The Gold Market, the US Presidential Election, and a BRICS Precious Metals Trading Platform

by Melanie YoungAs gold continues its upward trend in Australia it is easy to lose sight of all the factors that affect the precious metals market. With gold coming off its all time high at the time of writing, trading at $4,105.50, silver trading at $51.45, and platinum at $1,574.82, it is still currently the super star in the bullion world. The price of gold in Australia continues to be buoyed by a strong American Dollar (read more about this HERE), yet in the States and abroad there is an undercurrent of uncertainty shadowing gold’s climb to new heights.

While an increase in purchases from retail investors is noticeable, it is interesting that despite all-time highs there is a lack of evidence of substantial inflows heading into gold. This is said to be largely due to anxiety related to the upcoming US presidential election. So what justifies this anxiety? The answer is simply, volatility. While official ABC News polls put Kamala Harris more likely to win with 48% of the vote (versus Donald Trump at 46%), blockchain-based election betting site, Polymarket, says a red wave is coming with Trump given a 60% chance of winning by punters on the ground. The political uncertainty caused by the election and the inevitable financial consequences is a reasonable cause for pause by those with serious skin in the game. However it is possible that regardless of who wins, domestic politics will likely dictate expansionary fiscal policy which may deepen the US deficit and rekindle inflation – all of which is good for gold.

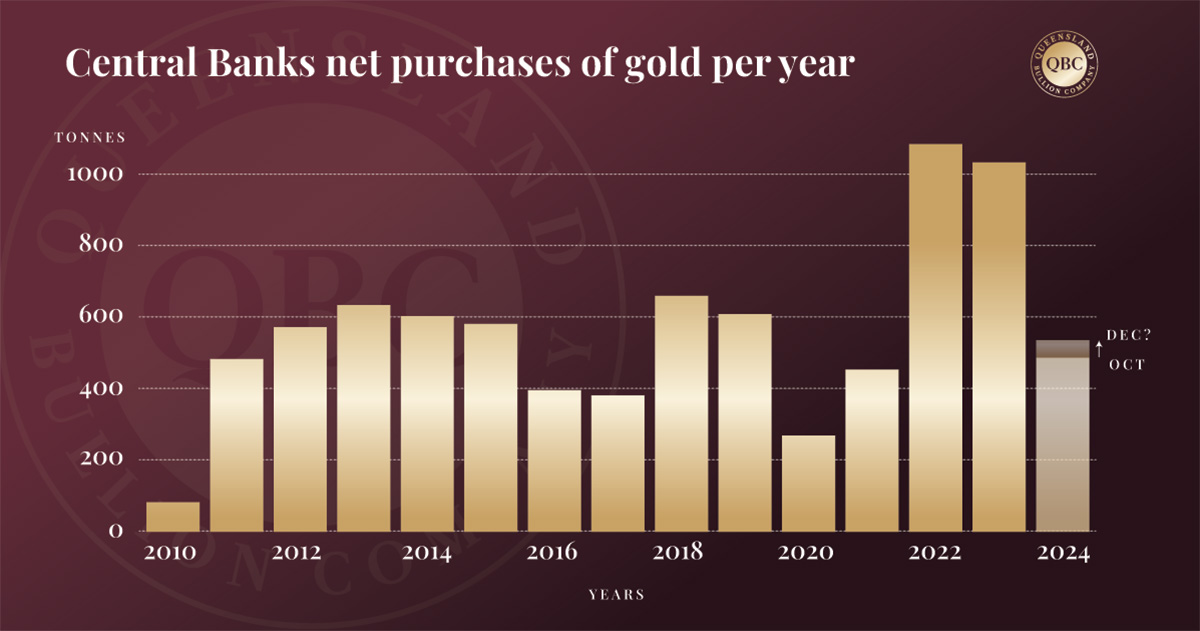

This pattern is playing out internationally as well. Central banks generally support encumbered governments (in this case, the Democrats), but on a global scale central bank net purchases for gold is forecast to be about half the amount compared to 2022. Yes, it makes sense that, combined, central banks purchased over 1000 tonnes of gold in 2022 and again in 2023 when gold was cheaper, but comparative to where gold prices are expected to go during the coming anticipated bull market, gold is still heavily discounted; however, those reading our articles regularly will know it’s not so simple as considering just gold. Read about how over the counter silver purchases change the overall landscape HERE. So what has paused central bank buying?

Like investors, nations are paying close attention to what policy will triumph as the world’s largest superpower heads to the polling booths. And when contrasted with the business of BRICS expansion, one wonders how any American government can manage the mismatch of domestic and international fiscal needs. As the front-runner, Trump has executed a hard-line campaign based on 100% tariffs on imports for all countries who move away from the waning Petro Dollar. Concurrently, Putin has welcomed another 14 members into BRICS, including Turkey (a NATO member since 1952) and most recently Iran. It is one thing to push a global decentralised finance system, but what would happen if BRICS were to formalise as a military block to challenge NATO, and what would this military alliance mean for precious metals? Does the inclusion of Iran in BRICS signal we are one step closer to World War III?

One thing that is historically proven is that conflict results in a steady rise in precious metal prices. What will also push metals further is the BRICS nations intention to start their own members only Precious Metals Exchange. Russia cites price indicators, standardisation of trade, accreditation, clearing and auditing purposes to justify the initiative, but clearly this is also part of a continued de-dollarisation effort. Experts suggest that as the BRICS anti-West agenda unfolds on the world stage it will potentially hasten a financial re-set wherein precious metals will be front and centre on the upward trend, enjoying a certain level of protection from downward pressure as Western nations use it to essentially hedge against financial ruin.

Moving forward, when considering all-time high gold prices, it is important to understand the risks. While the US election and growing geopolitical tensions both introduce uncertainty and therefore potential volatility to the markets, ultimately large investors and central banks cannot sit on the sidelines forever. When they decide to join retail investors in purchasing gold in a significant way, it is possible that a bank of suppressed buying could finally flood the markets.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Queensland Bullion Company Pty Ltd or any other associated entities. The author has made every effort to ensure accuracy of information provided; however, neither Queensland Bullion Company Pty Ltd nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Queensland Bullion Company Pty Ltd and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.