The Fed is boxed in while gold and silver look ready to fly.

by Evie SoemardiOvernight gold and silver have experienced a spike in prices worthy of note. With gold trading at $4,751, silver at $54.01, and platinum at $1,617, volatility seems to be the top concern in the precious metals markets and global economies in general. While main stream media will emphasis that US President Donald Trump inherited high employment rates, strong GDP growth, low inflation and a soaring stock market, they are quick to dismiss the fact that the Federal Reserve is in a bind with no obvious or effective way to remedy. Importantly, this bind is one that has been long in the making, independent of which government has held power.

Since the Covid 19 Pandemic America’s monetary base (currency in circulation) is up 60 percent, M2 money supply is up 36 percent in the past four years (cash, checking and savings deposits, etc), and the inflation surge in the same period is cumulatively about 22 percent. What this means is that too much money has been injected into the American economy since the 2008 Global Financial Crisis (GFC) which has never been addressed. Adding more money in the system can contribute to rising prices via inflation. This monetary expansion is now at breaking point and the Federal Reserve has few moves to try and resolve what can no longer be avoided.

Cutting interest rates

When the Fed cuts interest rates it lowers borrowing costs to stimulate the economy. This is because cutting rates incentivises borrowing via access to easy credit lines. Consequently institutional investors have not been able to adjust to higher interest rates since the GFC when interest rates were close to zero for ten years straight, and then again for a few years during the Pandemic. By last year, rates eventually rose to 5.5%. Because institutional investors are addicted to this easy money, if the Fed does not cut rates it risks an economic slowdown and stock market volatility. This is why there is a call for a rate cut, regardless of whether it is actually justified. And while the act of cutting rates is not generally inflationary, it can create inflationary measures which manifest as asset bubbles such as in the real estate, stock, or collectables (eg, art) markets. Such bubbles tend to burst and this in turn could lead to recession.

Balance sheet manipulation and inflation

While the Fed could be simultaneously cutting rates to stimulate the economy as well as reducing inflation by removing some of the cash in circulation, it is increasingly shy to do so. And this is where the Fed’s true resolutions become evident. It has given in to inflation. To hide this fact the media directs all attention onto the Fed’s rate cutting decisions at each meeting. In contrast the balance sheet rarely gets a mention; however, it is the state of the assets and liabilities on the balance sheet that dictate how effective rate increases or decreases actually are. If inflation is not controlled, other instruments can become skewed and somewhat meaningless.

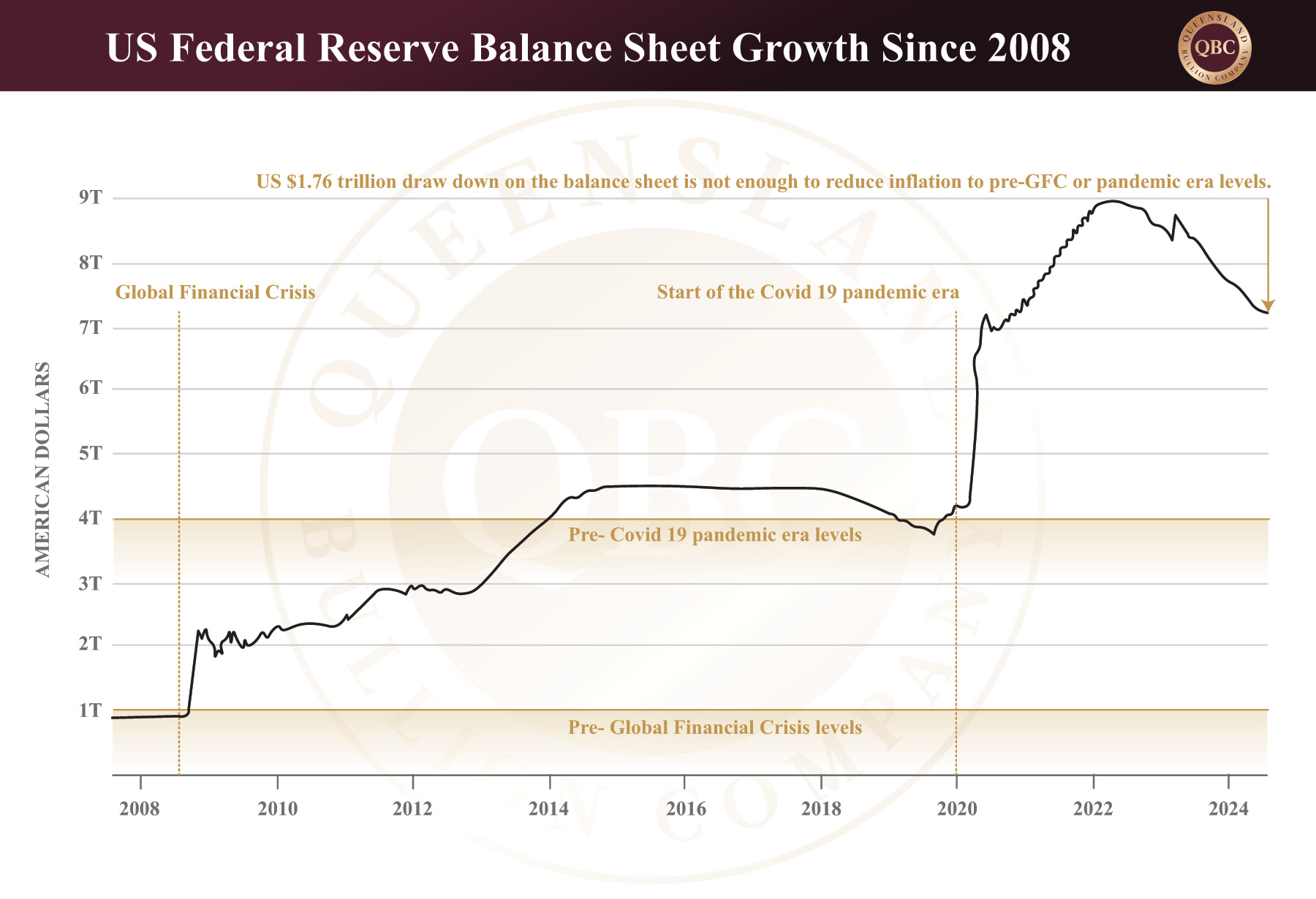

In principal the balance sheet is a list of every asset and liability the Federal Reserve holds. During periods of quantitative easing, the Fed uses easy money to purchase assets (e.g. Treasury bonds) and therefore inject capital into the market to stimulate the economy. The result is that for each asset purchased the liabilities grow to equal proportion. This growing balance is reflective of more money circulating in the economy. Hence, quantitative easing is inflationary by definition. To put this in perspective, before the GFC the Federal Reserve held assets equivalent to just over US $900 billion. Just prior to the pandemic era it had ballooned to just under UD $4 trillion. After the pandemic era, an additional US $5 trillion was introduced putting the balance sheet at US $9 trillion. Said differently, the Fed effectively circulated an additional US $8 trillion in the economy in fourteen years in an attempt to keep it from collapsing. This is the ultimate epitome of inflation.

The most effective way to reduce inflation is to decrease the balance sheet by taking money out of the market. Reducing inflation is the most appropriate way to lower the cost of living for taxpayers. So in 2022 the Fed started doing just this. It tightened the balance sheet to the tune of US $1.76 trillion, nowhere near enough to erase the US $5 trillion they injected over Covid. Below is a graph that tracks the total growth of the Federal Reserve balance sheet since the GFC:

As is evidenced in the above graph the recent tightening is far from enough to getting back to pre-pandemic era levels. While we progressively slide into another recession, there has been little effort to erase the quantitative easing that occurred during the pandemic era let alone the GFC. By reducing the speed at which it shrinks its balance sheet the Fed is effectively leaving far too much liquidity in the market. This flies in the face of any attempt to reduce inflation. But if the Fed tightens the balance sheet too fast, and hence pulls too much liquidity out of the system, it may exacerbate financial instability and could spark a severe correction. The takeaway is that there is so much liquidity in the economy now trying to reduce it without affecting the market is a near impossibility. So inflation is going nowhere fast. The trouble is that if the balance sheet remains high or increases, at some point the market will lose confidence in the Fed being able to meet its debt obligations. Again, this could lead to market volatility and recession.

In summary, the Fed is now in a no-win situation. It cannot effectively fight inflation without triggering an economic collapse. Volatility is likely to be a key feature this year and investors should ready themselves to buy the dip before gold moves higher in response to renewed inflation concerns. By this stage we all know what this means for gold and silver. As the preferred instrument to hedge against inflation, economic volatility, and recession, precious metals will be once again tested and be proven out to be real money as it has been for over 5000 years.