Are We Already in Recession? How High Can Gold Go?

by Evie SoemardiGold reached an all-time high this on Wednesday this week in local markets topping out at $4,401 thanks to a strong US dollar. With gold currently trading at $4,383.25, silver at $48.84, and platinum at $1,554.50, gold has once again taken centre stage with a robust start to the year. Some analysts suggest gold prices could be as high as USD $3,380 by the year’s end, while others forecast a little lower. Last week we touched on a number of factors that will influence the value of precious metals. Now let’s revisit the most influential fundamental that will push the value of gold higher this year: recession. How have we found ourselves in this position… again?

Federal Reserve rate-cutting cycles

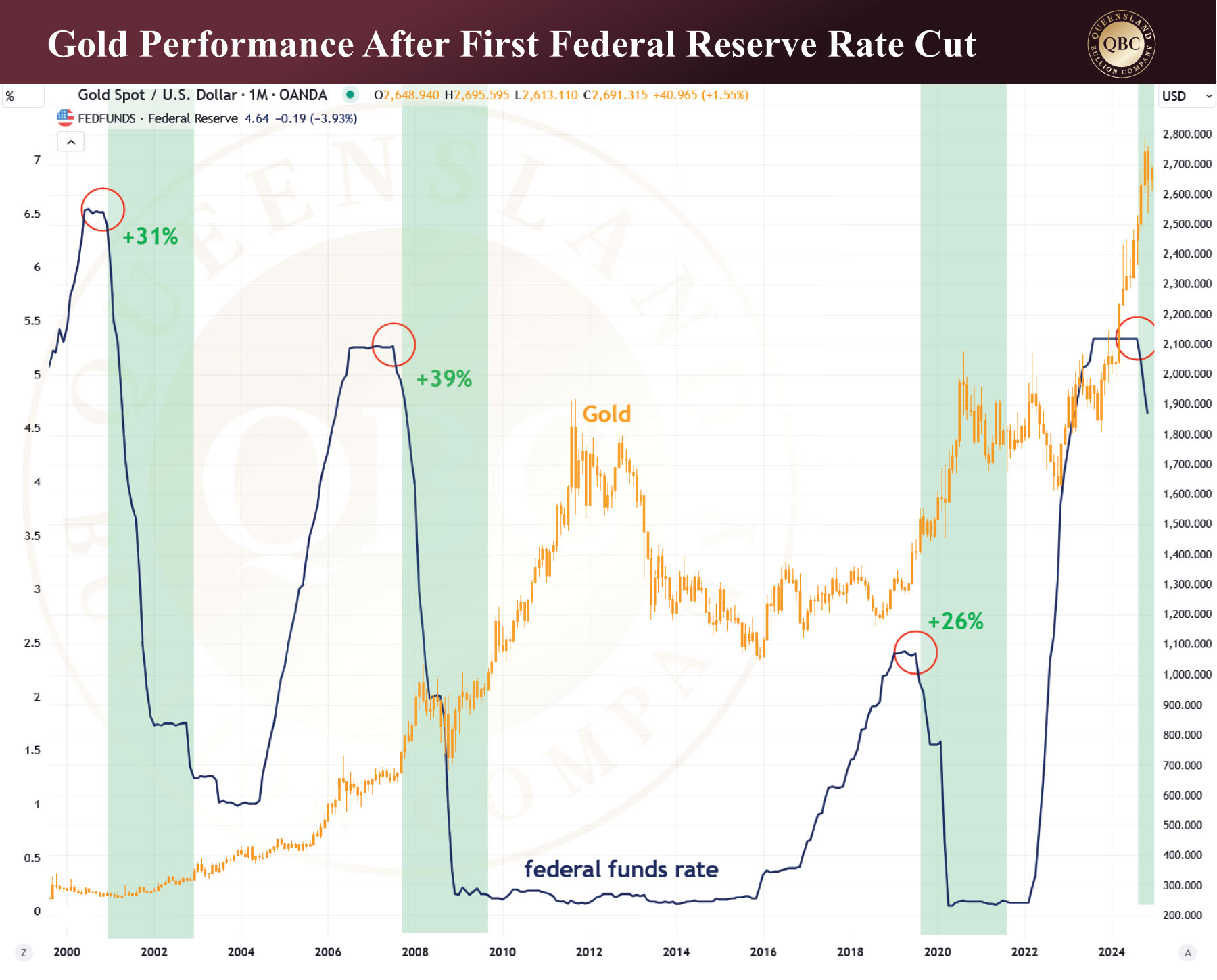

The Federal Reserve goes through cycles of rate increases and cuts in order to pursue its dual mandate of fostering maximum sustainable employment and price stability. In order to meet these (sometimes opposing) goals, the reality is that they hike rates until “something breaks” or at least threatens to. This is then followed by a rate-cutting cycle. The more aggressive a rate cut is the higher the risk is of an incoming financial crisis, thus justifying the cut. In 2008 the Federal Reserve started cutting rates on September 18th by 50 basis points (a fairly aggressive cut that was followed by the Great Financial Crisis). Fast forward now to 2024, and the Fed has again cut interest rates by 50 basis points on September 18th, providing a perfect 17-year delta. The below graph illustrates how recessions generally follow rate-cutting cycles:

According to In Gold We Trust, over the last three rate-cutting cycles gold increased in value at an average of 32% within two years of the initial rate cut. If this trend is applied to the September 2024 rate cut, gold could see prices as high as $4,554 and possibly higher by the end of this year .

Overvalued stock markets

Another indicator of recession is whether the stock market is over capitalised. The stock market can be vulnerable to correction when it grows faster than the economy. Also known as the “Buffet Indicator,” the Stock Market Capitalisation to GDP Ratio currently reveals this is the case in the US. To date the indicator stands at 208.3% which is staggering; this is almost double what it was just prior to the Great Financial Crisis (GFC) when it was only 106%. Australia does not need to feel left out. The local stock market stands at 108.67%. While this is considered fair it is still more than what the American market was in 2008 and only needs to climb another 30% to match what it was prior the GFC. Watch to see if our local stock market inflates further during the year to match its 2008 figure. With significant overvaluation in the US stock market, we can expect America to lead the way when the correction finally comes.

Buffet and corporate insiders holding cash

Needless to say is that Warren Buffet is acutely aware of the insane overvaluation of the US stock market. As CEO of Berkshire Hathaway, Buffet has traditionally positioned the company to hold cash before a recession and uses the above ratio as his main indicator to inform such choices. As at the third quarter of 2024, Berkshire Hathaway held cash or equivalents of USD $325.2 billion, up by USD $48.3 billion from three months earlier. And Buffet is not the only one to move into cash. Stock sales in America by corporate insiders reached an all-time high after the election of then President-elect Donald Trump. And where there are sellers there must also be buyers. Recent surveys indicate that 56% of retail investors are bullish on the stock market’s prospects over the next 12 months. Sadly, we are currently witnessing a transfer of wealth from retail investors to Wall Street purely based on different speculative perceptions of the US stock market.

Note also that Bitcoin and other cryptocurrencies tend to move in near lock-step with the US stock market, especially the NASDAQ where the overlap of investors are the highest.

Quantitative Tightening versus Quantitative Easing

Finally, in recent years the Federal Reserve has engaged in quantitative tightening (where they reduce their balance sheet of assets). Usually this has a reductive effect on the price of gold, which is what makes gold’s performance last year absolutely stellar and very telling of where the market is really at. While it is not always a marker of a coming recession, it is worth mentioning because of how it fits into a recession cycle. During recession central banks will be compelled to reverse positions and switch to quantitative easing in trying to manage the corrections in the market. This is important to precious metals because, amidst the environment of quantitative easing, the role of gold as a safe haven asset is highlighted significantly.

In summary, gold appears to be following the same patterns as its bullish trajectory during its 2007 – 2008 history. Institutional responses to recession include massive increases in government debt, cutting interest rates back to zero (and then into negative territory), and injecting trillions of new dollars into the economy through quantitative easing. All these responses support the increase of value in precious metals.

With recession signals flashing and the majority of retail investors none-the-wiser, it is imperative that the 1% of investors in the precious metals markets prepare as best they can for what is clearly spelt out for those who wish to see. Being financially prepared for volatility and recession, in addition to any geopolitical curveballs that usually accompany fiscal corrections, allows one to be in a position of power to help others if one is inclined. But one of the greatest gifts is the gift of knowledge. Be the one to educate now and help others to help themselves before recession bites too hard.