Five Reasons that Silver is Set to Skyrocket in the Near Future

by Melanie YoungThe silver correction in the Australian market since the beginning of November now exceeds 11%. With gold trading at $4,158.35, silver at $47.43, and platinum at $1,464.90, it is little wonder if retail investors feel a little overwhelmed momentarily; however, the prospects for precious metals for 2025 remain promising, in particular, silver. Below we outline five reasons why silver will likely increase in the coming year.

Global recession will likely be declared next year.

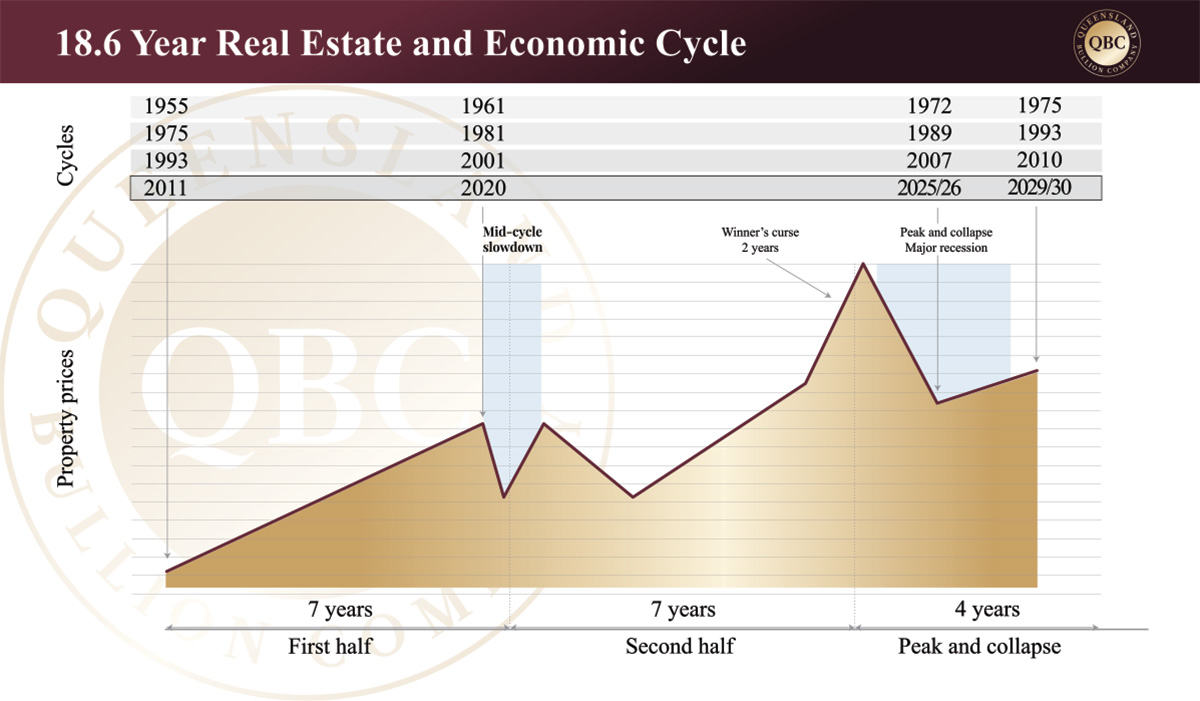

This is a big statement so what is it founded on? Based on financial cycles where recessions occur every 18.6 years, it can be argued that a recession can be expected anytime from now if one applies this formula from the 2008 Global Financial Crisis (GFC). The GFC officially occurred between December 2007 and June 2009. However, be aware that recessions take years to wind up and wind down. View a timeline on how the GFC unfolded here. As per most recessions the US government declared it retroactively in December 2008, twelve months late. This means that Western world could already be in recession now, as many economists acknowledge, even though the Australian government is still spruiking blue skies and a healthy real estate industry. Silver tends to outperform gold in the pre-recession and post-recession stages. Could the spike in silver prices this year herald a recession in 2025? The odds are likely. Although gold performed almost as well, perhaps the pre-recession spike is yet to come.

The below graph shows the 18.6 year real estate and economic cycle as it has played out since the 1950s.

Silver provides positive responses to FED and RBA interest rate cuts.

Historically silver responds well to central bank rate cuts. For the last three announcements by the Reserve Bank of Australia silver has responded with an increase between 1 and 3%. Interestingly, silver responds even better to US Federal Reserve rate announcements, averaging price increases between 3.3 and over 8% in Australian markets. The general consensus is that if rates are to move next year it will continue to decrease. Expect healthy responses from silver each time a central bank executes a rate cut.

Silver has seen physical production deficits for the fourth year running.

According to the Silver Institute, it has had slight growth in supply and (paper) demand but the global market is likely to close the year with a record physical deficit for 2024. This will be the fourth year running with both 2023 and 2024 elevated by historical standards, and with deficits likely to persist in the foreseeable future. To read about why the price of silver is suppressed despite the physical deficit read our previous article.

To this point, the Silver Institute anticipates that industrial demand is set to increase by 7%, surpassing 700 million ounces this year. The main driver is applications around the solar industry; however, two more drivers worth watching in the coming year derives from the rapid adoption of AI and storage of information because of the amount of energy both use (as well as physical demand in the form of chips and so on). For example, the amount of data used in 2025 is anticipated to be 50% more than it was this year. A simple ChatGTP search uses ten times more energy than a standard Google search. While technology giants will be looking to nuclear power as a source of energy, smaller companies will likely turn to solar energy. Further, as financial markets weaken institutions will look at how best to boost national economies, with the tech sector offering an easy answer as far as funding innovation goes.

The gold to silver ratio is unbalanced.

2024 has seen the gold to silver ratio sit at 1 ounce of gold to between 80 and 90 ounces of silver. In recent times this ratio has averaged 1:63 over the last 50 years, and 1:56 over the last 100 years. But thanks to the paper derivative market the ratio is now insanely high. When the derivative market corrects, expect this ratio to adjust at the same time.

The USD to AUD exchange rate will push silver prices higher.

Finally, as discussed in our last article, the likelihood of the USD strengthening is high. As it strengthens, and if the Australian Dollar does not, the price of silver locally will also increase.

In summary, despite the talk of war, recession and associated societal discomfort, there is a lot to look forward to in 2025 for gold and silver bulls. The super cycle may have already started, with governments yet to play catch up.