative of a big stick, a negotiating tool he can pull out of his pocket if and when he needs. All this adds to more uncertainty. Trump does not dictate whether world conflict escalates but he can influence it.

Moving forward, it remains to be seen how the world’s largest superpower will exert its influence. One thing is for certain, though, and that is the current pull back in gold and silver makes a perfect discounted buying opportunity before they start their projected accent again.