Gold Up More Than $100 Over Tariff Turmoil… Is it Justified

by Evie SoemardiGold prices soared this week to a new all-time high in Australian markets, increasing by over $100. While last week’s article celebrated a breakthrough over $4400, this week sees gold currently trading at $4,505.92, silver at $50.95, and platinum at $1,673.93. These prices are bucking the downward trend that traditionally happens at the end of each month, so what is responsible for the unusual reaction in the markets? Trump’s threat of 25% tariffs for Canada and Mexico with a deadline of Saturday seems to be enough to put the market into a spin, but is it justified?

The fear that the wide-ranging tariffs on imports could include precious metals is playing out in the market and reflected in the spike in prices. Regardless of whether tariffs are actually applied to precious metals, traders have been preparing by moving as much stock onto American soil as possible prior to any potential implementation. While it usually only takes a few days to move bullion held at Bank of England (the UK’s central bank), the wait time has blown out to six to eight weeks. Since the US election provided a solid win in favour of President Trump, gold traders have moved 12.2 million troy ounces into the Comex commodity exchange in New York, which now has the highest holdings since August of 2022.

Gold is not the only precious metal to get caught up in the hype of the moment, with silver also experiencing a massive trans-Atlantic shift towards New York. To quote Bank of America, “There has been apprehension that liquidity on London’s physical market has fallen as traders have shipped silver to the US in anticipation of trade [tariff] restrictions, a dynamic worth following.”

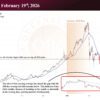

The below graph shows gold and silver prices in the Australian market over the last four days.

But has the market taken the time to logically step through the implications of placing tariffs on precious metals and assess the likelihood of The US Government actually following through? It is well established that the current American President has a tendency to not only keep the world guessing, but also negotiate hard and then pull back. If a US tariff strategy was developed that included precious metals, the reality would be that the market would be left scrambling to source non-tariffed metals to complete current non-tariffed orders (filling like for like). No amount of preparation would solve this market problem given the shorting positions on gold and silver. Eventually it would effectively push money out of the United States and into other markets. This type of behaviour is not in line with what Trump has outlined for his legacy. Does incentivising traders to hold gold and silver in New York instead of London complement his intentions? Clearly Trump would not discourage this. But pushing money outside America is also not on his radar.

So while the threat of tariffs, in addition to currency exchange, pushes the price of gold and silver up in Australia, local investors can thank Trump for the momentary boost. It is incumbent upon us to remember that many factors, tariffs included, point to toward a volatile but profitable year in precious metals. Remaining emotionally neutral to the everyday politics of the market will serve us well in 2025.