Silver at USD $50 by Midyear? Find Out Why

by Evie SoemardiWhile all eyes are on gold, it did not disappoint hitting an all-time American high breaking USD $2900 for over 20 minutes yesterday. A significant mile stone, it is understandable that investors can’t help but stare at the screen and the price of gold, yet there is a growing number of analysts who are looking the other way at gold’s “poor cousin,” silver. Many now anticipate that silver will outperform gold on a percentage basis in 2025. With gold currently trading at $4,551, silver at $51.53, and Platinum at $1,596 let’s examine two pieces of credible evidence behind the claim.

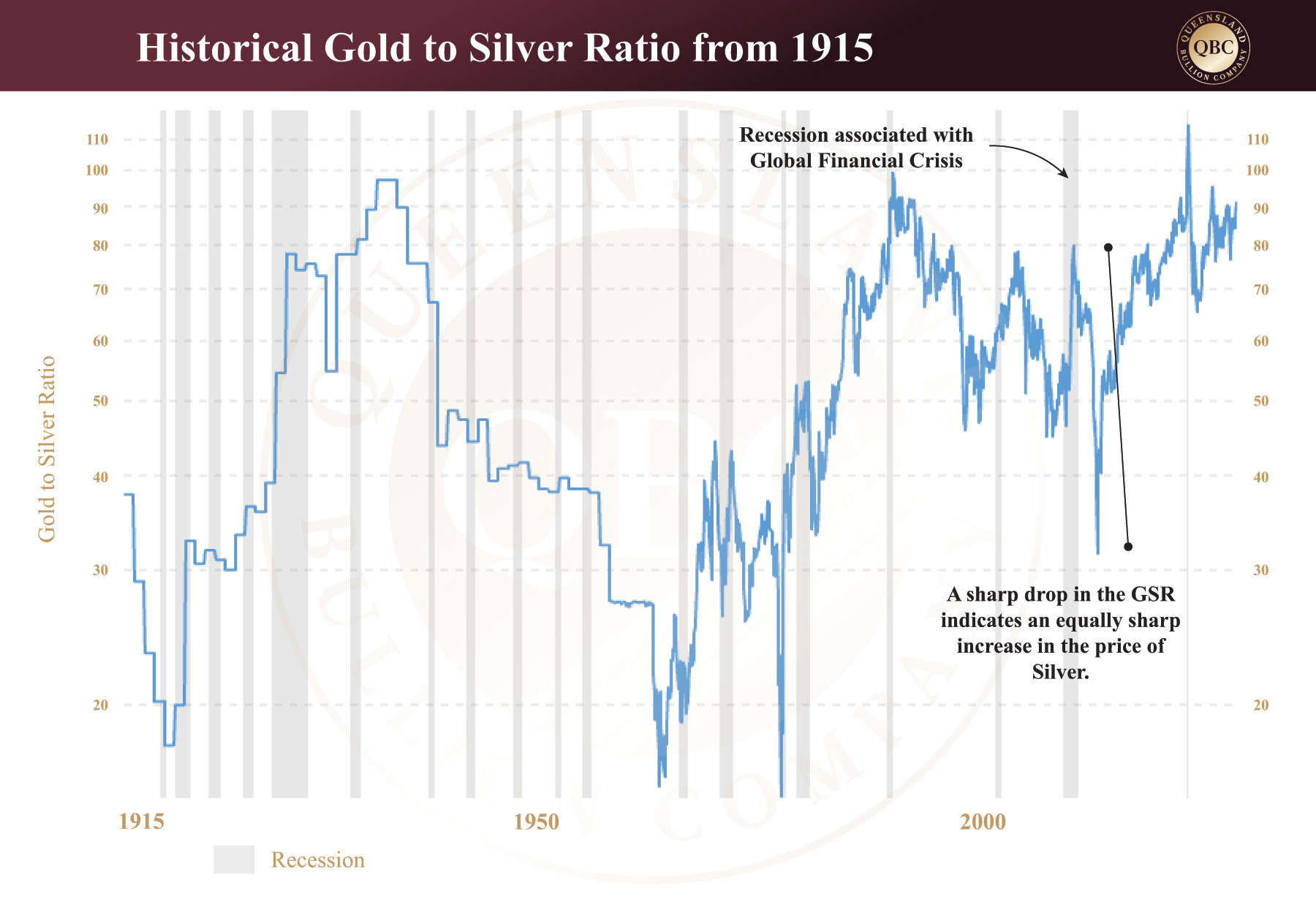

Gold to Silver Ratio

The Gold to Silver Ratio (GSR) has long been a fundamental factor that affects the price of silver. The GSR has been oscillating between 88 and 90 over the last year.

It is currently 88.78, meaning it takes 88.78 troy ounces of silver to purchase 1 ounce of gold. Miners are digging 15 ounces of silver out of the ground to 1 ounce of gold, so there is a massive disconnect between the paper markets and the physical reality on and in the ground. For the whole of the 20th century, the average gold-silver ratio was 47:1. In the 21st century, the ratio has ranged mainly between 50:1 and 70:1, breaking above that point in 2018 with a peak of 104.98:1 in 2020. So 88.78 indicates there is currently a divergence between the price of gold and silver. For the GSR to return to a more traditional ratio this divergence would need to snap back closer together, and analysts predict that this will see the price of silver slingshot upward to compliment the price of gold, as opposed to gold dropping down to match silver.

Below is a historical chart of the Gold to Silver Ratio since 1915. Note how the GSR generally increases during recessions, indicating low silver prices. Then observe how it dropped to 31.6 in April of 2011 after the Global Financial Crisis when silver prices hit all-time highs. We have already established how current market trends are mimicking the cycle just before the GFC. This is why some analysts expect the ratio to drop in the future, citing targets of 1:70 in 2025, then gradually to 1:50, and eventually 1:30 in the long term prior to it rising again. Let’s step this out to see how it translates to investment figures. If gold prices surge to USD $3000 – 3300, it would put the price of silver between USD $42 – 47 (or AUD $67 – $75 at the current exchange rate).

If you would like an analysis on gold in the Australian market for 2025, stay tuned and look out for next week’s newsletter, or read our past articles on gold.

Industrial use and silver deficits

Silver Bulls know that the grey metal enjoys a dual application of being a store of wealth with industrial use. Currently, industrial use accounts for 55% of the demand for silver. To this end silver easily overshadows gold which only has 10% of its demand allotted to industrial use. The use of silver in various industries can be read about in past articles. What concerns us here are the quantities. Overall demand for silver in 2024 was in the range of 1.21 billion ounces, the highest recorded quantity in history representing a 7% increase from the year before.

The industrial use of silver accounted for 700 million ounces in 2024. This amount is set to increase particularly because of silver being the ultimate conductor for electricity. As such, silver plays an integral role in the all manufacturing involving electronics and energy exchange. If it has an on-off switch, it likely has silver in it. As long as first-world lifestyles rely on electricity, industrial demand builds in support for the price of silver in a way that gold does not enjoy.

The final point worth raising is that there is a deficit in silver, meaning demand outstrips supply. It has for the last four years and 2025 will be no different. The Silver Institute anticipates an increase in mining production in the coming year pushing total output to a massive 844 million ounces, but compared to last year’s demand of 1.21billion ounces it pales in comparison and points to the fact that silver will become more scarce in the future based on this deficit created by increasing industrial demand.

In summary

At this point we come full circle and link increasing scarcity of silver to the decline in the Gold to Silver Ratio. Hence, the case for silver is made in 2025. While more volatile than gold, it has historically outperformed gold in the last five bull runs and has more than earned its place as a viable investment option. If you are looking to balance your investment in gold with another metal that has a potentially greater upside, consider silver. Perhaps it is not so much the “poor cousin” after all.