Stocks, Real Estate, and Precious Metals

by Evie SoemardiEven though gold has dipped over the last couple of days, it has continued trading sideways for much of the month and decreased by only $10 from February 10th. This consolidation period is not uncalled for and allows gold to build a more solid foundation for moving forward. With gold currently trading at $4,625, silver at $50.54, and platinum at $1,530, it could be an opportune time to step back and view two of the fundamentals that support the expected precious metals super cycle that has, essentially, already started. This article explores the relationship between precious metals and the two main bubbles that are about to burst: stocks and housing.

Stock Market

Leading up to the year 2000 a massive stock market frenzy occurred based on internet-related companies, now referred to as the dot-com bubble. At the time the psychology was that the newly installed internet was the way of the future and investing in related stocks was a sure bet. The result was significant over-valuation of said stocks, where they increased in value much faster than the rate of monetary expansion at the time. When assets outpace the organic monetary expansion within an economy, the inevitable result is a correction. Today we are experiencing the same phenomena in relation to tech stocks, this time related to social media, smart phones, apps, cloud computing, e-commerce, electric cars, and more recently, artificial intelligence, hence the rise of the Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla). The difference is this bubble is comparatively much bigger than the dot-com bubble. And while tech stocks are a bubble in themselves, the stock market in general also hugely overvalued to the tune of 208%. Read more about this in our previous article.

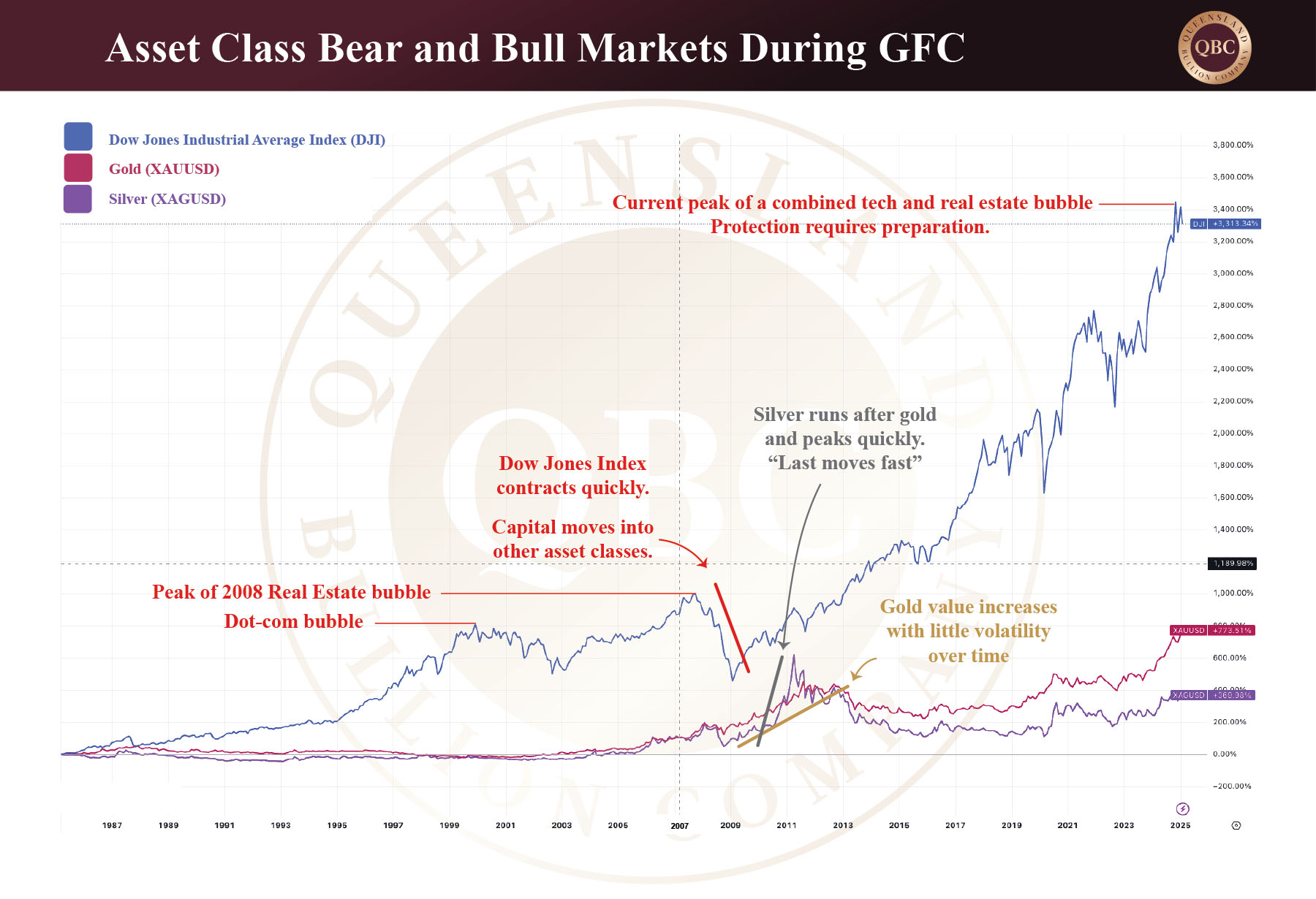

What happens to gold and silver when the stock market is overextended? After the dot-com bubble peaked in 2000, it unravelled into a devastating bear market much to the dismay of the investors involved. The below graph is based on the Dow Jones Industrial Average Index (which is a broader indicator of the stock market than the NASDAQ). It illustrates not just how quickly the bear market started and ended, but also how gold and silver started a bull run shortly afterward as money was redistributed into everyone’s favourite safe haven assets. From the bottom of the stock bear market to the next peak in gold, it rose about 151% in value in the American market. Similarly, silver rose 387%. It made more gains and also fell faster than gold, which speaks to one of the fundamental differences between the two metals.

Real Estate Market

The average real estate retail investor would interpret the current market by its extreme unaffordability in the present moment. Locally, based on a median income household earning of $112,000 those looking to purchase a property can only afford 14% of what the market offers. This figure has plummeted from 43% four years ago, even with a slowdown in the market already evident. In America, 2024 housing sales have fallen to their lowest since 1995 for the second year running. Concurrently homebuilding stocks appear to have peaked and are now rolling over – all these patterns are extremely similar to pre- 2008 Global Financial Crisis conditions. Because the real estate sector generally leads the economy both into and out of recessions, the slow-down is a good indicator that we are already moving through the beginnings of a major downturn.

What does this mean for gold and silver?

What is important to remember is that stock and real estate bubbles occur independent to the price of gold and silver. Hence, precious metals do not factor into any bear markets in those sectors. However, the result is always positive. Stocks, housing and precious metals compete against each other for capital. During a bubble capital flows to the asset class experiencing a boom, in the current circumstance that would be stocks and real estate. When these asset classes crash capital is redirected to safe haven assets such as gold. Eventually, when retail investors are priced out of gold, silver becomes popular. This is why gold runs first then silver follows.

To conclude, being able to remove any hype from your assessment of the market (eg, “Bitcoin is going to US $1M”) allows you to identify the top and shift capital to another asset class before a bear market in a methodical and neutral fashion that is proactive as opposed to reactive. Liquidating stocks and real estate and shifting into precious metals at this point in the economic cycle could be a life changing event for those in a position to do so.