Trump Reverses Course and Assets Whipsaw

by Evie SoemardiAs American President Trump dramatically reverses course regarding his reciprocal tariffs, markets experienced volatility similar to what happened during the 2008 Global Financial Crisis (GFC). The President reduced country-specific tariffs down to a universal 10% for 90 days to facilitate negotiations and this applies to all trade partners except China. Instead, tariffs for China have further increased to a massive 125%, effective immediately, as per the Amendment to Executive Order 14257. The White House has advised that this reversal was part of a strategy implemented to encourage trading partners to enter negotiations. With gold trading locally at $5,159, silver at $50.05, and platinum at $1,494 at the time of writing, the volatility can be felt even amongst safe-haven assets such as precious metals.

Market responses:

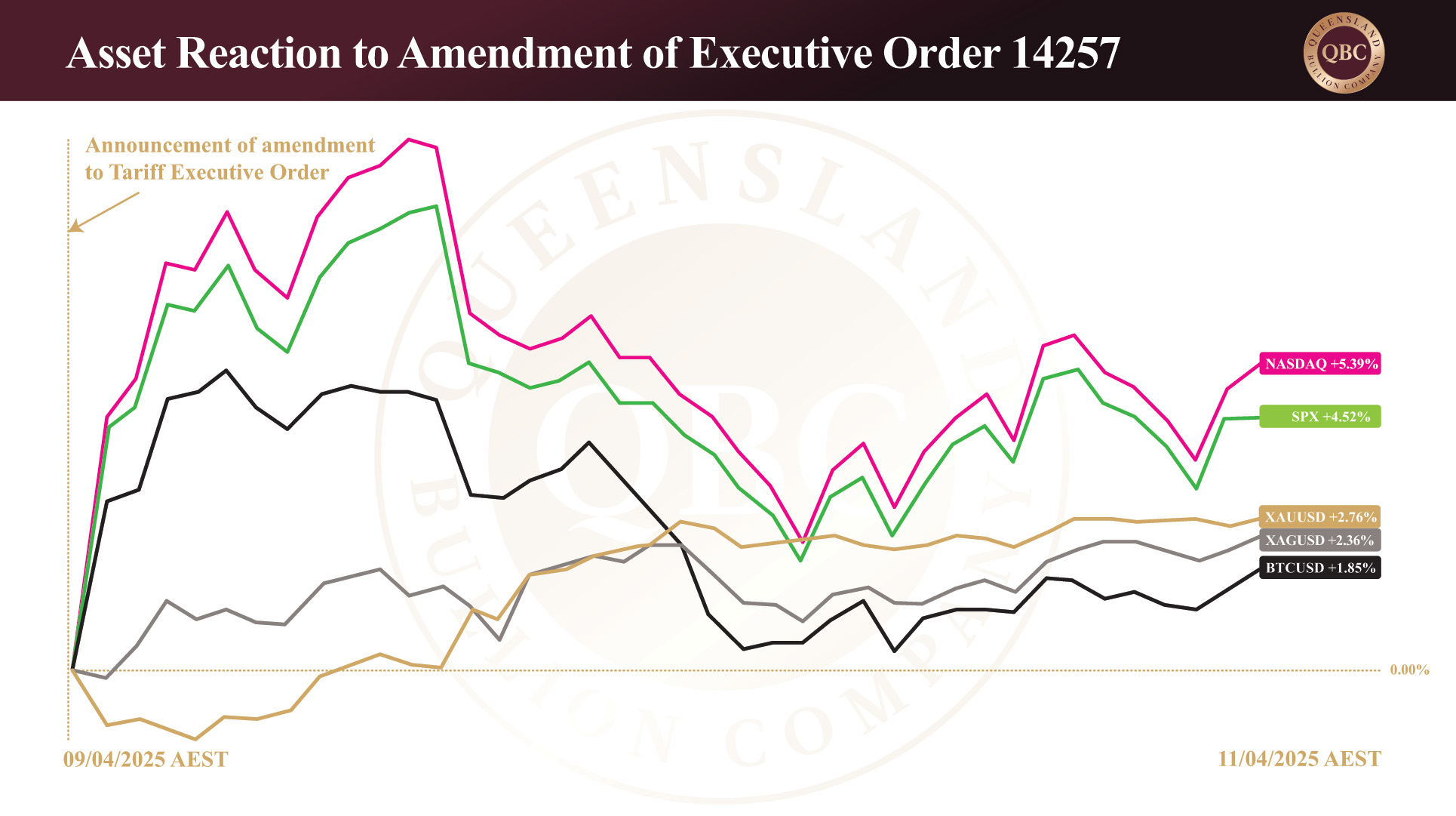

In response to the tariff changes, the American stock market has whipsawed up and down with significant volatility. As can be expected the S&P 500 (bell-weather index for largest-capitalised companies), NASDAQ 100 (largest tech stocks), and Bitcoin experienced initial gains that have subdued overnight. During this time the S&P marked its biggest one-day gain since the GFC and offers an indication of how close we are to repeating the financial cycle. Naturally gold softened as stocks rose but it still benefited from the tariff amendments. As at 9:20 this morning, the Bitcoin is the biggest winner gaining 7.19%, the S&P 500 bounced 4.52%, and the NASDAQ is up 5.39%.

Gold experienced a modest gain of 2.36%; however, it also experienced the smallest loss, thus proving itself again to be one of the least volatile asset classes in times of trouble. Silver benefited least with a 1.85% gain. Precious metals fared worse in Australian markets finishing down 0.39% for gold and 1.81% for silver.

Below is a graph representing these gains.

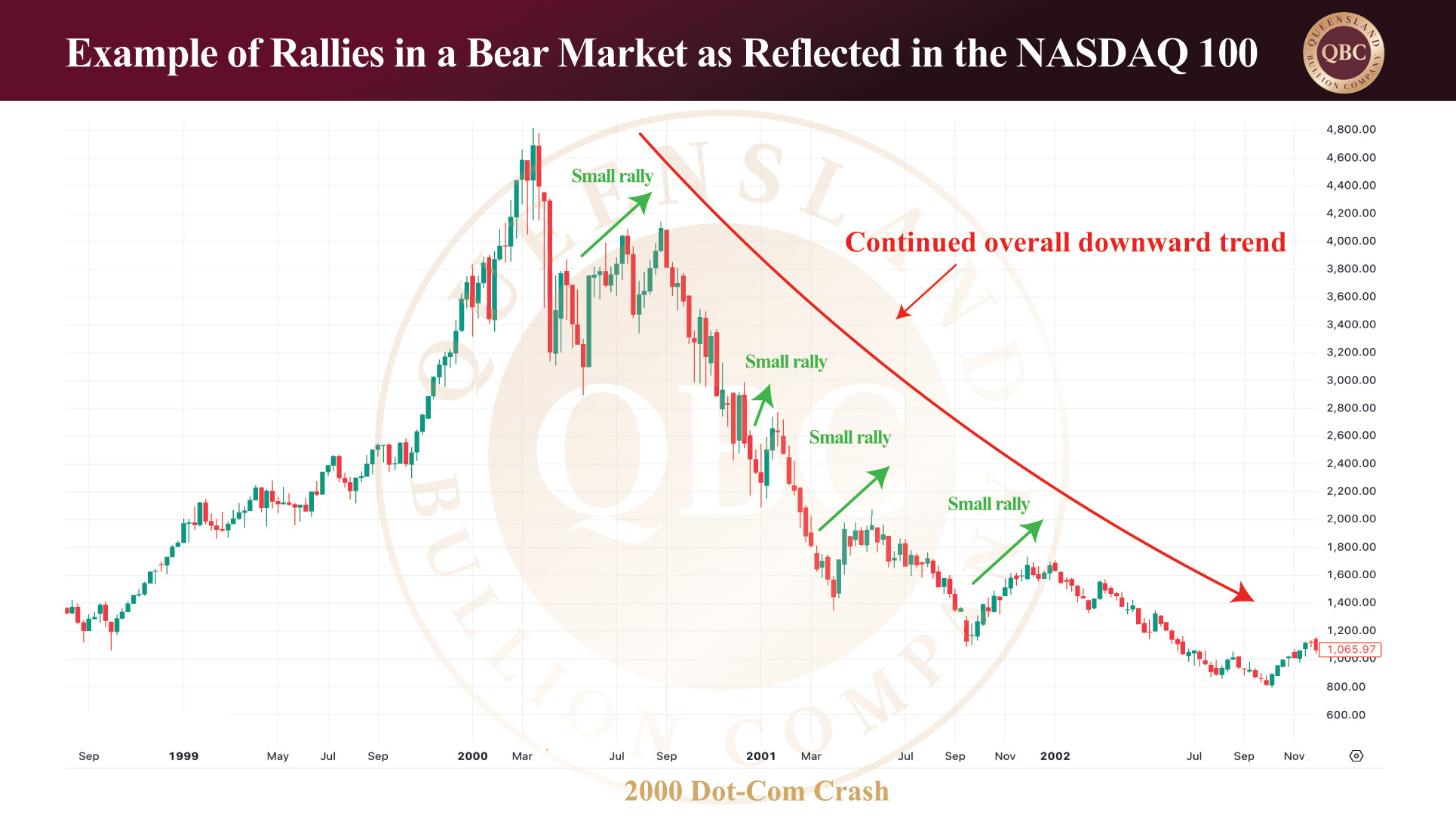

Keep in mind that short-lived and sometimes steep recoveries accompany every bear market that often fool retail investors into believing that the worst is over. This can be referred to as a “dead cat bounce” amongst traders. This is exactly what happened with the announcement of the tariff amendments- markets went up and have come down in a matter of days. This is also evident in the GFC, the 2000 to 2001 dot-com bust and in every crash in history. As such it is a fundamental mechanism of the market and those investing during a bear market need to be aware of it to avoid investment decisions based on heightened emotional reactions. We recommend to always keep in mind the long-term trends and individual goals when considering how to invest in any market. Below is an example of how the NASDAQ experienced small rallies during the dot-com crash while it continued to wipe out all gains. Each time there was a rally, investors breathed a sigh of relief only to be punished again. It pays to follow long term trends.

Bitcoin in trouble?

Regarding Bitcoin, MicroStrategy Executive Chairman, Michael Saylor, has flagged that the company may need to sell Bitcoin amid extreme predictions of the value crashing to USD $10,000. The company anticipates a USD $6 billion loss for the first quarter alone. With vast wealth held in Bitcoin and a business model that relies on accruing more at ever higher prices, Saylor said that selling Bitcoin was an option being considered should the company fail to secure funding to cover debt obligations. As the largest publicly traded corporate holder of Bitcoin, a significant sell-off could spark panic in the market or copy-cat selling from other investors. It could potentially affect the price and start a downward trend that may be hard to recover from. In Australian markets the value of Bitcoin mimicked its American counterpart, finishing slightly worse off at 0.26% to the downside since the amended tariffs were announced.

Summary

2025 is shaping up to be as volatile as any trader can imagine. Regardless, gold has still made gains over 20% in Australian markets, year to date, and hit another all-time high today. And despite losing traction in April, silver is still up over 7% in the same time. Moving forward expect the uncertainty to continue. President Trump can affect the markets with a single comment which is exactly what he wants. His moves are calculated yet erratic and markets respond not just to his policy, but also to rumours of policy. As safe haven assets, gold and silver are the obvious investments in turbulent times and stand to benefit the most. Protection requires preparation.